-

European stock markets trade higher

-

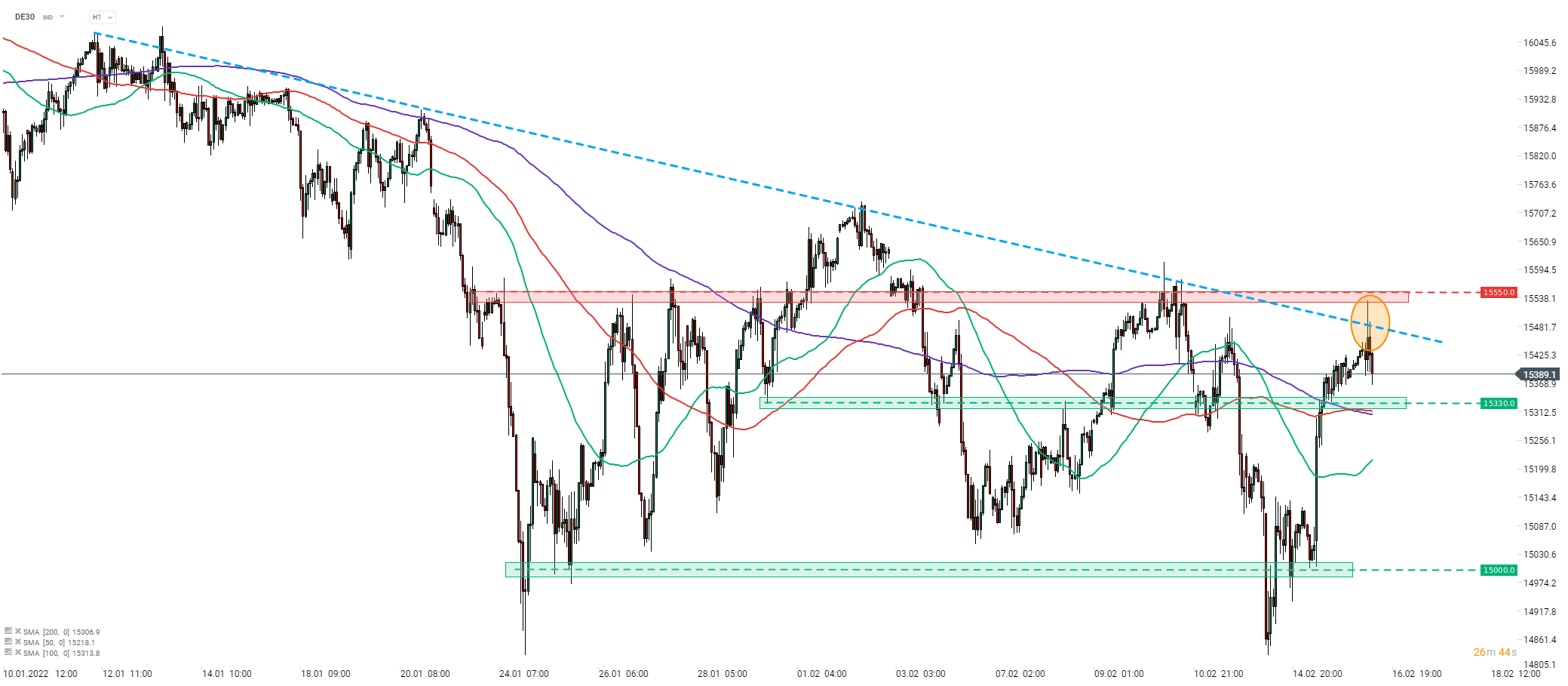

DE30 erases morning gains

-

MTU Aero Engines gains after Q4 2021 earnings release

European stock market indices are trading higher on signs of tensions de-escalating in the Eastern Europe. Russia announced yesterday that some of its troops will be withdrawn from the Ukrainian border. The announcement triggered a risk-on rally. However, NATO said today that there are no evidence of any withdrawal actually taking place and instead, the number of Russian troops near the border continues to increase. Traders should keep on guard as markets are nervous and sentiment can shift within a minutes on a single headline.

Source: xStation5

Source: xStation5

DE30 launched today's trading higher. Index jumped at the start of the European cash trading session today and attempted to break above the downward trendline. However, the attempt was a failed one and index started to move lower. DE30 has already erased all of the gains and trades flat on the day. Should the downward move deepen, the near-term support to watch can be found in the 15,330 pts area and is marked with the previous price reactions. Key support zone ranges near 15,000 pts and serves as the lower limit of the descending triangle pattern (aforementioned trendline serves as the upper one).

Company News

Airbus (AIR.DE) announced two new deals for its A350 freighters at Singapore Airshow today. Airbus received an order for seven A350 freighters from Etihad Airways as well as an order for seven jets from Singapore Airlines, with an option to order additional 5 aircraft.

MTU Aero Engines (MTX.DE) reported results for Q4 2021 today. German industrial company reported sales of €1.18 billion (exp. €1.28 billion) and adjusted EBIT at €161 million, up 53% YoY and slightly above €152.9 million forecast. Adjusted EBIT margin reached 13.6%. On a full-year basis, MTU managed to increase sales by 5.3% YoY to €4.19 billion (exp. €4.3 billion) while adjusted net income was 16% YoY higher at €342 million (exp. €326.5 million). Company proposed 2021 dividend per share at €2.10 (exp. €1.99). MTU Aero Engines expects 2022 revenue to reach €5.2-5.4 billion.

Norma Group (NOEJ.DE) reported preliminary results for 2021. The German company reported adjusted EBIT at €113.8 million, above last year's €45.3 million. Consolidated sales increased 14.7% to €1.09 billion. Adjusted EBIT margin reached 10.4%, up from 4.8% in 2020.

Amadeus Fire (AAD.DE) reported preliminary results for 2021. Company reported a 32.9% YoY jump in revenue, to €372.4 million, and 61.8% increase in operating EBITDA to €66.5 million. Operating EBITDA margin reached 17.8%, up from 14.8% in 2020.

Analysts' actions

-

Delivery Hero (DHER.DE) downgraded to "hold" at Deutsche Bank. Price target set at €80.00

Shares of MTU Aero Engines (MTX.DE) trade higher today following the release of Q4 and full-2021 results. Stock broke above the €200.50 swing area at the start of today's trading and continued to move higher until it reached €208 area. Part of gains was erased later on but shares continue to trade over 2% above yesterday's close. Source: xStation5

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

DE40: European markets decline due to concerns about the U.S. banking sector

Morning wrap (17.10.2025)