-

Equity indices trade higher on upbeat trade remarks

-

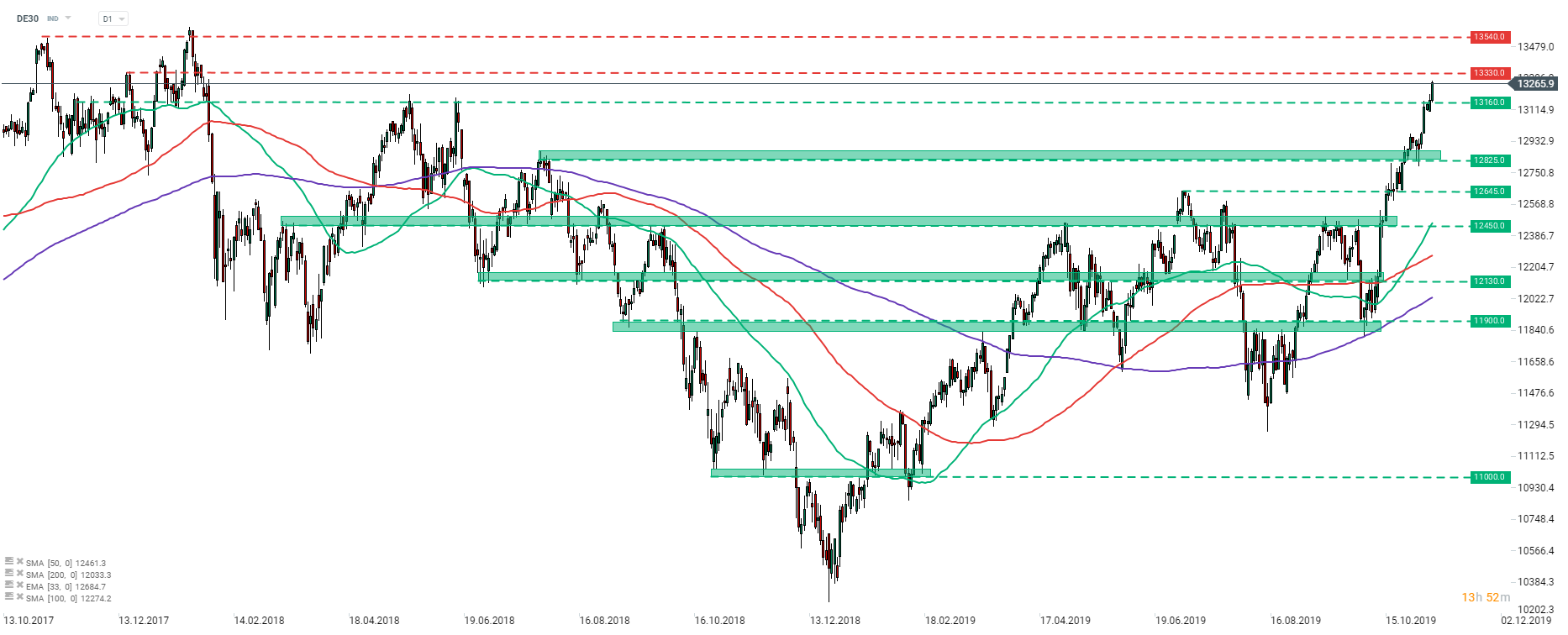

DE30 closes in on all-time high

-

Deutsche Telekom (DTE.DE) sinks after cutting dividend payout

European stock market indices opened higher today, thanks to news saying that China is ready to negotiate tariff cancellation with the United States. Gains can be seen all across the Old Continent with Italian and Swedish equities rising the most. The smallest gains can be spotted on the Russian and Swiss stock exchanges.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appRally on DE30 shows no signs of stopping. The index is closing in on the all-time high, thanks to upbeat trade news. The closest resistance level to watch can be found at 13330 pts - the level of local peak from mid-December 2017. However, this level did not see many price reactions therefore its significance may not be too big. More important resistance levels can be found in the ATH area above 13540 pts. This area is also marked with the equality of upward impulses - should the ongoing upward wave be equal to the one from the first half of 2019, the index will test the ATH. The double top from May-June 2018 at 13160 pts is the first support level to watch.

DAX members at 8:52 am GMT. Source: Bloomberg

DAX members at 8:52 am GMT. Source: Bloomberg

5 DAX members released earnings report before opening of today’s cash session - Deutsche Telekom (DTE.DE), Deutsche Lufthansa (LHA.DE), HeidelbergCement (HEI.DE), MunichRe (MUV2.DE) and Siemens (SIE.DE). All five companies managed to report earnings that were higher than market consensus. However, Deutsche Telekom and HeidelbergCement slightly missed revenue expectations.

Deutsche Telekom (DTE.DE) can be found among the worst performing DAX members today. The company managed reported earnings that were 14.3% higher than estimates and revenue that missed median estimate by 1.2%. However, the company decided to cut dividend reasoning the decision with high mobile spectrum costs. Payout was lowered from €0.70 per share to €0.60 per share. The company ruled out further dividend cuts.

Lufthansa (LHA.DE) is the best performing DAX stock on Thursday morning. The company reported earnings that almost 50% higher than expected. Nevertheless, the earnings fell 8% YoY. Decline of this scale can be seen as an improvement against previous quarters. However, the company is struggling with cabin-crew strikes currently and was forced to cancel over a thousand flights already.

Siemens (SIE.DE) reported earnings that were 23% higher than expected and revenue that beat median estimate by 6.8%. However, the company warned that the ongoing slowdown is likely to hit factory volumes next year.