-

Global stock markets plummet in response to disappointing ISM reading

-

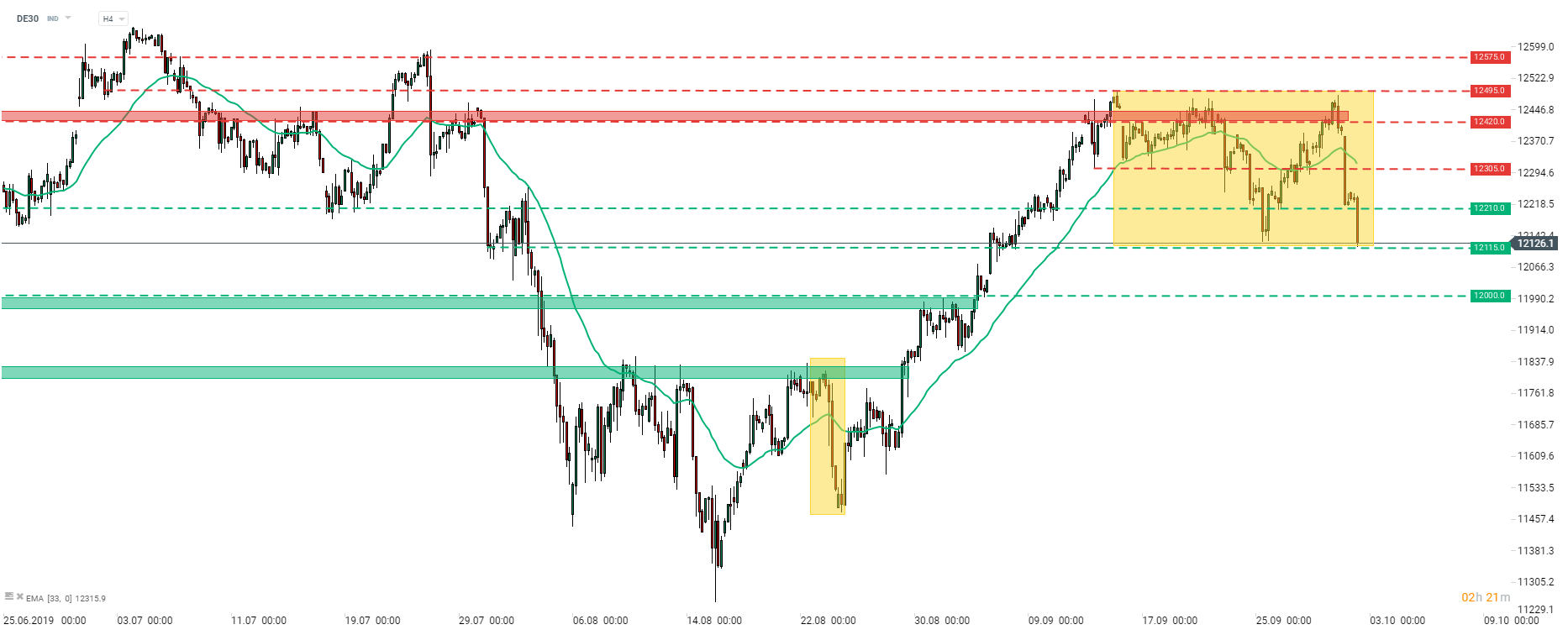

DE30 tests the lower limit of the Overbalance structure

-

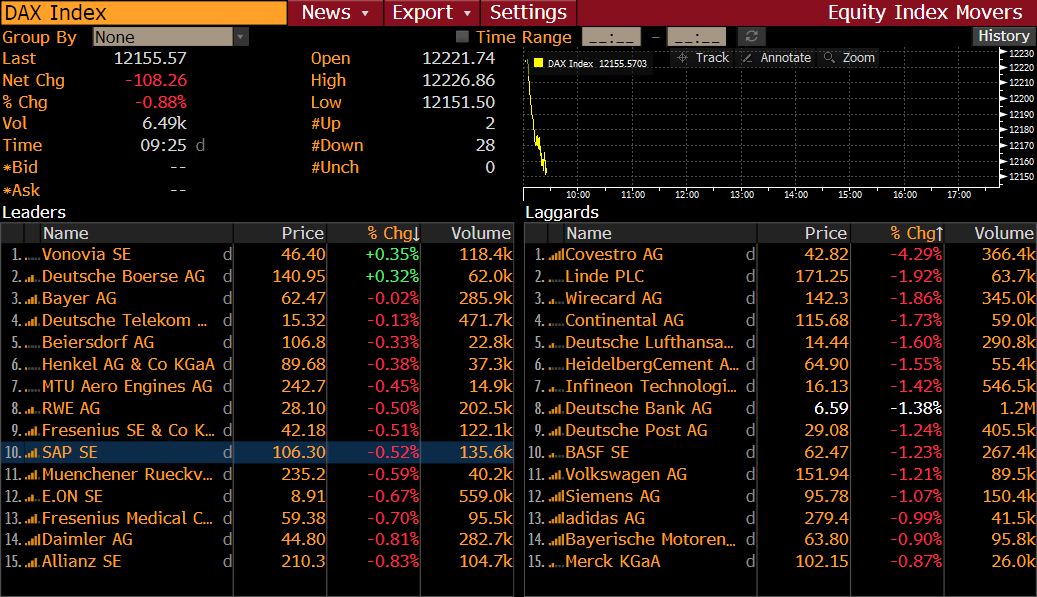

Covestro (COV1.DE) sinks after receiving downgrade at MainFirst Bank

Major European indices opened lower as moods on the global stock markets remain sour after lacklustre US manufacturing ISM reading. Not a single blue chips index from the Old Continent managed to diverge from this trend in the first minutes of Wednesday’s trading.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appJust like other major indices, DE30 plummeted after the release of US manufacturing ISM for September. The German index declined around 130 points in an hour and smashed through a few support levels. Downward move was halted at the support zone ranging above the 12210 pts. However, decline was resumed after the open of today’s cash session. DE30 is eyeing a test of the lower limit of the Overbalance structure (yellow box). In theory, a break below could herald a trend reversal and further weakness. In such a scenario, the first area to watch will be the price zone ranging near the 12000 pts handle.

Covestro (COV1.DE) leads DAX lower after receiving a downgrade at MainFirst Bank. Source: Bloomberg

Covestro (COV1.DE) leads DAX lower after receiving a downgrade at MainFirst Bank. Source: Bloomberg

Bayer (BAYN.DE) can be found among DAX leaders today. Liam Condon, company’s head of agrochemicals unit, said that Bayer is willing to make settlement of the GLyphosat claims but only on the condition that it will be financially adequate and final.

Reuters reports that Allianz (ALV.DE) is seen as a front-runner for the insurance business of BBVA (BBVA.ES) after Generali (G.IT) reportedly dropped out of a race. The deal could be worth around €1 billion and would provide Allianz with solid distribution network in Spain. None of the companies involved commented on the news so far.

Covestro (COV1.DE) received a downgrade at MainFirst Bank. The Bank lowered recommendation for the stock from “neutral” to “underperform”. Price target was lowered from €47 to €41, implying an 8% decrease against yesterday’s closing price.

Covestro (COV1.DE) shares failed to break above the 200-session moving average (purple line) in mid-September and subsequent retest was a failure as well. Shares are taking a significant dive lower today due to a downbeat recommendation from MainFirst Bank. The area ranging €41.50-42.00 should serve as the important support zone as 50- and 100-session moving averages can be found there (green and red lines respectively). Source: xStation5

Covestro (COV1.DE) shares failed to break above the 200-session moving average (purple line) in mid-September and subsequent retest was a failure as well. Shares are taking a significant dive lower today due to a downbeat recommendation from MainFirst Bank. The area ranging €41.50-42.00 should serve as the important support zone as 50- and 100-session moving averages can be found there (green and red lines respectively). Source: xStation5