-

German elections to be held this Sunday

-

First federal elections in post-Merkel era

-

SPD leads in polls but will need partners to rule

-

Market impact expected to be minimal

Federal elections will be held this Sunday in Germany. Germans will decide who gets a seat in the lower house of Bundestag, the German parliament. Elections are closely watched as they will be the first ones in the post-Merkel era. More importantly, the decline of Angela Merkel's party in polls also suggests that continuation of current policy looks unlikely. Take a look at our quick guide to the upcoming German elections.

German electoral system

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appBefore we take a look at top contenders in the upcoming German elections let's take a moment to explain how elections in Germany work. Germans will cast 2 votes - one for a local MP candidate and one for a political party. Half of the seats in the German government will be decided by direct votes while the remaining half will be decided by political party votes. Once all seats are decided, MPs will vote on who will be the next German Chancellor. However, as usually neither party gets enough seats to rule alone, coalitions are made and in turn Chancellery may not be decided until coalition talks are finished

Recent polls

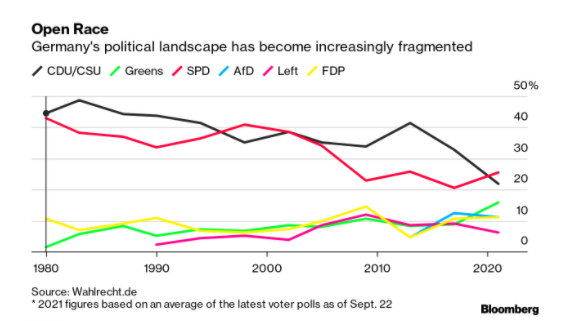

The upcoming elections may result in a big change on the German political scene. CDU/CSU coalition that was ruling in Germany for years saw its support slide this year from over 35% to below 25%. Meanwhile, centre-left SPD gained support and emerged as leader in polls with over 25% support. Greens are currently projected to win the third biggest support - 15%. Free Democrats (FDP) and Alternative for Germany are both polling around 11%. Support for The Left (Linke) has been more or less stable in the 6-7% range in recent months.

A key takeaway from current poll numbers is that it is highly unlikely that any party will be able to rule alone. Similarities in policies of different parties as well as current poll numbers provide an outlook at what the next German ruling coalition may be.

Recent German elections polls. Source: Bllomberg

Recent German elections polls. Source: Bllomberg

Potential coalitions

There are currently three coalition options being taken under consideration given poll numbers:

-

SPD-CDU/CSU

-

SPD-Greens-The Left

-

SPD-Free Democrats-Greens

The first option, also called Grand Coalition, has already been in play in Germany and Germans have mixed feelings about it - drop in support for CDU/CSU shows that people of Germany want a change. All three parties under the second option (SPD-Greens-The Left) called for higher taxes on wealthy households and fixed €12-13 minimum wage. This group also supports reform of the debt limit so it won't slow public investments. Meanwhile, both CDU/CSU and Free Democrats are opting for tax relief for wealthy households and want the private sector to invest more by offering tax incentives.

The third option is probable but there are some key differences between those parties - for example on taxes - that make it less likely then the previous two options.

Market impact

Market impact of German elections is not expected to be significant. Another term of SPD-CDU/CSU coalition would hint at continuation of current policy and its impact would most likely be neutral. SPD-Greens-The Left coalition may make outlook for equities slightly negative due to increase in taxes while at the same time may boost bond yields due to changes in debt limit. SPD-Free Democrats-Greens coalition is expected to be neutral for stocks.

A point to note is that any coalition involving Greens could be beneficial for eco-friendly companies as Greens opt for high investments on making the German economy carbon-neutral.

Last but not least, it looks highly likely that the German ruling coalition will be a three-party coalition. This is probably the most important change as steering away from a two-party coalition increases the likelihood of friction between coalition partners and may create a bigger risk of a political gridlock in case of disagreements.

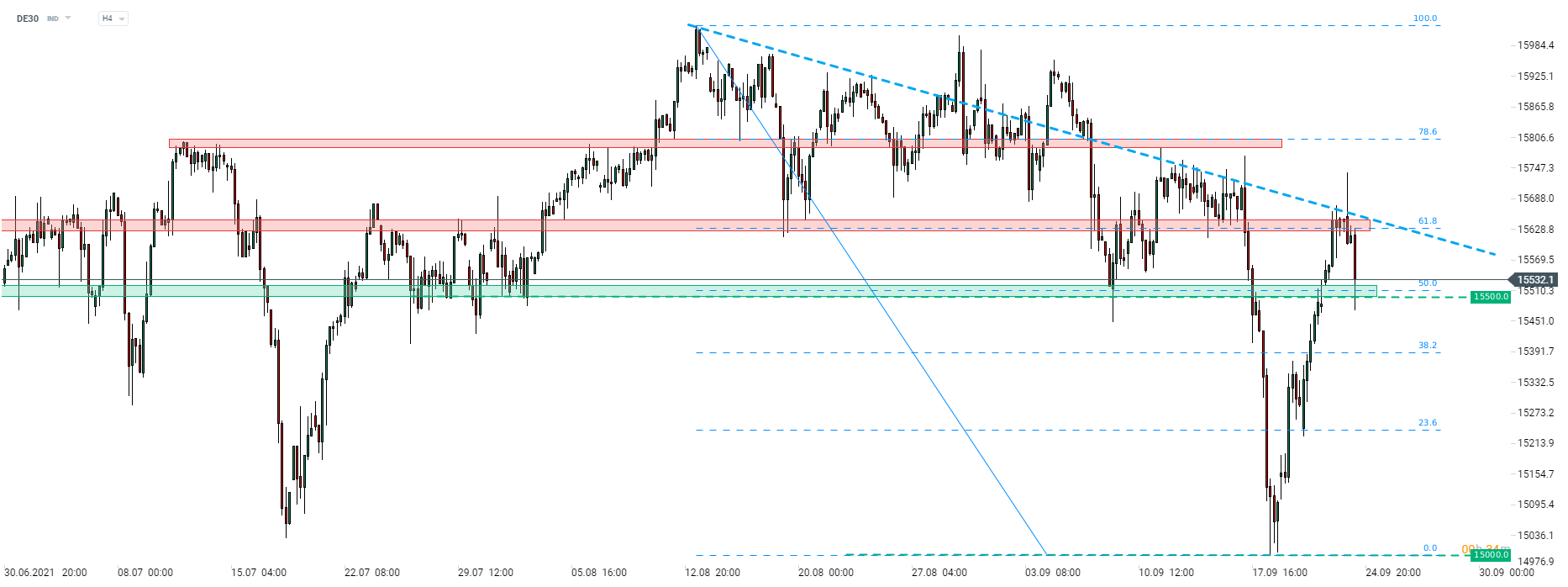

Technical look at DE30

A look at the German DAX chart (DE30) shows that recovery movement on the German stock market has taken a pause today. Index failed to break above the resistance zone marked with 61.8% retracement of recent downward move and launched a pullback. Support marked with 50% retracement in the 15,500 pts area is currently being tested. Long lower wick of current H4 candlestick suggests that bulls are looming in the area and resumption of the upward move cannot be ruled out. Should buyers regain control and push the index above the aforementioned 61.8% retracement, near-term technical outlook would improve as it would also mean breaking above the short-term downward trendline.

Source: xStation5

Source: xStation5