Global stock markets took a hit yesterday. DE30 managed to test post-pandemic highs at the start of the European session but has been giving up gains later on. Bearish candlestick with a long upper wick surfaced on the chart and the index continues to decline this morning. Is it just a brief pause or are we set to see a correction similar to the one from September? Two important events for European markets will be held today - EU summit on budget and ECB meeting - and they may offer both bulls and bears more fuel.

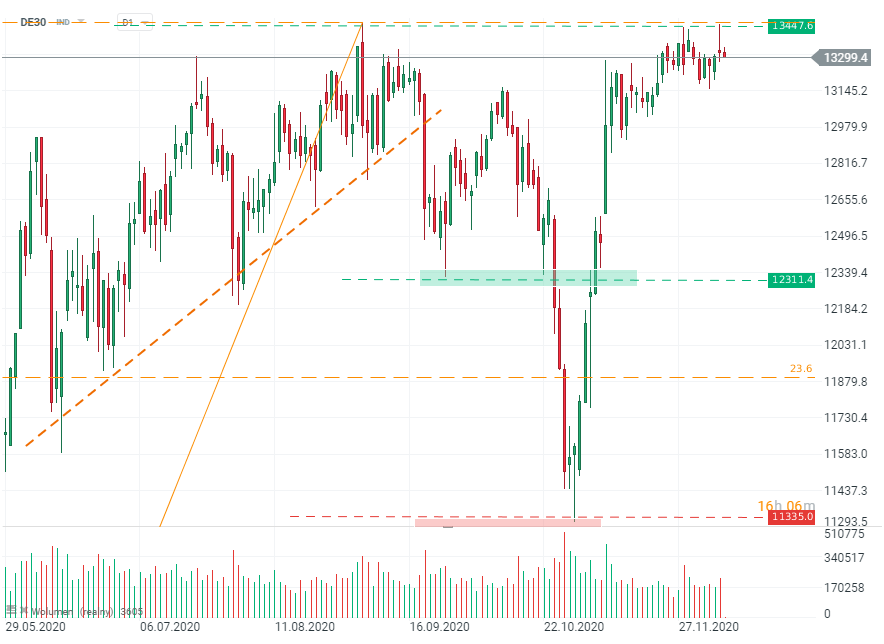

DE30 made the third failed attempt of breaking above 13,450 pts area yesterday. Long upper wick of the daily candlestick can be seen as a warning, especially as it was painted in such a key area. Source: xStation5

DE30 made the third failed attempt of breaking above 13,450 pts area yesterday. Long upper wick of the daily candlestick can be seen as a warning, especially as it was painted in such a key area. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022