-

European indices open significantly lower on Tuesday

-

Deutsche Boerse (DB1.DE) expects net revenue growth to surpass 5% in 2020

-

European sales of Daimler (DAI.DE) drop 10.1% YoY in January

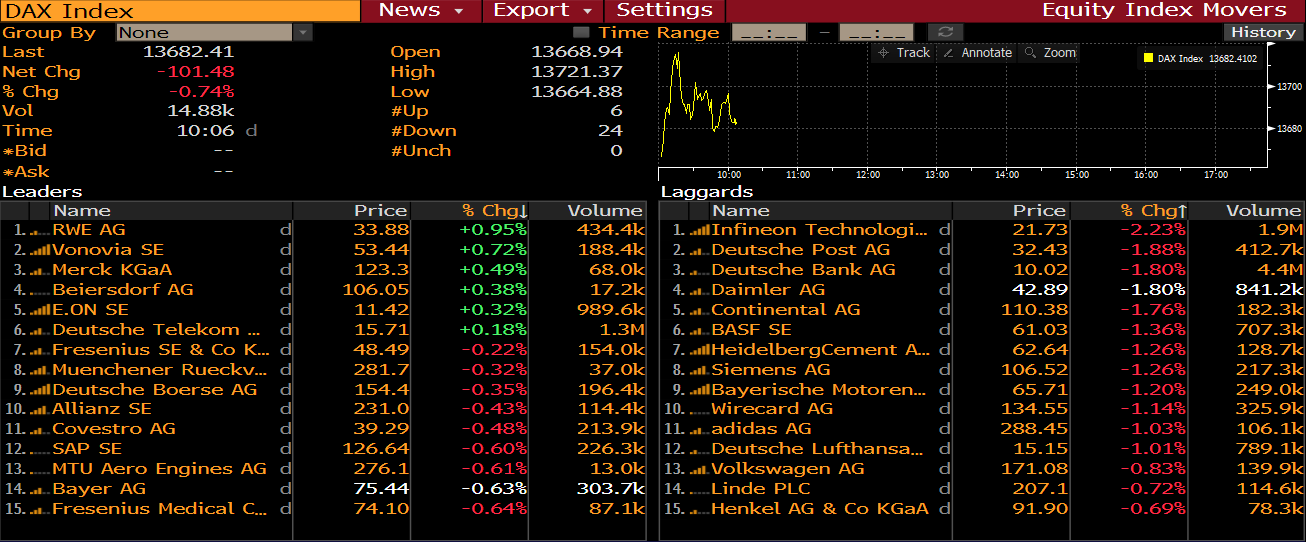

Major stock market indices in Europe launched today’s trade lower after Asian indices slid significantly. Italian FTSE MIB (ITA40) is an outlier and trades higher as UBI Banca (UBI.IT) gains over 25% on a surprise takeover offer from Intesa Sanpaolo (ISP.IT). Miners, carmakers and tech stocks are top laggards in Europe while utilities outperform.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

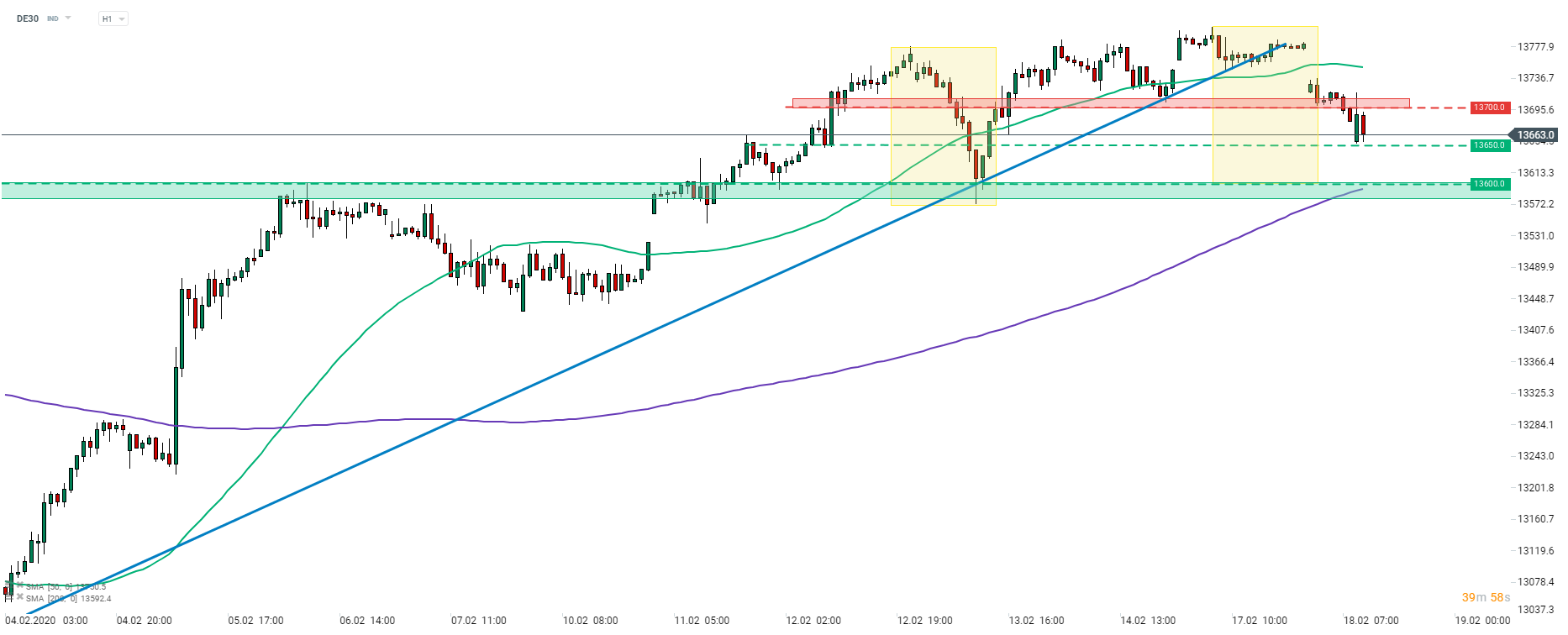

Create account Try a demo Download mobile app Download mobile appDE30 opened near the swing level of 13650 pts today. The index rallied at the beginning of the European cash session and reached an intraday high of 13718 pts. However, bulls failed to sustain momentum and DE30 pulled back below the price zone at 13700 pts. The index tested 13650 pts handle later on and it looks like today’s trading may be locked within 13650-13700 pts range. The lower limit of the Overbalance structure that marks final support can be found at 13600 pts. There are no major data readings scheduled for today therefore traders may expect market moves to be focused on coronavirus-related supply disruption news.

DAX members at 9:06 am GMT. Source: Bloomberg

DAX members at 9:06 am GMT. Source: Bloomberg

European data released today showed a 7.4% YoY drop in car sales and 7.5% YoY drop in new car registrations. Declines come after new emissions rules took effect at the start of 2020. Sales of Daimler (DAI.DE) dropped 10.1% YoY while Volkswagen (VOW1.DE) experienced a drop of just 0.1% YoY. BMW (BMW.DE) managed to book a 3.8% YoY increase.

Infineon Technologies (IFX.DE) is moving lower along with other European chip stocks following Apple’s warning. The US company said that it does not expect to meet revenue guidance this quarter citing coronavirus-related supply and demand disruptions.

Deutsche Boerse (DB1.DE) published full-year 2019 results today ahead of the cash session open. Net revenue of €2.94 billion came in-line with estimates, just as full-year adjusted EPS of €6.03. Adjusted consolidated net profit amounted to €1.105 billion. The company said that it expects net revenue to grow at least 5% in 2020 while adjusted net profit should rise to €1.2 billion.

Analyst actions

-

Siemens (SIE.DE) raised to “buy” at Nord/LB. Price target set at €126

-

Deutsche Bank maintained “buy” recommendation for Linde (LIN.DE). Price target raised to €235

-

Deutsche Boerse (DB1.DE) raised to “buy” at Commerzbank. Price target set at €174

Infineon (IFX.DE) started a pullback after reaching local peak from July 2018 at €23.15. The stock heads towards the support zone at €21.20. Final support can be found at the lower limit of the Overbalance structure that coincides with recent low (€19.50). Source: xStation5

Infineon (IFX.DE) started a pullback after reaching local peak from July 2018 at €23.15. The stock heads towards the support zone at €21.20. Final support can be found at the lower limit of the Overbalance structure that coincides with recent low (€19.50). Source: xStation5