-

German paves the way for deficit spending in 2021

-

DE30 tested 13,450 pts but failed

-

Telefonica (O2D.DE) lost ruling at EU Court of Justice

European stock markets launched Thursday's session higher and extended gains after the opening bell. German DAX tested 13,450 pts mark but failed to break above and a slight pullback could be observed later on. Nevertheless, the majority of blue chip indices from the Old Continent still trade over 1% above yesterday's closing prices.

German authorities backed a plan to allow deficit spending during the next year in order to shore up the economy amid a coronavirus-related downturn.

Just as it was the case yesterday, DE30 made a strong upward move at the start of today's session. Upward movement eased after reaching 13,450 pts handle and a pullback started. Lower limit of the overbalance structure at around 13,335 pts could offer some support but traders should focus on a support in the 13,300 pts swing zone. Watch out for elevated volatility during release of jobless claims (1:30 pm BST) and ISM non-manufacturing (3:00 pm BST). Source: xStation5

Just as it was the case yesterday, DE30 made a strong upward move at the start of today's session. Upward movement eased after reaching 13,450 pts handle and a pullback started. Lower limit of the overbalance structure at around 13,335 pts could offer some support but traders should focus on a support in the 13,300 pts swing zone. Watch out for elevated volatility during release of jobless claims (1:30 pm BST) and ISM non-manufacturing (3:00 pm BST). Source: xStation5

Siemens Healthineers (SHL.DE) sold new shares yesterday. 75 million shares were sold to fund managers for around €2.73 billion. However, the company is readying a plan to raise even more capital. According to a Bloomberg report, Siemens Healthineers is exploring ways to do it by another share placement or issuing additional debt. The decision is likely to be made during the next Annual Shareholders' Meeting. Siemens Healthineers wants to raise cash for its recently announced acquisition of Varian, a cancer treatment company.

Telefonica (O2D.DE) has lost a ruling at the EU court relating to the roaming price plan introduced in 2017. Court ruled that Telefonica failed to transfer some customers to a new price plan that would lower roaming fees for them. Ruling by the European Court of Justice is binding and final but it will be a court in Munich that will decide on details of punishment for the German telecom.

Bayer (BAYN.DE) received a "neutral" recommendation at Credit Suisse. Price target was set at €60.

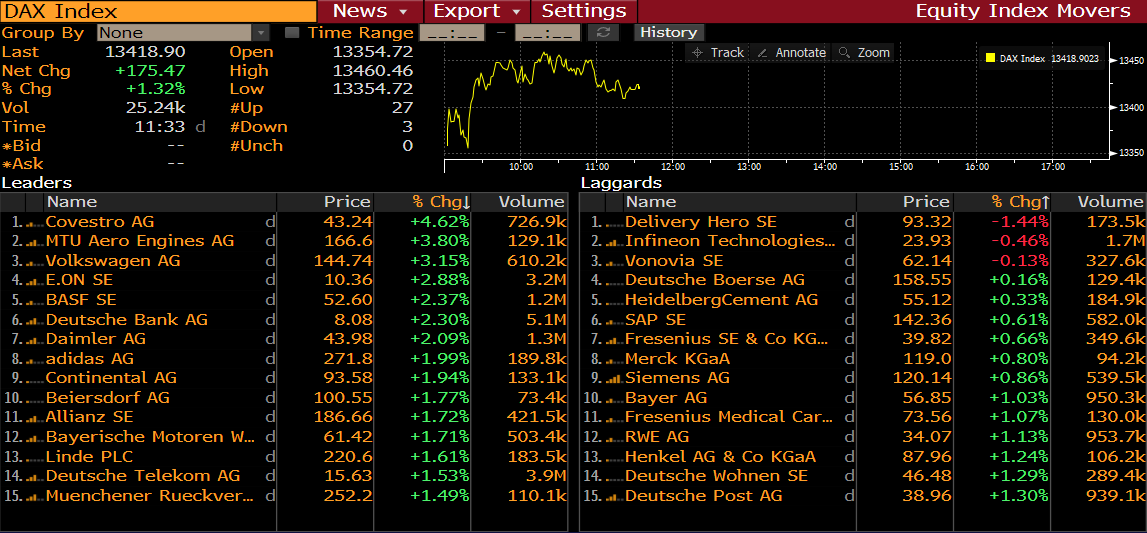

DAX members at 10:33 am BST. Source: Bloomberg

DAX members at 10:33 am BST. Source: Bloomberg

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

DE40: European markets decline due to concerns about the U.S. banking sector

Morning wrap (17.10.2025)