-

European indices try to recover

-

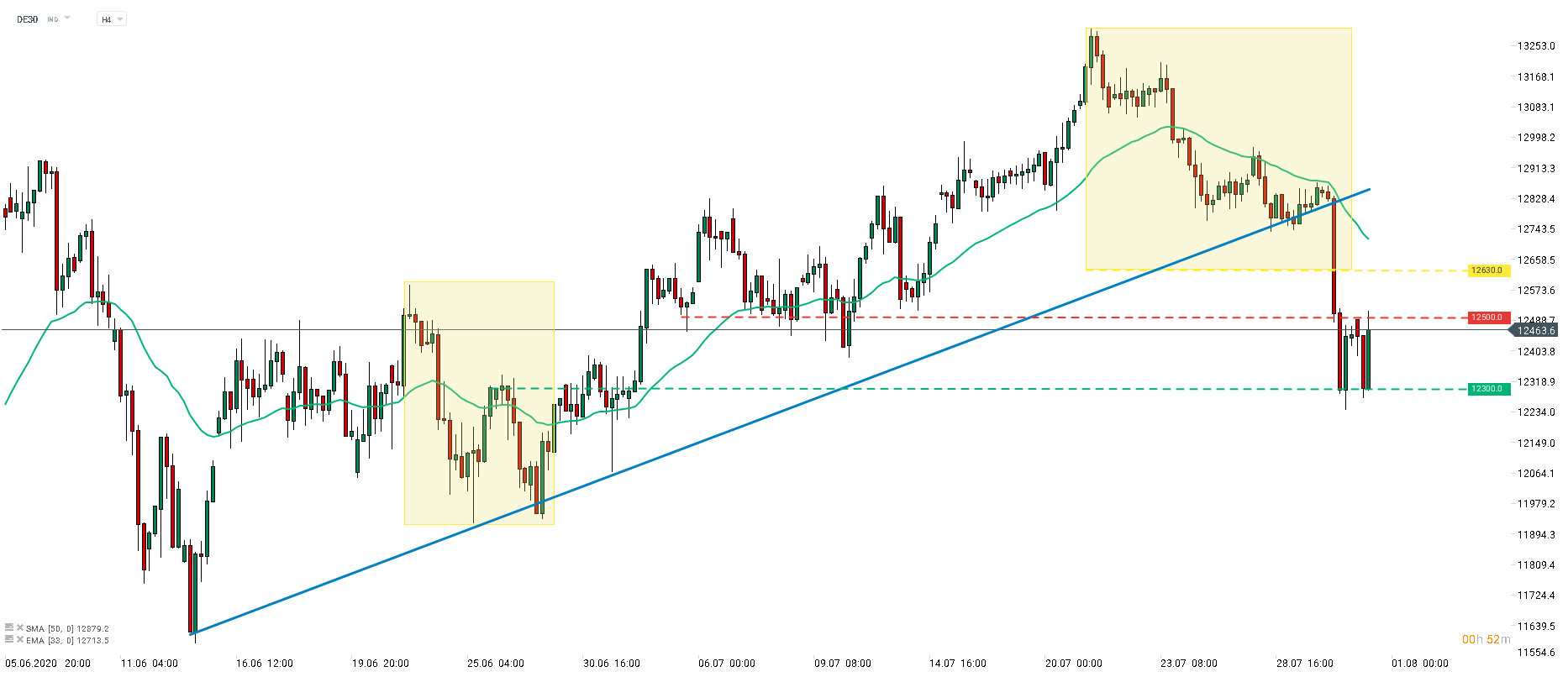

DAX tests 12,500 pts but fails to break above

-

Nemetschek (NEM.DE) gains after earnings report release

Stocks in Europe are trading higher and attempt to recover from yesterday's losses. However, in most cases gains do not exceed 1%. Investors continue to weigh the deteriorating pandemic situation against the prospect of a new stimulus bill in the United States. So far, no agreement was reached but discussions are set to continue today and tomorrow.

Spain and Italy - two European pandemic hotspots - released Q2 GDP reports this morning. Both prints showed deeper contraction than the German reading yesterday but such an outcome was expected. Spanish GDP shrank 18.5% QoQ (exp. -16.1% QoQ) while Italian report showed 12.4% QoQ contraction (exp. -15% QoQ). While Q2 GDP data is important, it does not tell us anything about the pace of recovery in recent months. Having said that, markets saw only a minor reaction to the release. Euro area GDP print showed a 12.1% QoQ contraction.

DE30 painted a double bottom near the 12,300 pts handle. Index recovered at the beginning of today's European session and tested overnight highs in the 12,500 pts area. However, DE30 failed to break above this hurdle and ongoing pullback hints that we may see a sideways move in the 12,300-12,500 pts range today. Source: xStation5

DE30 painted a double bottom near the 12,300 pts handle. Index recovered at the beginning of today's European session and tested overnight highs in the 12,500 pts area. However, DE30 failed to break above this hurdle and ongoing pullback hints that we may see a sideways move in the 12,300-12,500 pts range today. Source: xStation5

ProSiebenSat.1 (PSM.DE) released Q2 earnings report. The German mass media company had a net loss of €52 million in the April-June period, compared to €85 million profit in Q2 2019. Revenue dropped 25%. Company said that ad revenue was 20% down in July and is trending at -10% for August. ProSiebenSat plans to focus on cost management and cash flow in the near future.

Nemetschek (NEM.DE) also reported Q2 2020 earnings. The German company said its revenue increased 2.8% YoY in Q2 2020 to €141.6 million. Sales were 7.6% higher in the whole first half of the year. Nemetschek noted strong subscription growth in the quarter and EBITDA margin remaining near previous year's level (28.8%). Net income of €21.1 million was slightly lower than €21.9 million booked in Q2 2019.

According to a Bloomberg report, board members of Commerzbank (CBK.DE) are seen proposing Hans-Jerg Vetter for a post of Bank's Chairman. The candidate will need to be approved by the Board during a meeting on Monday. Company's CEO and Chairman stepped down at the beginning of July amid mounting criticism over the Bank's performance.

Nemetschek (NEM.DE) bounced off the support zone at €59.50 on the back of a solid Q2 earnings report. The first resistance to watch, in case of a continuation of an upward move, can be found at €65.25. This swing area limited the previous two upward moves. More important resistance can be found near pre-pandemic highs at €68. Source: xStation5

Nemetschek (NEM.DE) bounced off the support zone at €59.50 on the back of a solid Q2 earnings report. The first resistance to watch, in case of a continuation of an upward move, can be found at €65.25. This swing area limited the previous two upward moves. More important resistance can be found near pre-pandemic highs at €68. Source: xStation5

US100 gains ahead of the Fed decision 🖋️

DAX: DE40 slightly gains driven by automakers 📈Mercedes up 5% on sales upbeat

BREAKING: SPA35 ticks down on lower-than-expected GDP in Spain 🇪🇸 📉

Morning wrap (29.10.2025)