-

European indices try to recover from post-FOMC drop

-

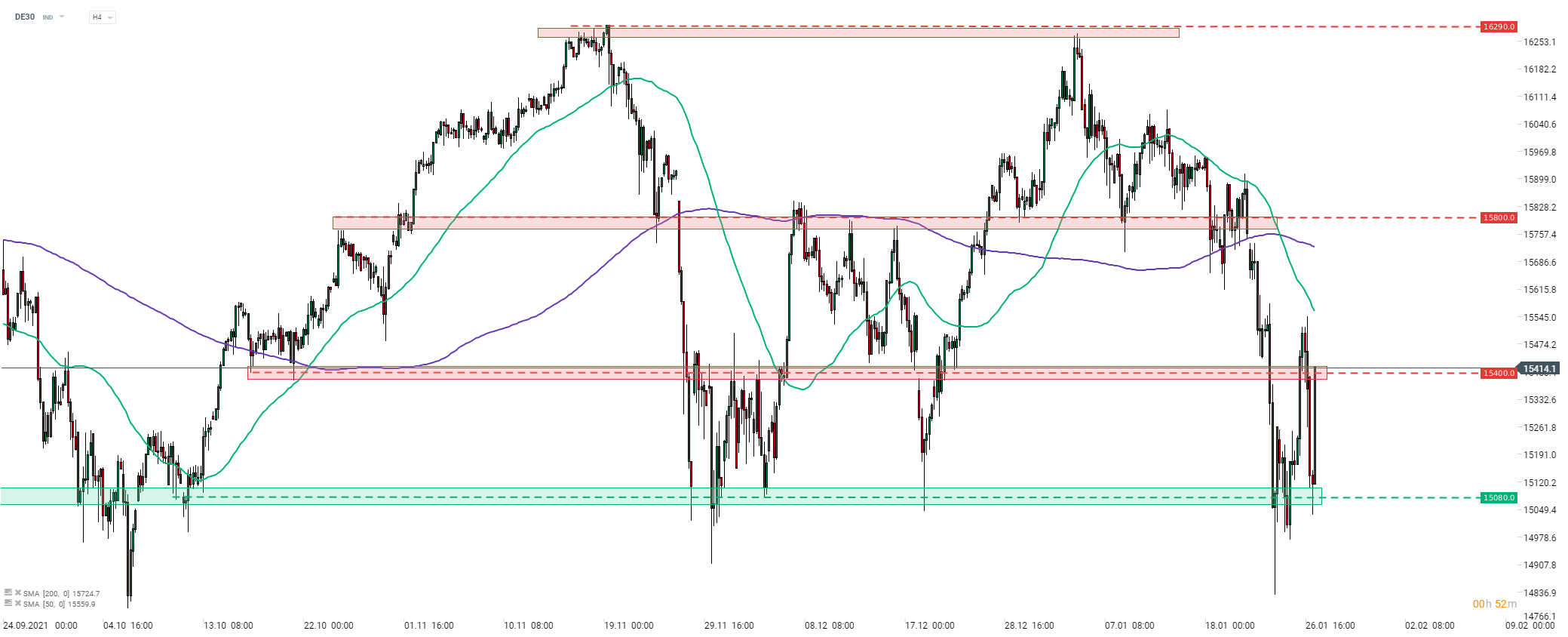

DE30 tests resistance in the 15,400 pts area

-

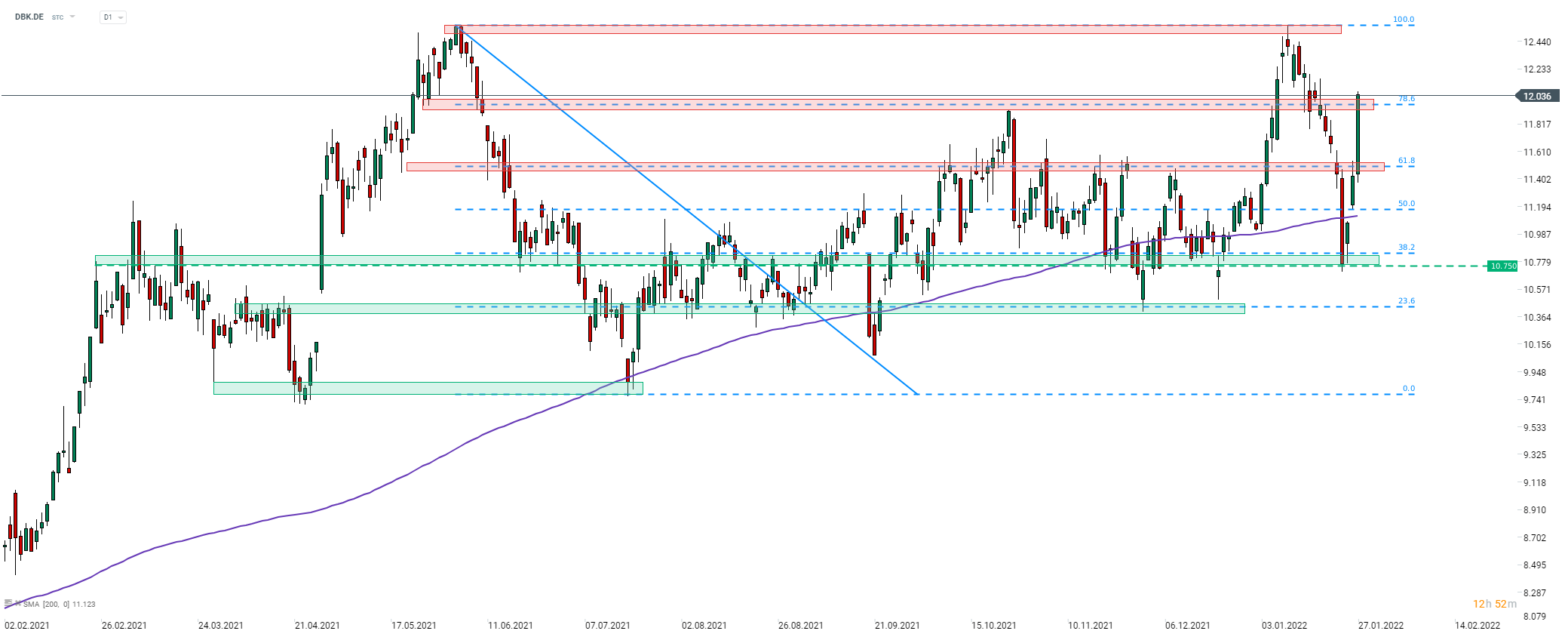

Deutsche Bank rallies on solid Q4 earnings

European stock markets launched today's trading with big bearish price gap amid post-FOMC risk aversion. However, strong upward move was launched at the beginning of the European session and now majority of European blue chips indices trade just slightly below yesterday's closing prices. The main event of the day is release of the US GDP report for Q4 2021 (1:30 pm GMT).

DE30 was on track to make a meaningful break above the 15,400 pts resistance yesterday but Fed dented market moods. Index plunged back to the 15,080 pts support where declines were halted. A recovery move was launched at the start of today's session and the index is once again testing the aforementioned 15,400 pts resistance. However, whether we see a break or not may depend on the US GDP report for Q4 2021 that will be released today at 1:30 pm GMT. Source: xStation5

DE30 was on track to make a meaningful break above the 15,400 pts resistance yesterday but Fed dented market moods. Index plunged back to the 15,080 pts support where declines were halted. A recovery move was launched at the start of today's session and the index is once again testing the aforementioned 15,400 pts resistance. However, whether we see a break or not may depend on the US GDP report for Q4 2021 that will be released today at 1:30 pm GMT. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDeutsche Bank (DBK.DE) is the best performing DAX member today. Stock gains following release of upbeat Q4 earnings report. The German lender reported an 8.2% YoY jump in Q4 revenue to €5.9 billion (exp. €5.68 billion) and €145 million in net profit. Trading revenue was slightly lower year-over-year at €1.2 billion. Full-year revenue jumped 6% to €25.3 billion. This was the best net result the company has achieved since 2011. Bank announced intent to pay out €700 million to investors through buybacks and dividends. Company also announced that it now expects to exceed its previous forecast of €25 billion in revenue for 2022.

Sartorius (SRT.DE) announced 2021 results today. Company reported a 48% YoY jump in sales, to €3.45 billion (exp. €3.41 billion), and 50% YoY jump in orders, to €4.27 billion. Adjusted net income was 85% YoY higher at €553.4 million (exp. €542.6 million) while adjusted EBITDA increased 70% YoY to €1.18 billion (exp. €1.17 billion). Sartorius confirmed the 2022 forecast with sales growth expected to reach 14-18%.

Deutsche Bank (DBK.DE) is the best performing DAX member today. German lender reported the best results in a decade and is trading 5% higher on the day. Resistance zone marked with 78.6% retracement of the downward move launched in June 2021 is being tested at press time. Breaking above would pave the way for a test of post-pandemic highs in the €12.50 area. Source: xStation5

Deutsche Bank (DBK.DE) is the best performing DAX member today. German lender reported the best results in a decade and is trading 5% higher on the day. Resistance zone marked with 78.6% retracement of the downward move launched in June 2021 is being tested at press time. Breaking above would pave the way for a test of post-pandemic highs in the €12.50 area. Source: xStation5

SAP (SAP.DE) is trading lower today. Company confirmed its preliminary earnings report for Q4 2021 today and 2022 outlook announced on January 13, 2022. Drop can be reasoned with somewhat disappointing full disclosure of Q4 results with analysts believing that company's forecasts pointing to business growth becoming more flat going forward.

RWE (RWE.DE) announced preliminary 2021 earnings today. Company reported adjusted net profit of €1.57 billion (exp. €1.28 billion) and adjusted EBITDA of €3.65 billion (exp. €3.30 billion). Adjusted EBIT came in at €2.19 billion. Solid results were driven by better than expected performance of trading unit into year's end as well as the Hydro/Biomass/Gas segment.

Adidas (ADS.DE) announced that it will increase global employment by 2,200 jobs this year. New hirings will be made across 47 countries and will start in the later part of the year.

Analysts' actions

-

LEG Immobilien (LEG.DE) upgraded to "outperform" at Exane. Price target set at €139.00

SAP (SAP.DE) is the worst performing DAX member today. Stock drops as forecast for 2022 were seen as somewhat disappointing. Share price plunged below the support zone ranging between €113.50 and 38.2% retracement of upward move started in November 2020 and is currently testing the next support at 50% retracement (€110.00 area). Source: xStation5

SAP (SAP.DE) is the worst performing DAX member today. Stock drops as forecast for 2022 were seen as somewhat disappointing. Share price plunged below the support zone ranging between €113.50 and 38.2% retracement of upward move started in November 2020 and is currently testing the next support at 50% retracement (€110.00 area). Source: xStation5