-

Sentiment in Europe weakens slightly

-

TSMC comments spoil the mood in the semiconductor market

-

Thyssenkrupp AG with contract for Indian navy

Tuesday's trading session brings a dampening of bullish sentiment among investors, who cannot decide on a specific trading direction. Overall, however, most companies listed on European trading floors are losing today. This sentiment may be prolonged, however, as there are no top-tier macro data releases scheduled for today's session. However, headlines from individual companies are worth watching.

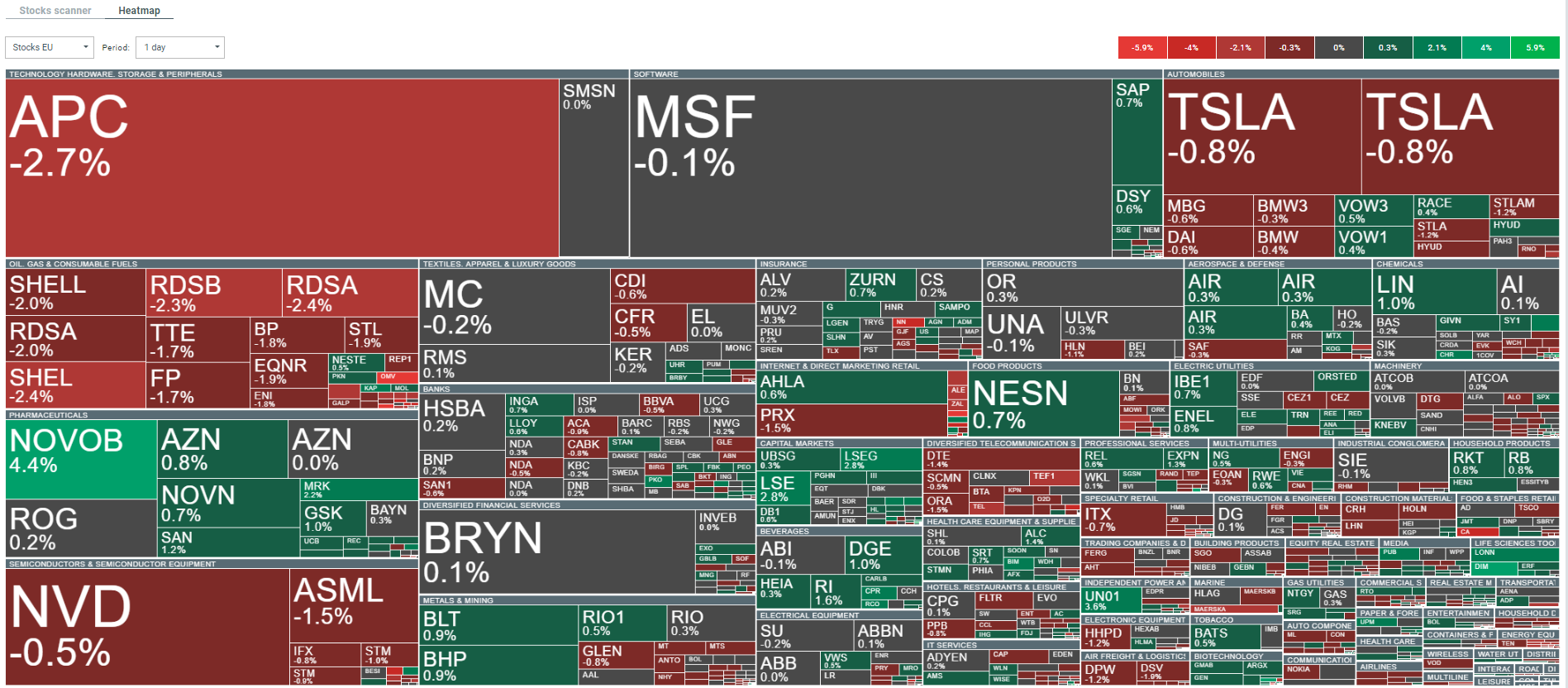

The mood in Europe during Tuesday's trading session is relatively negative. Weakness is mainly shown by companies in the technology, oil and semiconductor sectors. Source: xStation 5

The mood in Europe during Tuesday's trading session is relatively negative. Weakness is mainly shown by companies in the technology, oil and semiconductor sectors. Source: xStation 5

News:

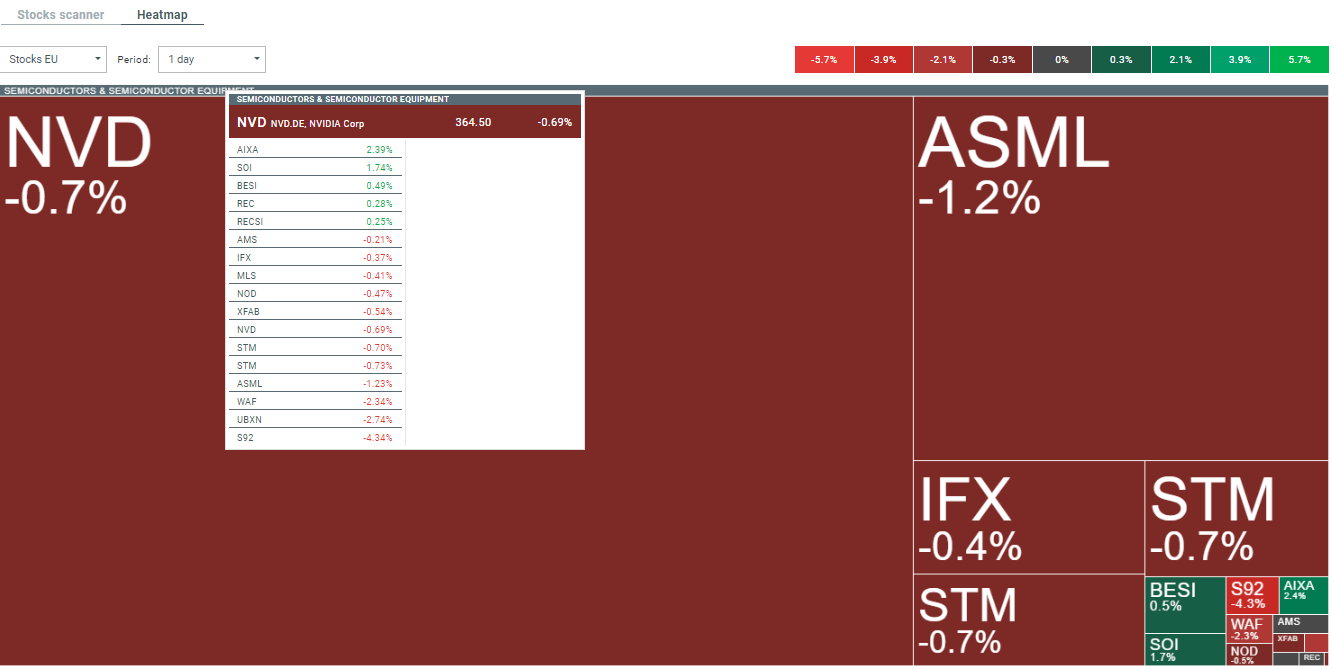

Weakness in the European semiconductor market today is primarily triggered by the announcement by the global giant when it comes to this sector, the Taiwan Semiconductor Manufacturing Company (TSM.US), which notified that this year's capital expenditure (capex) budget will be close to the lower end of the previously stated forecast. This has dampened hopes that the recent boom in demand for artificial intelligence computer chips will encourage chipmakers to increase production capacity in the near term, triggering a sell-off on European companies in the sector.

Source: xStation 5

Source: xStation 5

The marine unit of Thyssenkrupp AG (TKA.DE) and Indian shipbuilder Mazagon Dock Shipbuilders Limited are likely to jointly bid for a project to build six submarines for the Indian Navy worth an estimated $5.2 billion. The stock is currently losing close to 1.2%.

Thyssenkrupp AG (TKA.DE) share price chart, D1 interval. At the moment, the company's shares are testing the support area defined by the formation of the lower limit of the upward trend and are trading above the confluence of the 50-, 100- and 200- EMAs (coloured curves; blue, violet and gold respectively). Source: xStation 5

Thyssenkrupp AG (TKA.DE) share price chart, D1 interval. At the moment, the company's shares are testing the support area defined by the formation of the lower limit of the upward trend and are trading above the confluence of the 50-, 100- and 200- EMAs (coloured curves; blue, violet and gold respectively). Source: xStation 5

Symrise (SY1.DE) shares are gaining 1.56% today following the announcement of the company's willingness to acquire the entire Swedencare company.

Evotec (EVT.DE;+2.02%), Krones (KRN.DE:-1.13%) and Shop Apotheke (SAE.DE:+2.58%) will join the MDAX index. Demoted to the SDAX index were, Aroundtown (AT1.DE:-0.59%), United Internet (UTDI.DE:-3.73%) and Siltronic (WAF.DE; -2.4%).

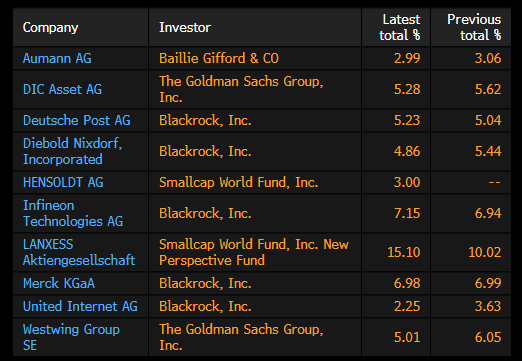

Changes in institutional holdings in individual companies of the DAX index (data from the last session). Source: Bloomberg

Largest percentage changes and information from individual companies in the DAX index. Source: Bloomberg

Largest percentage changes and information from individual companies in the DAX index. Source: Bloomberg

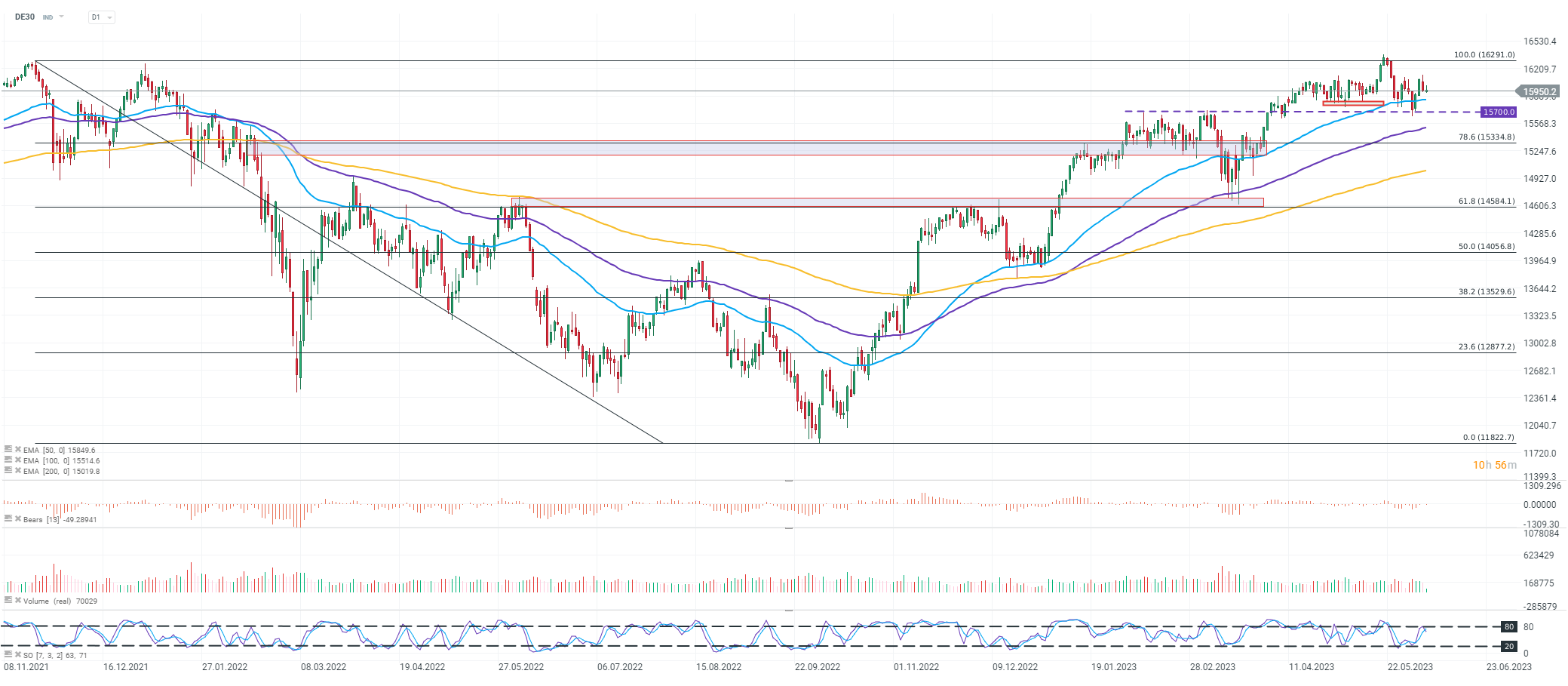

DE30 chart

Futures based on the German DAX index (DE30) are trading down slightly today and are attempting to permanently break below the last session's minimum zone. Source: xStation 5

Futures based on the German DAX index (DE30) are trading down slightly today and are attempting to permanently break below the last session's minimum zone. Source: xStation 5

IBM and Groq join forces to revolutionize AI processing

US Defense Industry Preview - Has it reached its peak?

Waymo: Race against the regulators

Will Alibaba’s Aegaeon Revolutionize GPU Usage?