Stock market indices are trading higher today with gains accelerating during the US cash trading session. This a result of a release of weak data from the United States. Namely, Conference Board consumer confidence index for August and JOLTS report on job openings for July. Huge miss in job openings is especially important as it is one of jobs market gauges that Fed watches closely.

Hawkish bets in money markets began to be trimmed with US yields also dropping following data release. This has allowed for a dovish reaction on the stock markets with German DE30 and US500 nearing key psychological levels.

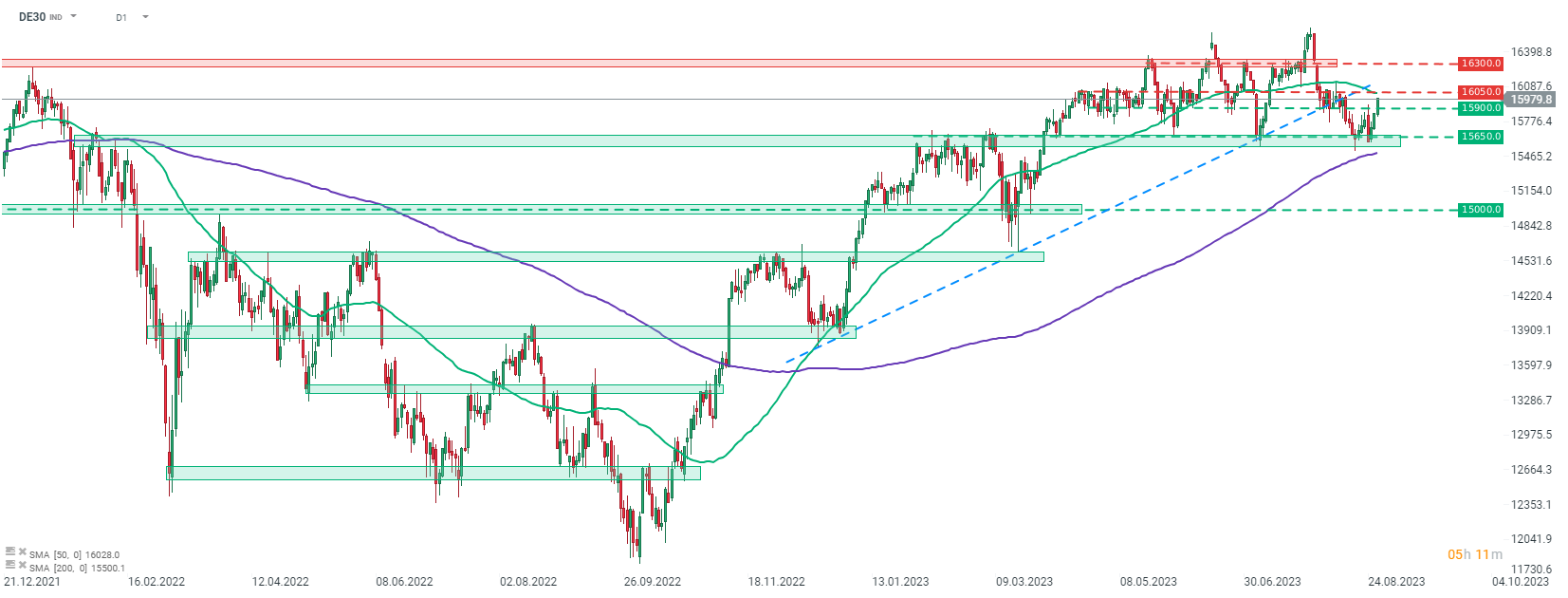

DE30

German DAX futures (DE30) are trading at 2-week highs, just a touch below 16,000 pts mark. The 16,000-16,050 pts area may offer some resistance especially as it is strengthened by a 50-session moving average (green line). Nevertheless, a key resistance to watch can be found in the 16,300 pts and is a final hurdle before all-time highs.

Source: xStation5

Source: xStation5

US500

S&P 500 futures (US500) are testing the resistance zone ranging below 4,500 pts mark. This resistance zone, apart from being marked with 50-session moving average and previous price reaction, also serves as a shoulderline of a potential head and shoulders pattern. A failure to break above and a subsequent drop below 4,370 pts support (neckline) may herald a deeper drop.

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street