-

UBS completes takeover of Credit Suisse

-

Bernstein supports Adidas quotes

The first trading session of the week starts with gains in European benchmarks. The German DE30 is attempting to break out above the consolidation structure set last week and is holding above the 16,000-point barrier. Although the macro calendar itself is empty for today, investors are eagerly awaiting tomorrow's scheduled US CPI reading and the subsequent FOMC and ECB interest rate decisions.

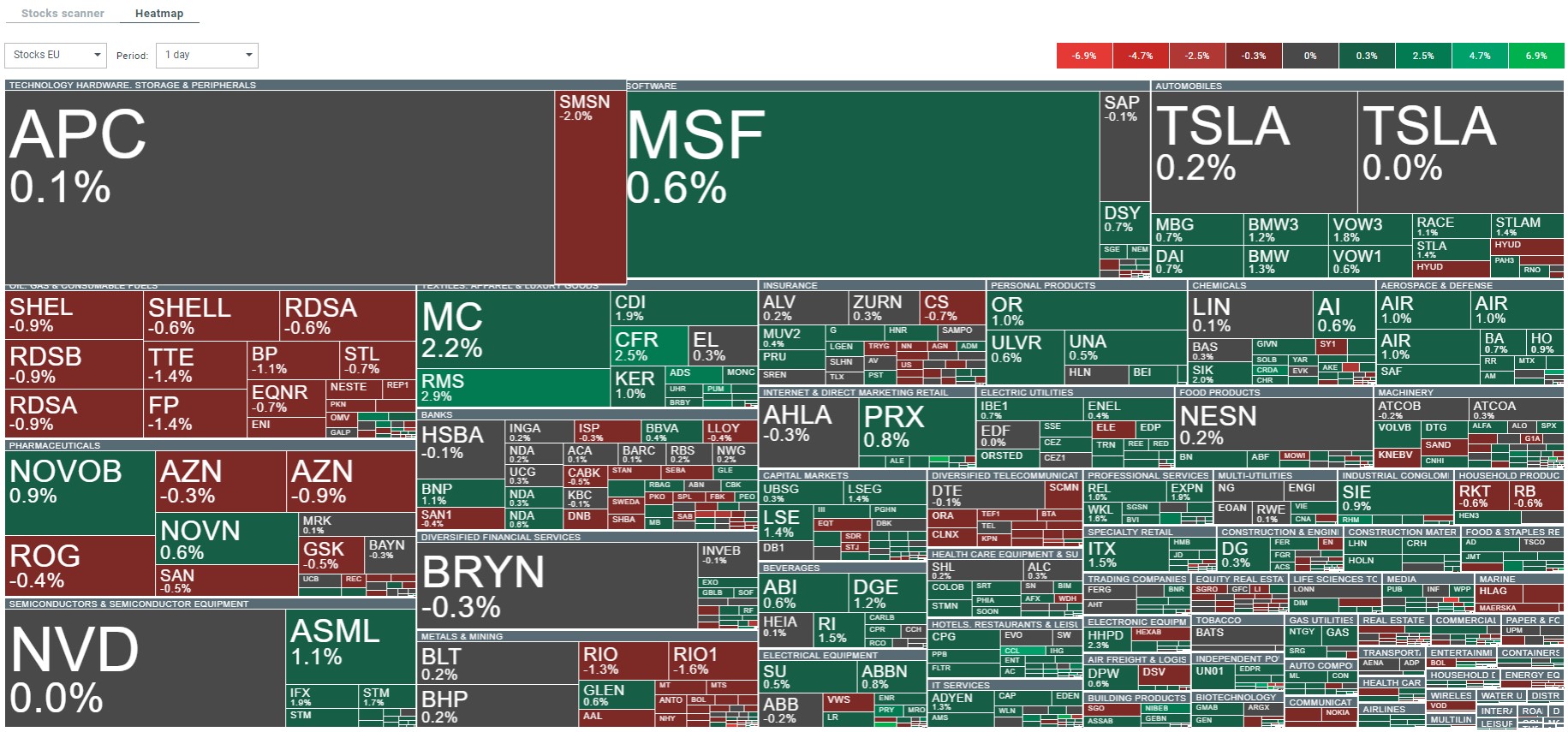

The mood in Europe during Monday's trading session was mostly positive. Very good sentiment was dominated by the luxury goods, semiconductor, aviation and hospitality sectors. Source: xStation 5

The mood in Europe during Monday's trading session was mostly positive. Very good sentiment was dominated by the luxury goods, semiconductor, aviation and hospitality sectors. Source: xStation 5

German DE30 futures are trying to break out above the consolidation structure set last week. At this point, however, part of today's upward momentum has been negated. Contracts are still holding above the psychological barrier of 16,000 points. Source: xStation 5

German DE30 futures are trying to break out above the consolidation structure set last week. At this point, however, part of today's upward momentum has been negated. Contracts are still holding above the psychological barrier of 16,000 points. Source: xStation 5

News:

Shares of Adidas (ADS.DE) are gaining nearly 5% during today's session due to Bernstein's upgraded recommendation on the company's shares. According to the company's analysts, the business climate around the company is improving after a weak 2022. The target price on the company's shares has been raised to €190 against a previous rating of €155.

Chart of Adidas (ADS.DE) shares and overlaid chart of Puma (PUM.DE), D1 interval. The companies show a listing correlation, however in this case Puma is trading from a much lower base. Source: xStation 5

Chart of Adidas (ADS.DE) shares and overlaid chart of Puma (PUM.DE), D1 interval. The companies show a listing correlation, however in this case Puma is trading from a much lower base. Source: xStation 5

Symrise (SY1.DE) shares lost more than 1.5% today, following a downgrade by Deutsche Bank, but the scale of the decline has now largely been negated. The bank's analysts commented that after years of strong expansion, the company may now be experiencing a slowdown. The target price for the shares has been lowered to €96 from the previous level of €122.

SY1 shares are testing the lower limit of the downtrend channel. D1 interval. Source: xStation 5

UBS Group (UBSG.CH) today finalised the acquisition of Bank Credit Suisse (CSGN.CH), officially ending its 167 years as an independent banking giant. UBS Bank now has the task of carrying out the entire process of absorbing the CSGN business into its structures. UBS shares are currently gaining more than 0.5%.

Changes in the institution's holdings in individual companies of the DAX index (data from the last session). Source: Bloomberg

The largest percentage changes and information from individual companies in the DAX index. Source: Bloomberg

The largest percentage changes and information from individual companies in the DAX index. Source: Bloomberg

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

Zions Bancorp rebound after sharp US regional bank stocks sell-off 📈

DE40: European markets decline due to concerns about the U.S. banking sector