This morning's macro calendar was basically empty, making it impossible to expect much volatility in the stock market. However, European indices started Wednesday's session with slight increases, trying to recover from yesterday's losses. Bigger movements are sure to be seen later in the hours. In the afternoon, US data will be released, the ADP report and ISM data for services, and in the evening the Fed will announce its decision on interest rate levels. The market is waiting for signals on US monetary policy in the coming months. These could indicate a pause in interest rate hikes or a continuation of the fight against high inflation. It is also worth noting that today companies such as Airbus Group (AIR.DE), BNP Paribas (BNP.FR), Deutsche Post (DPW.DE) will publish results.

News:

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app- The market expects the Federal Reserve to hike by 25 basis points tonight, despite recent concerns about a new banking crisis.

- Italy's Unicredit reported results for the latest quarter yesterday, with both revenue and earnings per share coming in above forecasts

- German government bond prices rise Wednesday ahead of the U.S. Federal Reserve's interest rate decision. The yield on the 10-year Bund fell slightly to 2.23 percent.

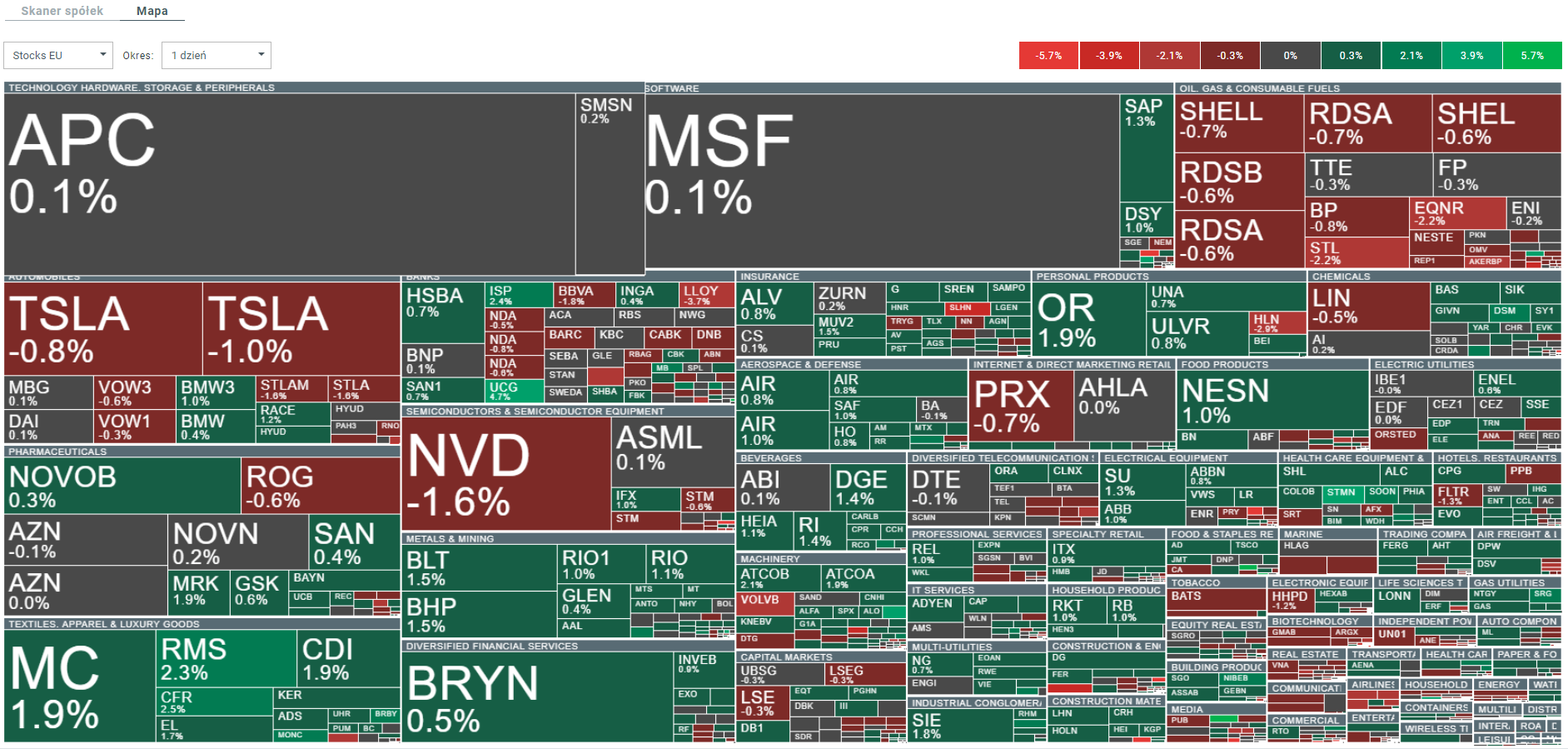

The mood during Wednesday's session is rather good, but volatility is limited. Source: xStation5

The mood during Wednesday's session is rather good, but volatility is limited. Source: xStation5

As for the technical situation, DE30 prices are rebounding after yesterday's strong decline. Currently, the course is struggling with the EMA100 average, and in case of its sustained breakout, a further move to higher levels is possible. If such a scenario is realized, the 50% and 61.8% Fibonacci retracements should be considered as the nearest resistances. Nevertheless, in the event of a return below the 100-period moving average, a resumption of the downtrend with a target at the recent lows in the region of 15800 points will not be ruled out.

DE30 H1 interval. Source: xStation5

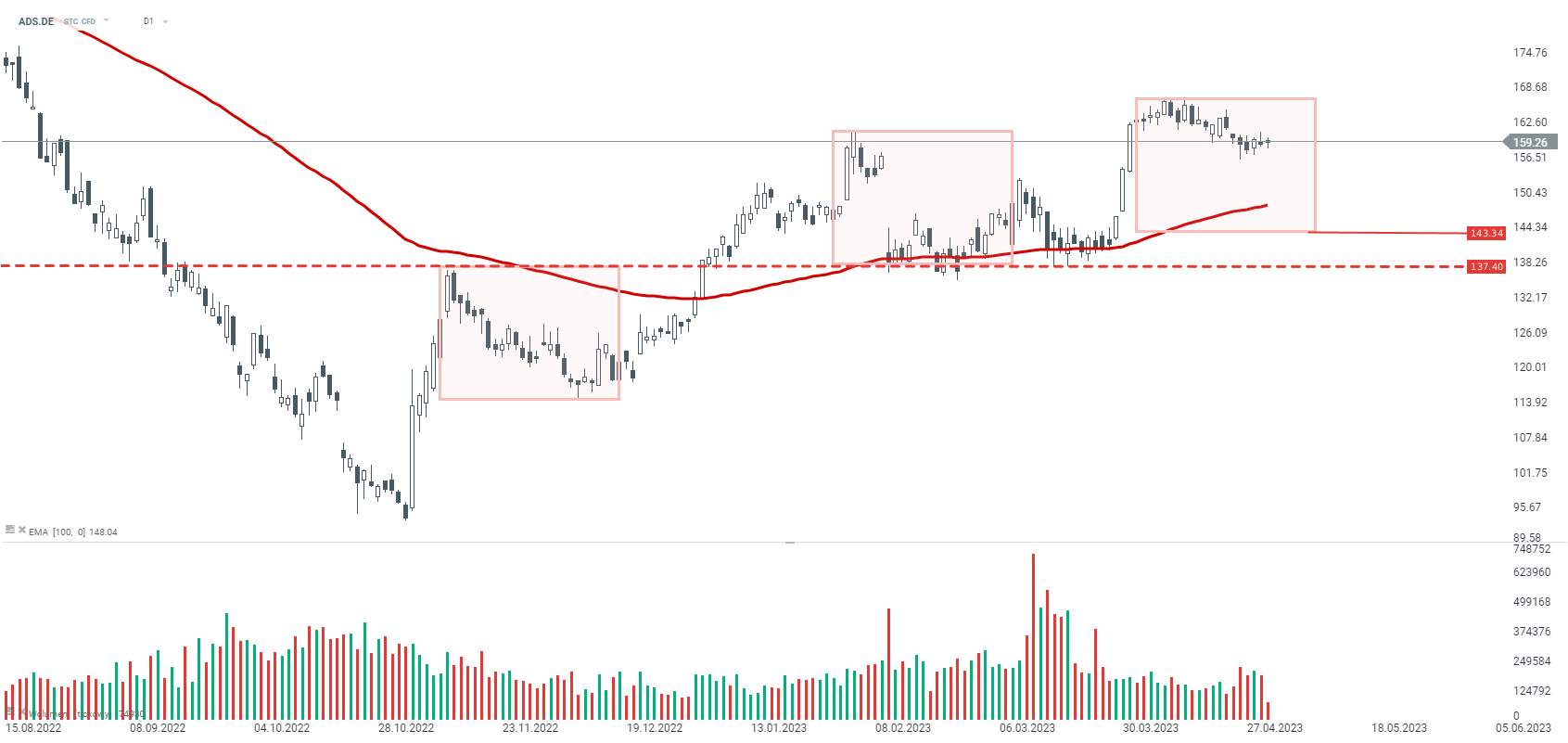

Adidas (ADS.DE) shares are struggling to reach higher levels. If the correction deepens, we should consider as important support the level of 143.34, where the lower limit of the 1:1 system is located. The next important horizontal level is 137.40.

Adidas (ADS.DE) D1 interval. Source: xStation5