-

European indices recover slightly after Friday's sell-off

-

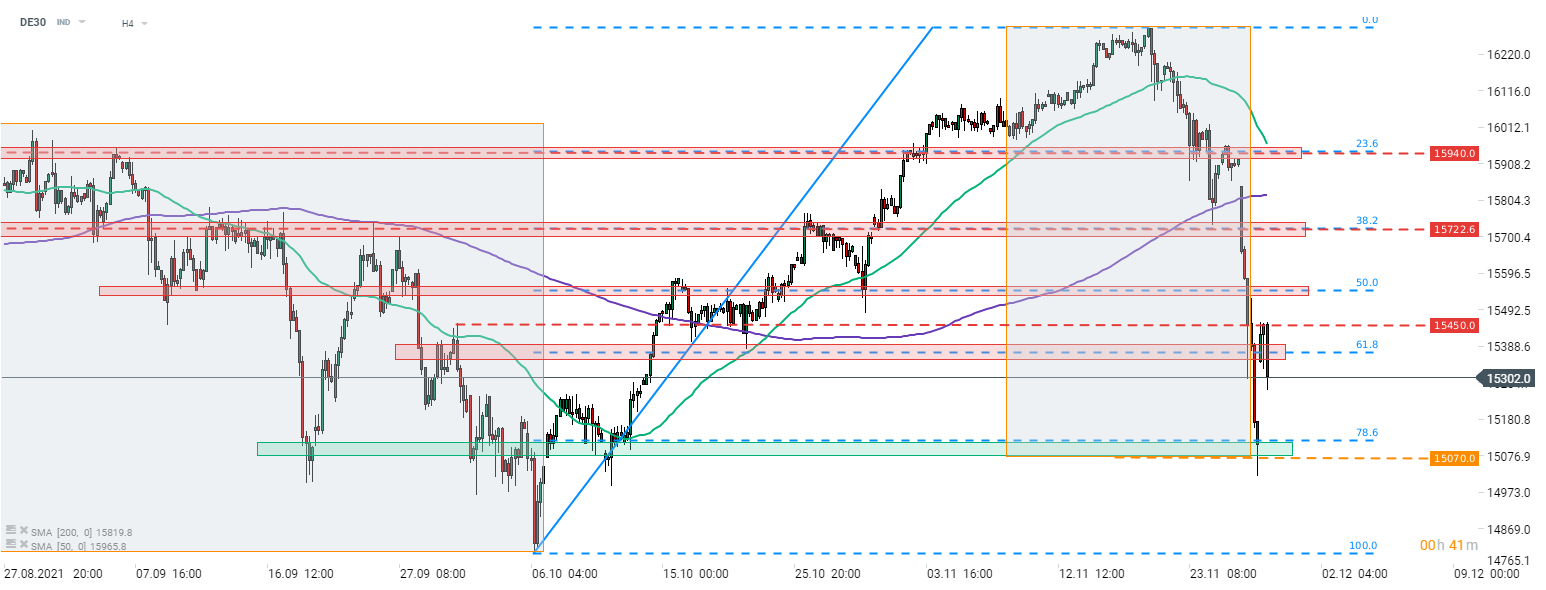

DE30 halts advance after test of 15,450 pts area

-

Friday's winners and losers reverse recent moves

European stock markets launched a new week higher. Reports saying that infection with new coronavirus variant has less severe symptoms than previous variants allowed stocks and other risky assets to catch a breath. However, recovery move was halted after start of European cash session as uncertainty remains large.

Source: xStation5

Source: xStation5

DE30 launched a new week with a big bullish price gap as concerns over a new coronavirus variant - Omicron - eased somewhat. German index launched trading near the 61.8% retracement of the upward move started at the beginning of October. DE30 continued to move higher until the advance was halted in the 15,450 pts area and the index started to pull back again. Situation is puzzling. On one hand, the index managed to bounce off the lower limit of the Overbalance structure, signalling that uptrend is still in play. On the other hand, the recovery move launched during the Asian session seems to be losing momentum. Nevertheless, as long as price sits above 15,070 pts area, technical outlook seems to favour bulls.

Company News

Concerns over impact of a new coronavirus variant eased slightly over the weekend. As a result, some of the stocks that experienced large moves on Friday are now trimming those gains/ recovering losses. HelloFresh (HFG.DE) and Zalando (ZAL.DE) are pulling back after strong gains booked on Friday while Airbus (AIR.DE) or carmakers are recovering.

Siemens (SIE.DE) partnered with Hyundai Motor and Kia Corporation. Technology partnership will aim to accelerate digital transformation of Asian carmakers. Siemens will provide product data management and next level engineering via its NX software and Teamcenter solutions.

Analysts' actions

-

Continental (CON.DE) downgraded from "neutral" to "sell" at Goldman Sachs. Price target set at €100

While most of the German automotive stocks manage to gain slightly at the beginning of a new week, Continental (CON.DE) continues to move lower. Stock is being pressured by a downgrade it received at Goldman Sachs. Major support zone to watch in case declines continue to deepen can be found ranging below the 50% retracement of the post-pandemic recovery move (€92.00 area). Source: xStation5

While most of the German automotive stocks manage to gain slightly at the beginning of a new week, Continental (CON.DE) continues to move lower. Stock is being pressured by a downgrade it received at Goldman Sachs. Major support zone to watch in case declines continue to deepen can be found ranging below the 50% retracement of the post-pandemic recovery move (€92.00 area). Source: xStation5

Chart of the Day: JP225 (20.10.2025)

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

DE40: European markets decline due to concerns about the U.S. banking sector