- European stock markets trade lower

- DE30 pulls back from 16,000 pts area

- German CPI for August and US ADP are key events of the day

European stock market indices are trading mostly lower today. It looks like bulls after taking a pause to catch a breath following yesterday's solid gains. Moreover, a number of key macro reports scheduled for later today - like German CPI and US ADP - advises caution.

Release of flash German CPI data for August is a key even in the European economic calendar for today. Market expects data to show a deceleration in price growth from 6.2% YoY in July to 6.0% YoY in August. However, state-level data that was already released was mixed - inflation in Hesse and Bavaria decelerated while inflation in Baden Wuerttemberg, Saxony and Brandenburg accelerated. Reading for the whole Germany will be released at 1:00 pm BST.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

Source: xStation5

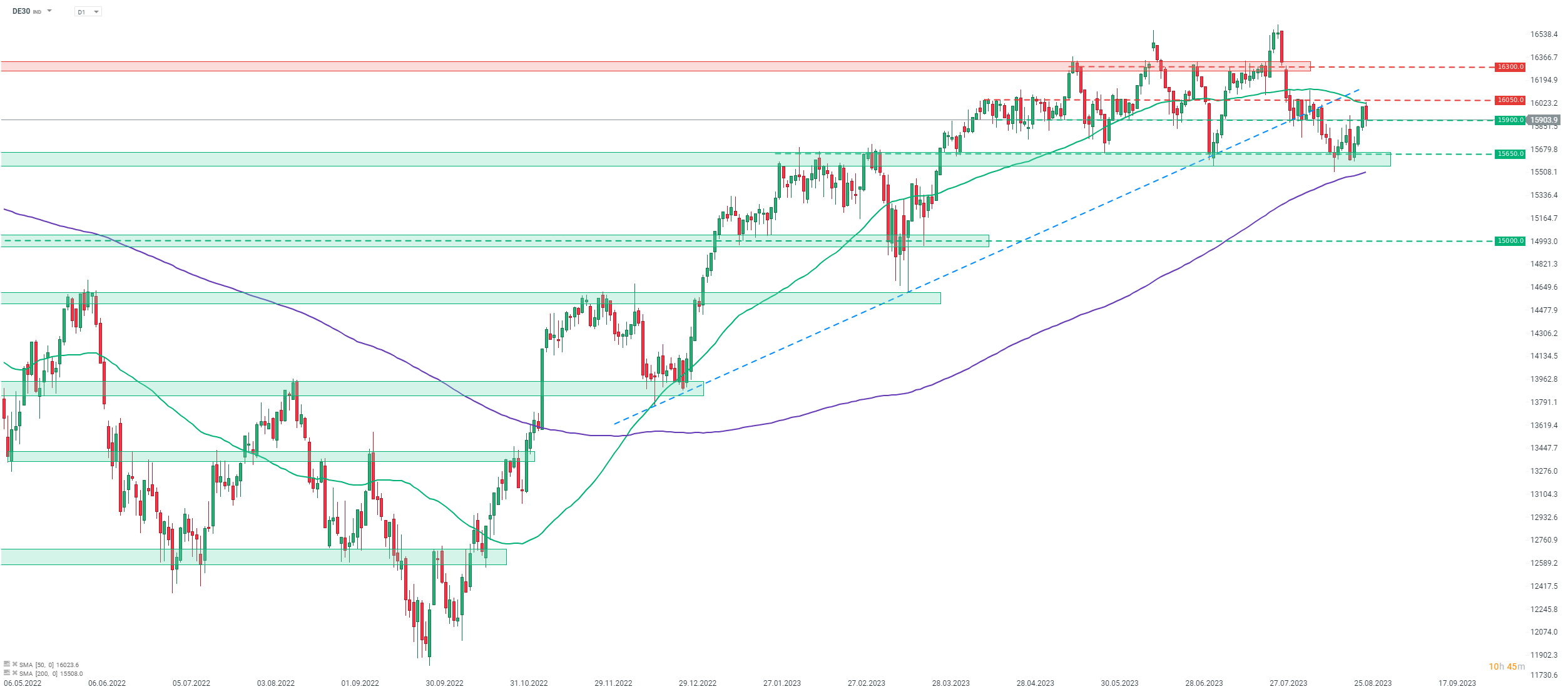

DE30 is pulling back today. The index experienced strong gains yesterday and managed to test the 16,000 pts area. Gains continued overnight. However, bulls failed to break above the 50-session moving average (green line) and sellers started to take over. DE30 has been pulling back throughout today's European cash session and is now testing a short-term support in the 15,900 pts area. Breaking below this zone and finished today's trading there may suggest that the next test of a key 15,650 pts support zone is just a matter of time.

Company News

European new car registrations increased 15.2% YoY in July, to 0.851 million units. New registrations of Volkswagen Group cars (VOW1.DE) increased 19.2% YoY to 280.29 thousand units, registrations of BMW Group cars (BMW.DE) were 19.9% YoY higher at 71.92 thousand while registrations of Mercedes-Benz Group cars (MBG.DE) were 4.4% YoY higher at 51.2 thousand units.

According to a Bloomberg report, Lufthansa (LHA.DE) is considering the sale of insurance brokerage unit Albatros as well as insurance business Delvag. This comes as the company is in the process of selling a minority stake in the maintenance unit as well as the catering unit. Lufthansa is selling non-core business in an attempt to boost cash position following Covid slump in aviation business.

Aroundtown (AT1.DE) rallies over 5% today following the release of H1 2023 results. Company reported a net loss of €1.31 billion for the first half of the year, compared to €471 million profit a year ago. Adjusted EBITDA came in at €497.5 million (-2.5% YoY) while revenue was 3.2% YoY higher at €815.3 million. FFO I (funds from operations) were 5.5% YoY lower. Company said that a net loss was driven by negative property revaluations. Aroundtown expects full-year FFO I to reach €310-340 million, up from previous forecast of €300-330 million.

Analysts' actions

- Fraport (FRA.DE) upgraded to 'buy' at Societe Generale. Price target set at €65.00

Aroundtown (AT1.DE) rallies today following an upgrade to a full-year FFO guidance. Stock jumped above the upper limit of the €1.39-1.46 trading range and reached the textbook range of the breakout at €1.53. Advance was halted later on and part of the gains was erased. Source: xStation5