- The Aegaeon innovation allows a single GPU to be shared among up to seven AI models, significantly reducing the number of required Nvidia H100 cards.

- Thanks to this technology, Alibaba greatly lowers operational costs and mitigates the impact of export restrictions on access to modern GPUs.

- While investors reacted enthusiastically, the market awaits proof of the technology’s effectiveness at scale, which could influence Nvidia’s record revenues from the data center segment.

- The Aegaeon innovation allows a single GPU to be shared among up to seven AI models, significantly reducing the number of required Nvidia H100 cards.

- Thanks to this technology, Alibaba greatly lowers operational costs and mitigates the impact of export restrictions on access to modern GPUs.

- While investors reacted enthusiastically, the market awaits proof of the technology’s effectiveness at scale, which could influence Nvidia’s record revenues from the data center segment.

Alibaba, one of the largest Chinese technology leaders, has developed an innovative solution called Aegaeon that could significantly change how hardware is used to support artificial intelligence. According to the Chinese giant, this technology reduces the number of Nvidia H100 graphics cards needed to run large AI models by as much as 82%, while maintaining high performance and speed.

What is the innovation about? Traditionally, each AI model is assigned a separate graphics processing unit (GPU), which often results in underutilization of its capacity. Aegaeon allows multiple models to share a single GPU simultaneously, greatly increasing hardware efficiency. Thanks to this, one GPU can handle up to seven models at once. System tests, which lasted over three months, showed that Alibaba Cloud was able to reduce the number of GPUs used from 1,192 to 213 without sacrificing service quality or speed.

Why is this important? It should be emphasized that graphics cards, especially advanced ones like the Nvidia H100, are very expensive, and the costs of purchasing and operating them constitute a significant part of the budget for companies working with AI and cloud computing. By reducing the number of required GPUs, Alibaba can save substantially, which positively impacts its financial results.

Additionally, due to export restrictions imposed by the US on Chinese companies, access to the latest GPUs is limited. Therefore, more efficient use of the hardware they already have becomes crucial for maintaining competitiveness.

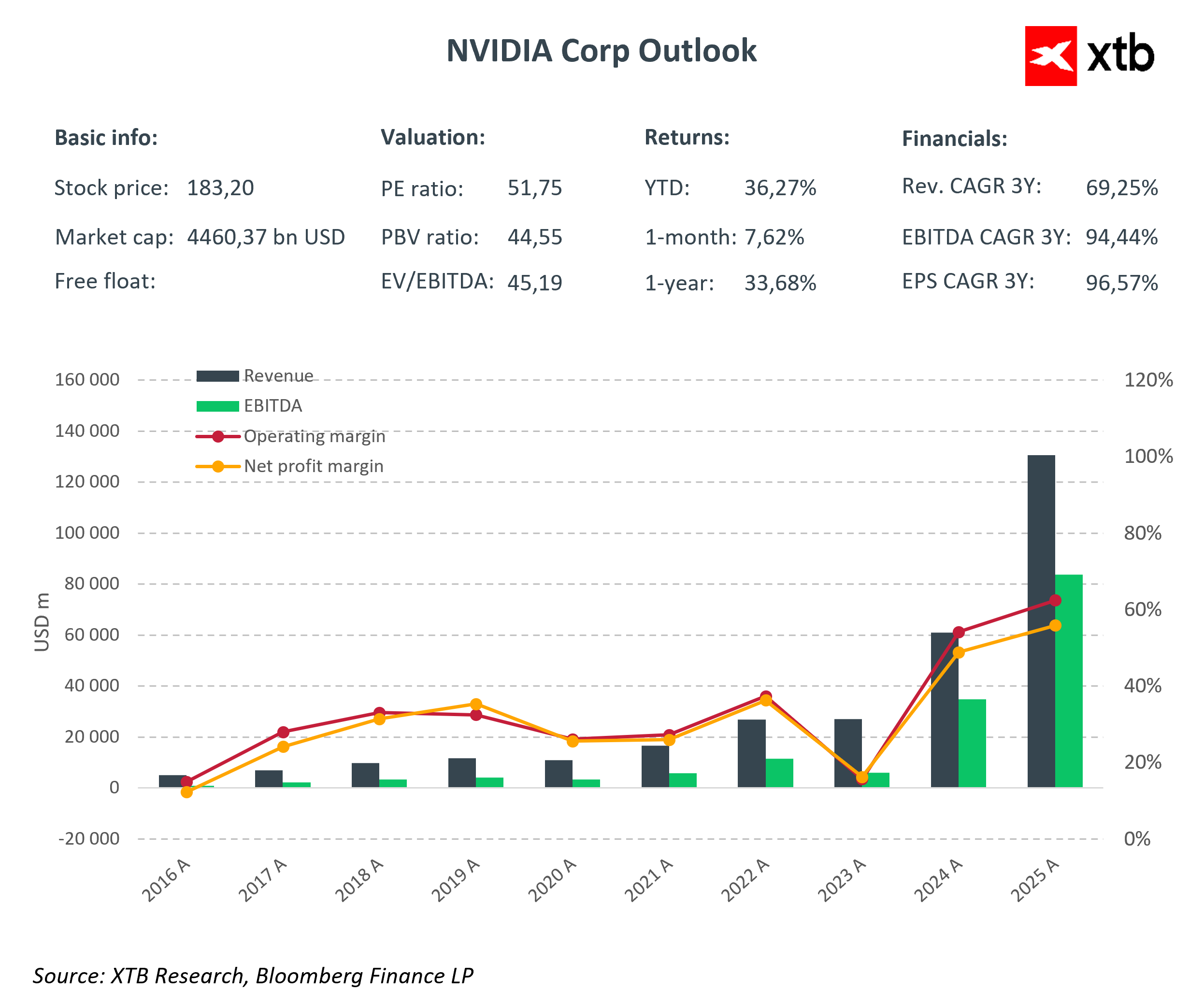

This raises the question: is this the end of Nvidia’s dominance? At first glance, lower demand for graphics cards could pose a challenge for Nvidia, one of the world’s largest manufacturers of this hardware. Nvidia generates a significant portion of its revenue from the sale of advanced GPUs used in data centers and AI development. This segment brings the company record revenues, so any significant reduction in demand from large clients like Alibaba could negatively affect the manufacturer’s financial results. Reduced demand may impact not only Nvidia’s revenues but also the entire supply chain and investment plans within the industry.

At the same time, the market is approaching this news with mixed feelings. On one hand, it recognizes the potential for significant cost savings and efficiency improvements, but on the other hand, it awaits confirmation of Aegaeon’s real-world performance. Markets want to see whether the promised reductions in GPU usage will hold at scale and whether any unforeseen issues might arise that could change this positive outlook.

Despite these expectations, news about the Aegaeon technology was met with a relatively positive reaction on the stock market. Over the past three months, Alibaba’s (BABA) shares have increased in value by nearly 40%, indicating trust from some investors in the company.

Source: xStation

Investors believe that Aegaeon will not only improve Alibaba’s financial results but also strengthen its position as a leader in the cloud computing and artificial intelligence sectors. The market sees significant potential for cost savings and building a competitive advantage, especially in the context of global challenges such as limited access to the latest hardware and rising operational costs. In light of the growing worldwide demand for AI services, this technology could become an important factor for the company’s long-term value growth and attract new business partners.

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)