-

European indices trade slightly lower

-

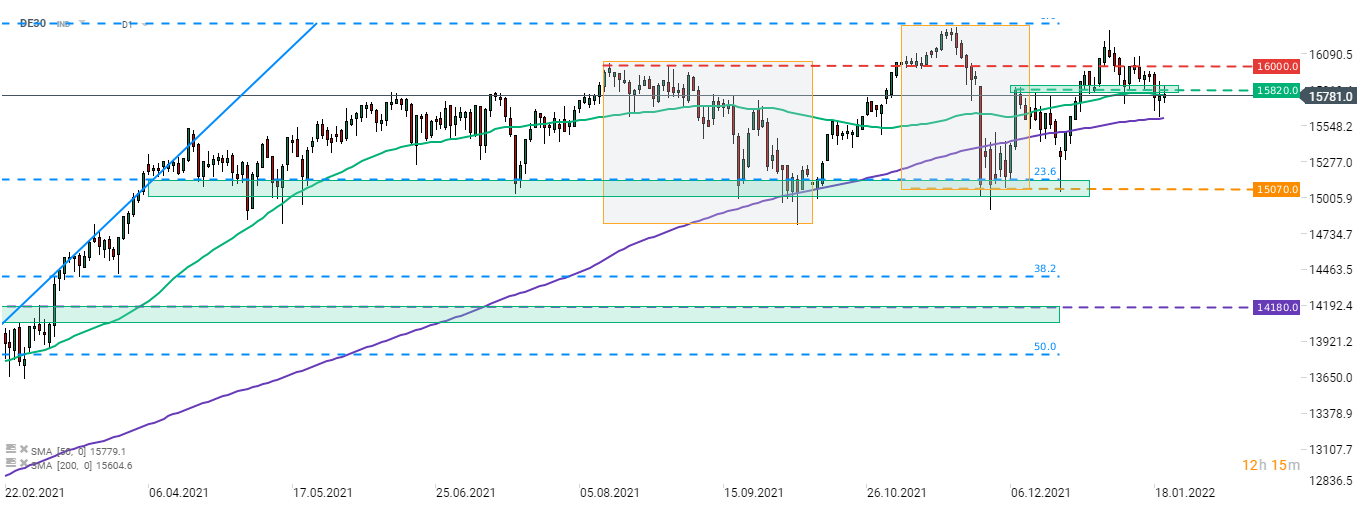

DE30 failed to break above resistance in the 15,800 pts area

-

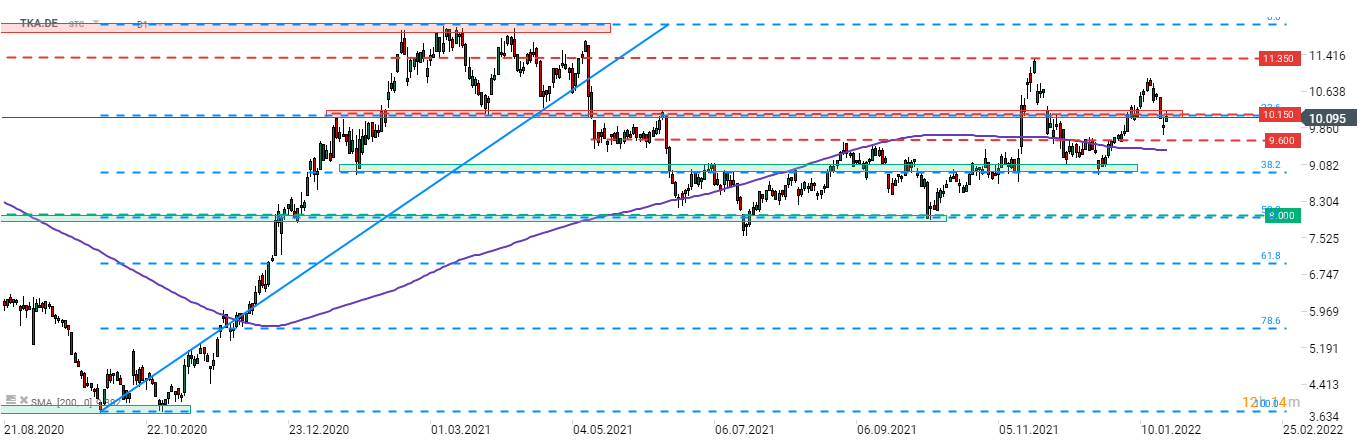

Thyssenkrupp signed submarine deal with Israel

European stock market indices launched today's trading more or less flat. However, bears took over at the beginning of cash trading and the majority of blue chips indices from the Western Europe now trade below yesterday's closing prices. However, declines are small. Russian indices outperform trading around 0.7% higher.

A massive surprise was reported in today's PPI data from Germany. Producer's inflation accelerated from 19.2 to 24.2% YoY in December (exp. 19.4% YoY). On a monthly basis price growth reached 5.0% while the market expected just 0.9% MoM. In spite of rising price pressures in the euro area, ECB President Lagarde said that the ECB does not need to follow the actions of the Fed while ECB's de Cos said that no rate hikes are expected in 2022. ECB minutes from the December meeting will be released today at 12:30 pm GMT but they are unlikely to touch on the issue of recent pick-up in inflation or market rates.

Source: xStation5

Source: xStation5

Price action on the German DE30 index was looking promising for bulls in the first half of yesterday's trading. Index managed to recover from a drop, painting a long lower wick, and made an attempt of breaking above the 15,820 pts price zone. However, the attempt failed and gains were erased, painting a long upper wick. Yesterday's daily candlestick hints at uncertainty in the markets and it can be spotted today with the majority of European indices trading either flat or slightly lower. In case bears take back control, traders should look towards the 200-session moving average as the first potential support.

Company News

Thyssenkrupp (TKA.DE) signed an agreement with Israel to develop and manufacture three high-tech submarines for Israeli Navy. Deal is worth €3 billion. Industrial strategic cooperation agreement was also signed that is worth over €850 million. First submarine is expected to be delivered in 9 years.

Airbus (AIR.DE) wants to increase employment by 6,000 jobs during the first half of 2022.

Analysts' actions

-

Siemens Healthineers (SHL.DE) upgraded to "buy" at Jefferies. Price target set at €75.00

-

Commerzbank (CBK.DE) upgraded to "outperform" at Exane. Price target set at €9.00

-

ProsiebenSat.1 Media (PSM.DE) rated "buy" at Goldman Sachs. Price target set at €18.10

-

Evotec (EVT.DE) upgraded to "buy" at Berenberg. Price target set at €51.00

Thyssenkrupp (TKA.DE) is trading higher following news of submarine deal reached with Israel. Stock is currently trying to climb back above the €10.15 price zone after strong declines from the beginning of the year. Should the attempt to break above this area fail and pullback starts, the nearest support can be find at short-term swing level at €9.60. Source: xStation5

Thyssenkrupp (TKA.DE) is trading higher following news of submarine deal reached with Israel. Stock is currently trying to climb back above the €10.15 price zone after strong declines from the beginning of the year. Should the attempt to break above this area fail and pullback starts, the nearest support can be find at short-term swing level at €9.60. Source: xStation5

Daily summary - Government stays shut, Market declines, crypto recovers

Extended decline at the end of a week! 🚨

US OPEN: Market extends decline at the end of the week

Daily summary: Optimism on Wall Street eases again🗽US Dollar drops from recent highs