Equity markets in Europe are enjoying another day of strong gains. Major blue chips indices from Europe trading over 1% higher at press time. The biggest gains can be spotted in Austria with ATX (AUT20) trading 2.8% higher and in Poland with WIG20 (W20) rallying 2.3%. The move is a continuation of the recovery rally as concerns over conditions of banks and potential financial crisis ease. A softer CPI reading from Spain may also be providing some fuel to the move. Having said that, German CPI data at 1:00 pm BST should be watched closely as it may also have impact on the markets.

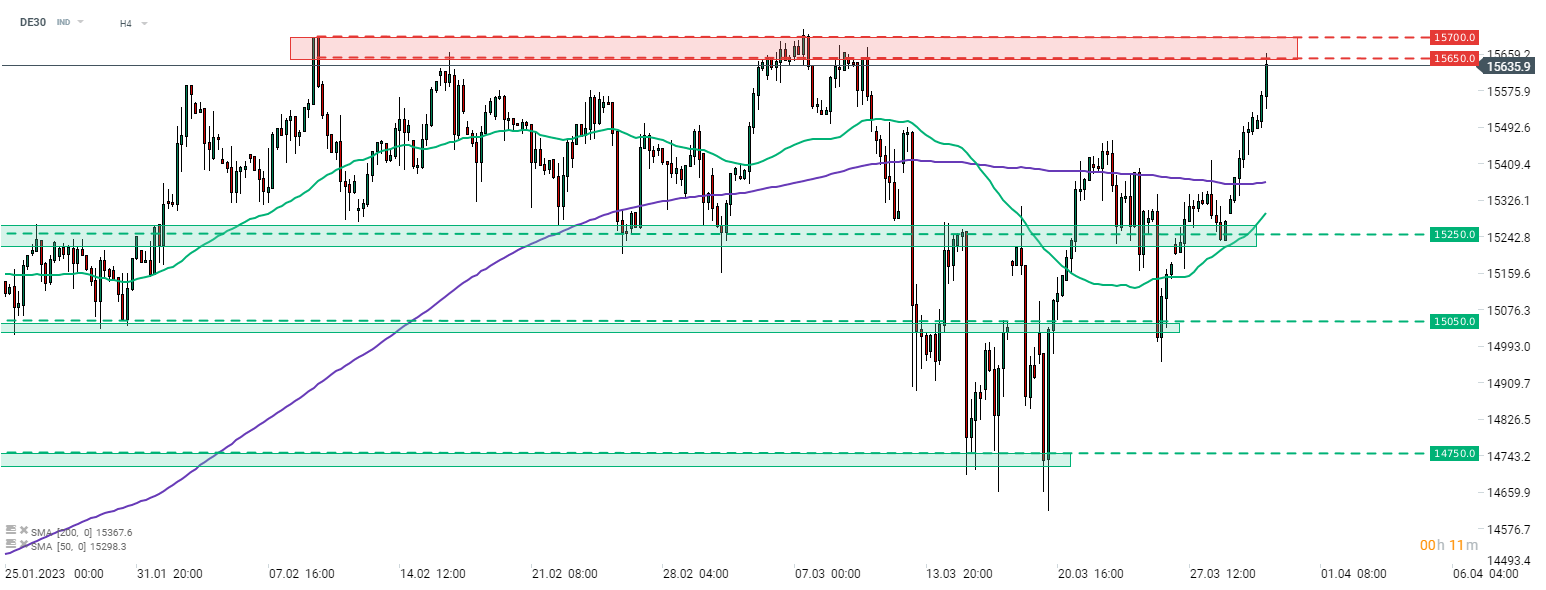

Taking a look at German DAX futures (DE30) chart at H4 interval, we can see that the index has almost fully recovered from a sell-off triggered by problems in US and European banking sectors and is on its way to year-to-date highs. Index reached a 15,650-15,700 pts resistance zone today, where 2023 highs can be found. A break above this area would put the index at the highest level since the turn of 2021 and 2022.

DE30 at H4 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers