-

Major European indices trade flat

-

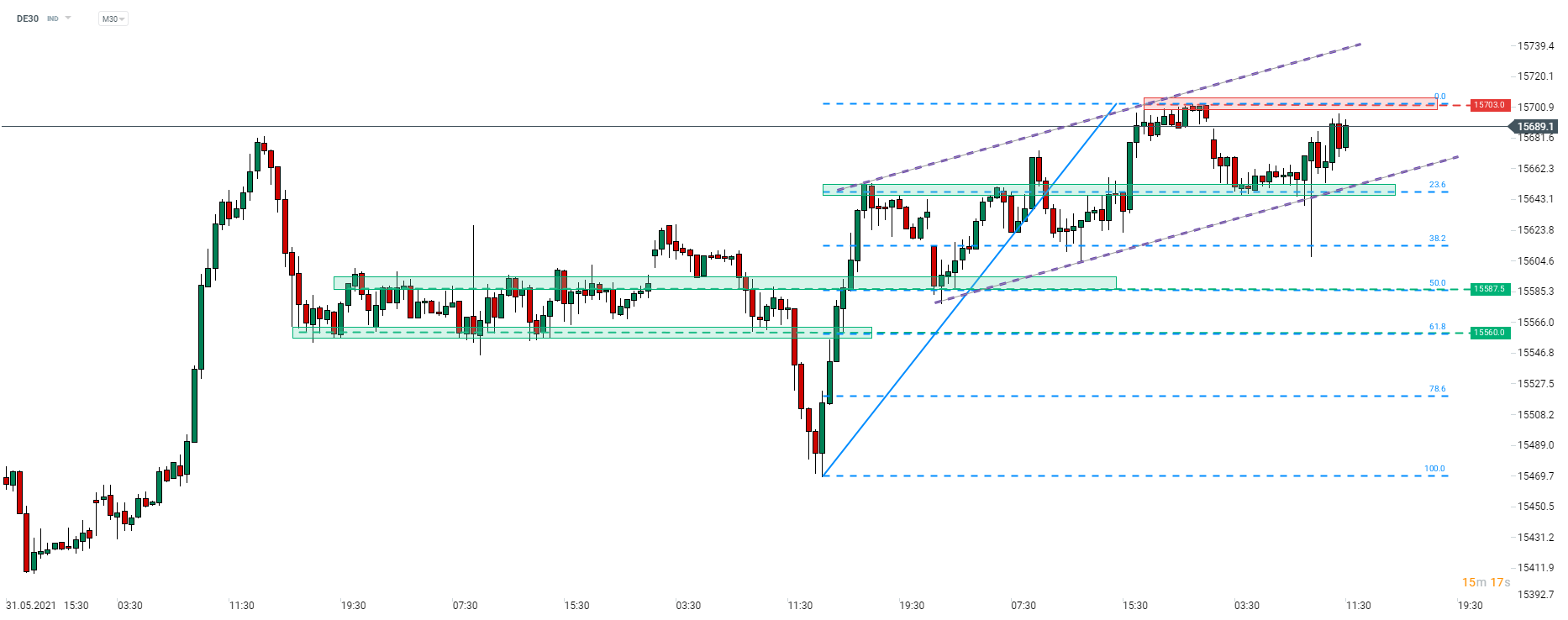

DE30 bounces off 23.6% retracement

-

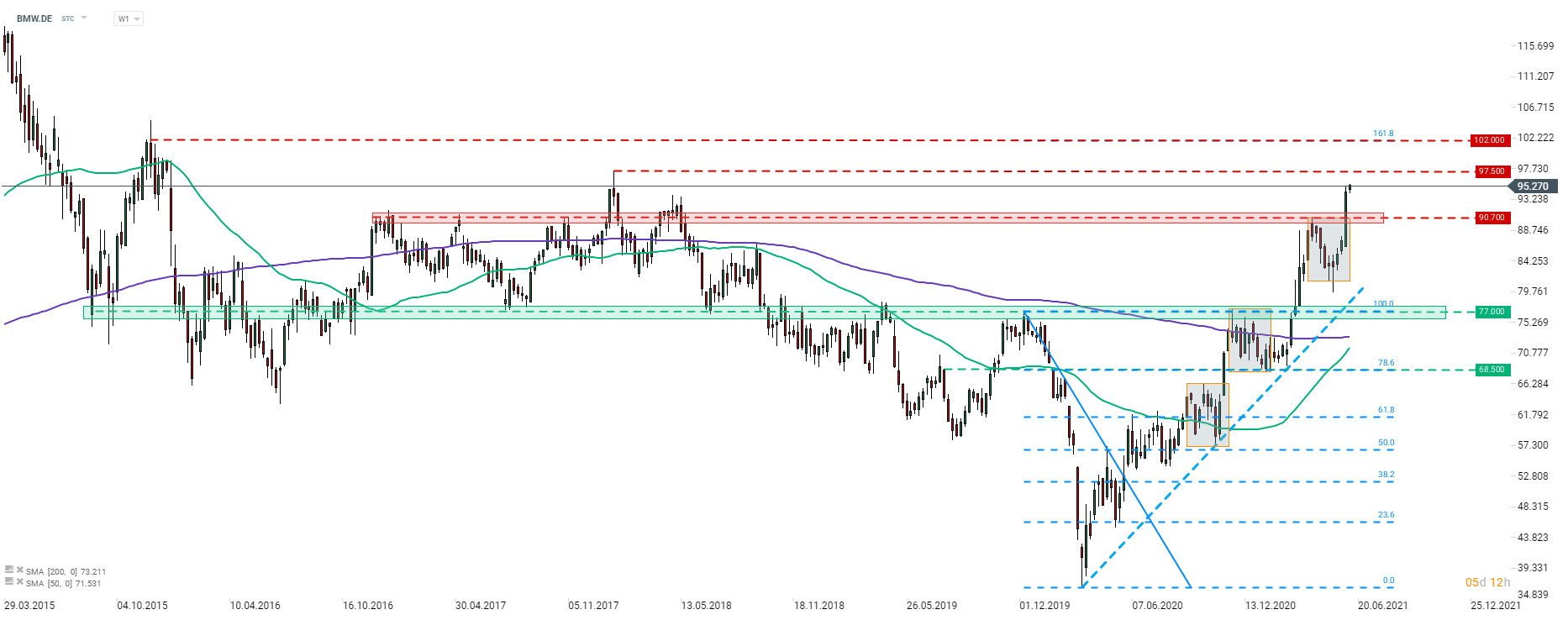

BMW to expand EV charging network in China by 20% this year

Major stock market indices from the Western Europe are trading flat at the beginning of a new week. Opening of the cash session was lower but major benchmarks managed to recoup losses and trade near Friday's closing prices. Italian FTSE MIB (ITA40) and Polish WIG20 (W20) are the best performing blue chip indices gaining around 0.5% each. On the other hand, Spanish Ibex (SPA35) is a top laggard dropping 0.2%.

Source: xStation5

Source: xStation5

German DE30 continues to trade within a short-term upward channel. Drop ahead of today's cash session launch pushed the index below the 23.6% retracement of recent upward impulse and below the lower limit of the channel but bulls managed to recoup losses. Index looks to be readying for a test of the resistance zone at around 15,700 pts, marked with all-time highs. Should we see a break to fresh records, the upper limit of the aforementioned channel at around 15,740-15,750 pts may turn out to be a near-term obstacle for buyers. On the other hand, should we see a pullback, investors should focus on Fibonacci retracements as potential supports - 23.6% retracement at 15,650 pts and 38.2% retracement at 15,615 pts.

Company News

According to the Handelsblatt report, Daimler (DAI.DE) wants to sell 25 workshops and showrooms across the United Kingdom, Belgium and Spain. Report claims that the company wants to sell those operations to an independent retailer group or investors and generate proceeds of €30-40 million per branch for a total of around €1 billion.

BMW (BMW.DE) plans to greatly expand its electric vehicle charging network in China this year. Company said that it aims to have 360,000 charging poles in the country by the end of 2021. This would mark an increase of around 60,000 charging poles, or 20%, over the course of the full year. China is taking big steps to reduce emissions and recent plans implemented by the government assume that the share of EVs in car sales may rise from 5% to 20% by 2025.

BMW (BMW.DE) extends a steep upward move at the beginning of a new week. Shares of the German carmaker bounced over 150% off March 2020 lows and trade at the highest level since the beginning of 2018. The nearest resistance zone to watch is marked with 2018 highs at €97.50 while the next major resistance can be found at the 161.8% exterior retracement of the 2020 drop (€102.00). Source: xStation5

BMW (BMW.DE) extends a steep upward move at the beginning of a new week. Shares of the German carmaker bounced over 150% off March 2020 lows and trade at the highest level since the beginning of 2018. The nearest resistance zone to watch is marked with 2018 highs at €97.50 while the next major resistance can be found at the 161.8% exterior retracement of the 2020 drop (€102.00). Source: xStation5

Daily summary: Wall Street tries to rebound 📈Amazon and Microsoft under pressure of Rotschild & Co Redburn

📌US500 loses 1%

US Open: Wall Street indices under continued selling pressure 📌Technology stocks slide

Morning Wrap (18.11.2025)