- DAX gains at the start of a significant week

- Markets fluctuate in valuing the end of rate hikes by the ECB

- BMW (BMW.DE) invests in a 110-year-old factory in the UK

- Rheinmetall (RHM.DE) to deliver 40 Marder armored vehicles to Ukraine

The start of the new week begins with quite a positive sentiment on the German DAX. The index is trading 0.50% higher at around the 15850-point level. Also, US index futures point to a higher opening for US500 and US100. The moods are supported by a slight weakening of the dollar against most major currencies.

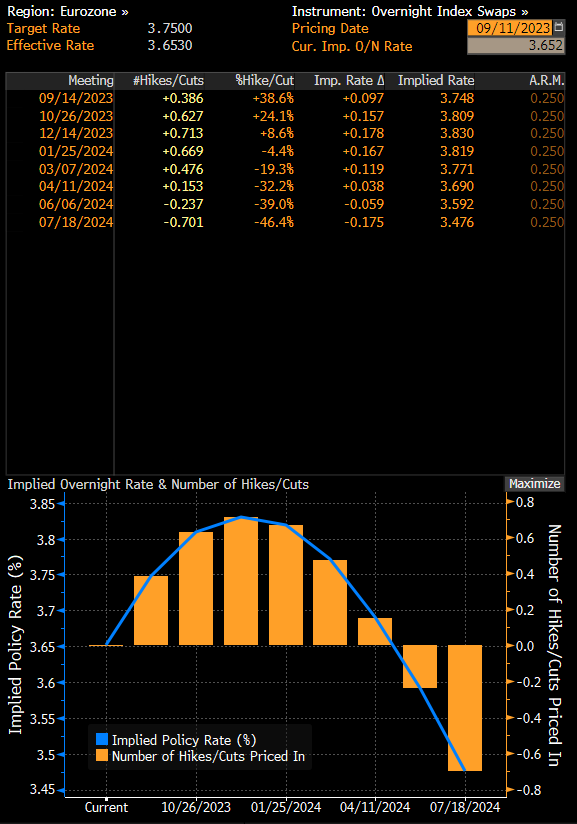

For the European markets, the key events of this week will be the ECB decision on interest rates and the US CPI inflation reading - the last one before the Fed decision. After a series of continuously weakening data in the EU, investors are beginning to doubt the continuation of rate hikes by the European Central Bank despite other assurances from politicians. Currently, swaps price a 39% chance of a 25 basis point increase at Thursday's meeting (Bloomberg Finance L.P.). Meanwhile, rate cuts are forecasted as early as the end of the first half of 2024. The Italian Minister of Industry and Italian Production openly appeals to the ECB to end aggressive policy pointing to stifling economic growth on an unprecedented scale.

On the other hand, inflation data show that the price increase is persistent. Today's forecasts of the European Commission indicate that inflation in the Eurozone in 2023 will remain at the level of 5.6% compared to forecasts of 5.8% in May and 2.9% in 2024 compared to forecasts of 2.8% in May. The Eurozone GDP forecast is lowered to 0.8% compared to 1.1% in 2023 and 1.3% compared to 1.6% in 2024.

Source: Bloomberg Finance L.P.

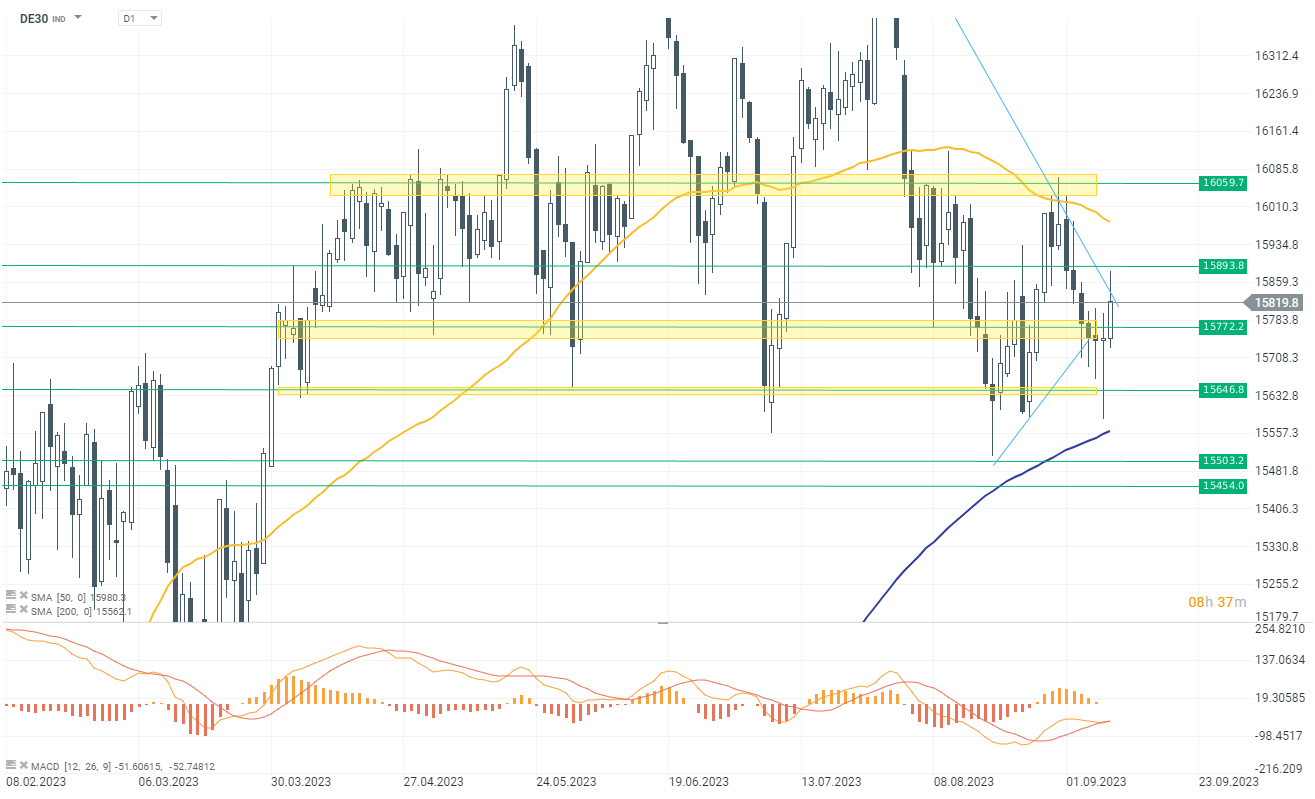

Looking from a technical perspective, DAX ended last week with a slight increase after 5 days of deep declines. The rebound on the index is continued today, with quotes increasing by 0.40% to 15800 points. The increases were halted in the resistance zone around 15900 points and currently, the quotations are maintained in a narrow range between this resistance and the support area at the level of 15750-15790. If selling pressure starts to dominate in the coming days, the index price may deepen declines to 15650 points, where the next support area is located. The key event this week, during which greater volatility is to be expected, will be the ECB decision and the Lagarde conference. A softer, dovish attitude may lead to a continuation of the current increases.

Looking from a technical perspective, DAX ended last week with a slight increase after 5 days of deep declines. The rebound on the index is continued today, with quotes increasing by 0.40% to 15800 points. The increases were halted in the resistance zone around 15900 points and currently, the quotations are maintained in a narrow range between this resistance and the support area at the level of 15750-15790. If selling pressure starts to dominate in the coming days, the index price may deepen declines to 15650 points, where the next support area is located. The key event this week, during which greater volatility is to be expected, will be the ECB decision and the Lagarde conference. A softer, dovish attitude may lead to a continuation of the current increases.

Company news

Rheinmetall (RHM.DE) - German weapons manufacturer Rheinmetall will deliver 40 more Marder infantry fighting vehicles to Ukraine based on an order placed by the German government in August. The first 20 will be delivered in March, and another batch of 20 ordered in June, which are currently being refurbished and delivered. This means that Rheinmetall will deliver a total of 40 Marder vehicles to Ukraine.

BMW (BMW.DE) - announced an investment in a 110-year-old factory where the Mini brand was born, dealing with the production of electric vehicle models. The factory in the UK is not currently in the best financial condition. However, BMW announced a desire for further development and plans for the coming years. According to this information, the factory is to end production of combustion models in 2026, and from 2030 completely switch to the production of fully electric models.

BREAKING: US CPI below expectations! 🚨📉

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)