-

European indices trade mixed

-

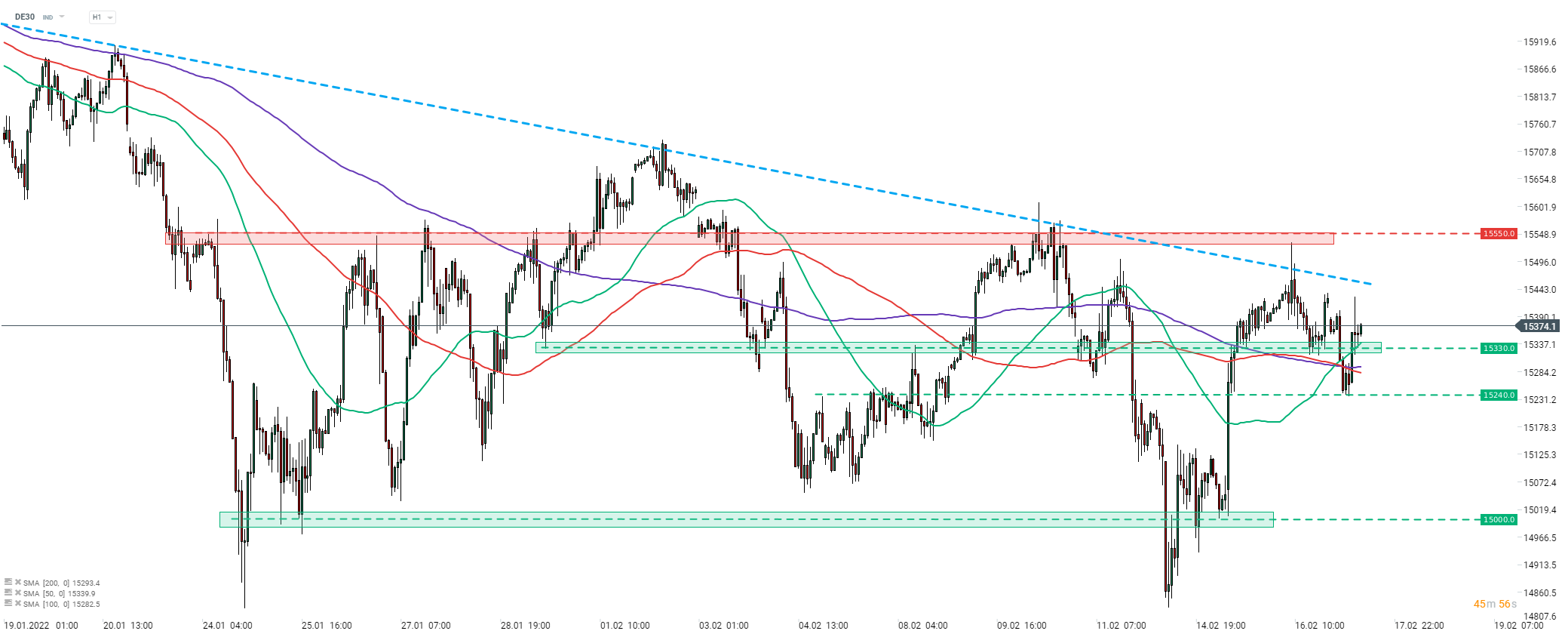

DE30 trades flat on the day

-

Airbus proposes €1.50 dividend per share from 2021 profits

European stock markets launched today's cash trading session lower amid increase in tensions in eastern part of Ukraine. Russian media reported that Ukrainian forces started mortar shelling of Russian-backed separatist in Donetsk and Luhansk Oblasts. These reports were not confirmed by Western media. However, Western media reported that separatists launched their own shelling and their missiles hit kindergarten in Donbas. Situation remains tense and asset prices are vulnerable to volatile swings on news headlines.

Source: xStation5

Source: xStation5

DE30 dropped during the Asian session on news of shelling in the eastern part of Ukraine. Index tested a short-term swing level at 15,240 pts as support this morning. Bulls managed to defend the area and launch an upward move. Index returned above the 15,330 pts price zone and is now trading more or less flat compared to yesterday's cash close. In case upward move extends, the near-term resistance to watch can be found at the downward trendline in 15,450 pts area. Economic calendar for today lacks major releases that could trigger bigger price moves therefore traders should focus on news headlines as drivers of today's moves.

Company News

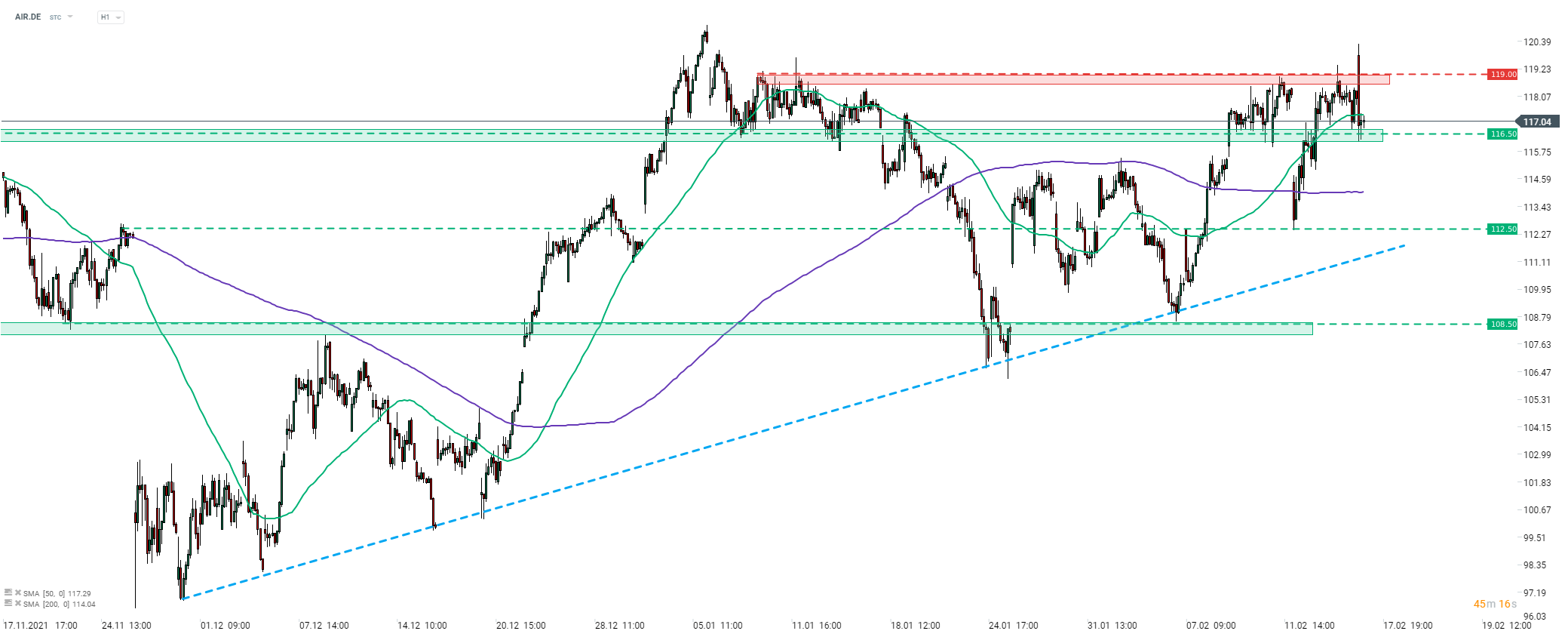

Airbus (AIR.DE) reported 4.5% YoY jump in revenue in 2021, to €52.15 billion (exp. €52.29 billion). Adjusted EBIT increased from €1.71 billion in 2020 to €4.87 billion in 2021. Non-adjusted EBIT reached €5.34 billion, up from a loss of €0.51 billion in 2020. Company booked €62.01 billion in order last year. Airbus proposed a €1.50 dividend per share from 2021 profits (exp. €1.14). Company expects to deliver around 720 aircraft in 2022 and generate adjusted EBIt of around €5.5 billion.

Commerzbank (CBK.DE) reported a 3.4% YoY increase in revenue in Q4 2021, to €2.099 billion (exp. €1.9 billion). Operating profit reached €141 million (exp. €57 million), compared to an operating loss of €328 million in Q4 2020. Net income was reported at €421 million (exp. €161 million). Commerzbank said it expects 2022 profit to exceed €1 billion and plans to resume paying out dividends from 2022 profits.

According to Manager Magazine, Continental (CON.DE) has restructuring plans ready and may be enacted any time. Plans assume several of the company's assets to be either sold or publicly listed in a process. Manager Magazine claims that automotive assets will be up for sale while Continental plans to retain its tire business.

According to a Handelsblatt report, Thyssenkrupp (TKA.DE) approached its competitors in the ship-building business to see if there is any interest in merger of marine divisions. According to the report, Thyssenkrupp approached Fincantieri, Naval and Saab. Thyssenkrupp's Marine Systems unit is valued at €1-2 billion. Handelsblatt says, however, that sale of the unit looks to be a more probable option.

Analysts' actions

-

Aixtron (AIXA.DE) rated "hold" at Jefferies. Price target at €16.00

-

Infineon (IFX.DE) rated "underperform" at Jefferies. Price target at €26.00

-

Lufthansa (LHA.DE) upgraded to "buy" at Bankhaus Metzler. Price target at €10.00

Airbus (AIR.DE) launched today's trading higher and traded above the €119 resistance at the beginning of the session. However, bulls failed to hold onto those gains and the stock dropped back below the aforementioned resistance. Share price is currently testing the support zone in the €116.50 area. Source: xStation5

Airbus (AIR.DE) launched today's trading higher and traded above the €119 resistance at the beginning of the session. However, bulls failed to hold onto those gains and the stock dropped back below the aforementioned resistance. Share price is currently testing the support zone in the €116.50 area. Source: xStation5

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

DE40: European markets decline due to concerns about the U.S. banking sector

Morning wrap (17.10.2025)