-

European market trade mixed

-

DE30 retests downward trendline in 15,900 pts area

-

Lanxess buys microbial unit from IFF for $1.3 billion

European stock market indices are trading mixed on Tuesday. Positive moods from the beginning of the week start to fade and markets seem to be in waiting mode for Jackson Hole. German DAX (DE30) and Dutch AEX (NED25) trade higher while French CAC40 (FRA40), UK FTSE 100 (UK100), Spanish IBEX (SPA35) and Italian FTSE MIB (ITA40) drop.

Revision of the German GDP data for Q2 2021 at 7:00 am BST turned out to be a small positive surprise. Growth reached 1.6% QoQ, up from 1.5% QoQ in the first release. On year-over-year basis growth reached 9.8%, up from 9.6% in initial reading. Nevertheless, revision did not have an impact on markets and did not trigger any major moves.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app Source: xStation5

Source: xStation5

After a sharp drop at the start of yesterday's cash session, DE30 slowly regained ground and has managed to once again test a downward trendline in the 15,900 pts area. This attempt has not been successful so far. The index struggles in the area. If bulls fail to revive the upward move, a pullback and retest of the 200-hour moving average in the 15,850 pts support area may be on the cards. However, if buyers regain control and push the index above the aforementioned trendline, the 15,950 pts swing area will be the next target. Note that today's calendar lacks any major releases therefore the session ahead may be a calm one.

Company News

Siemens (SIE.DE) received a contract to build two converter stations for a power-link between the northern and southern part of Germany. Value of the contract is said to be in "hundreds millions euros".

Lanxess (LXS.DE) signed a deal with International Flavors & Fragrances (IFF), a chemical company, to buy its microbial control unit. Deal is valued at $1.3 billion. Lanxess said that its suspended buyback programme worth €463 million will be terminated and that it has also secured bridge financing for the deal. IFF's microbial unit has an annual revenue of around $440 million.

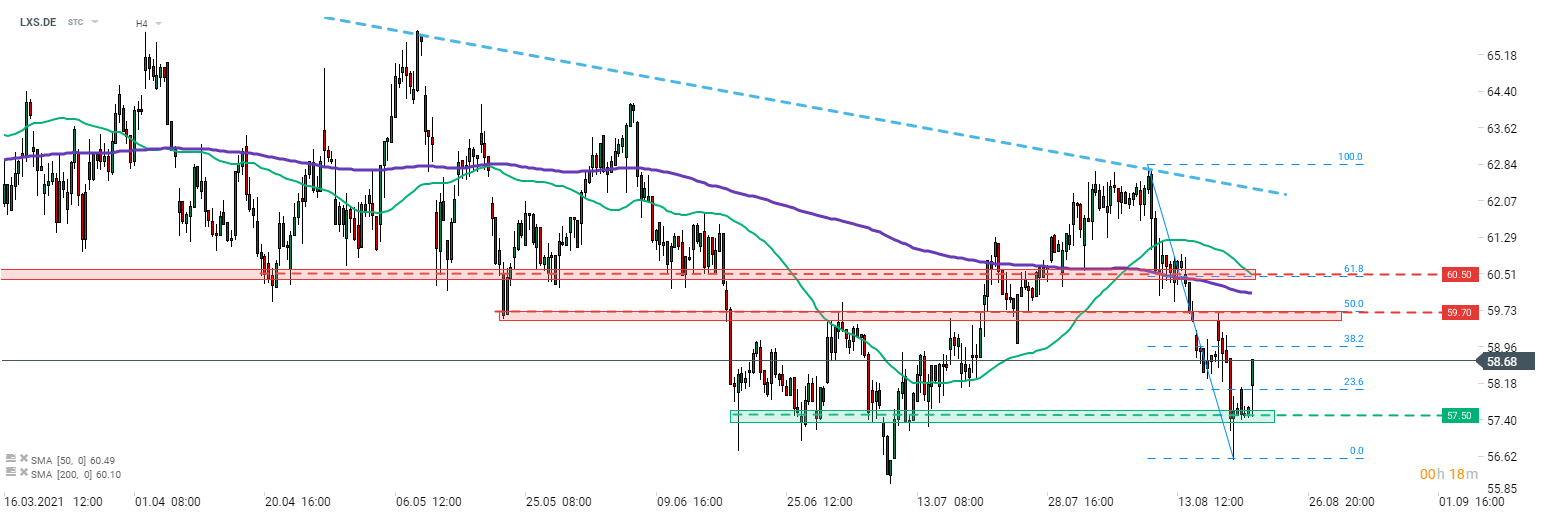

Lanxess (LXS.DE) rallies today following M&A announcement. Share price bounced off the support at €57.50 and moved almost 2% higher. The first major resistance to watch can be found at the 50% retracement of recent correction - €59.70. However, long-term trend on the stock remains downward. Source: xStation5

Lanxess (LXS.DE) rallies today following M&A announcement. Share price bounced off the support at €57.50 and moved almost 2% higher. The first major resistance to watch can be found at the 50% retracement of recent correction - €59.70. However, long-term trend on the stock remains downward. Source: xStation5