-

European stock market indices trade lower

-

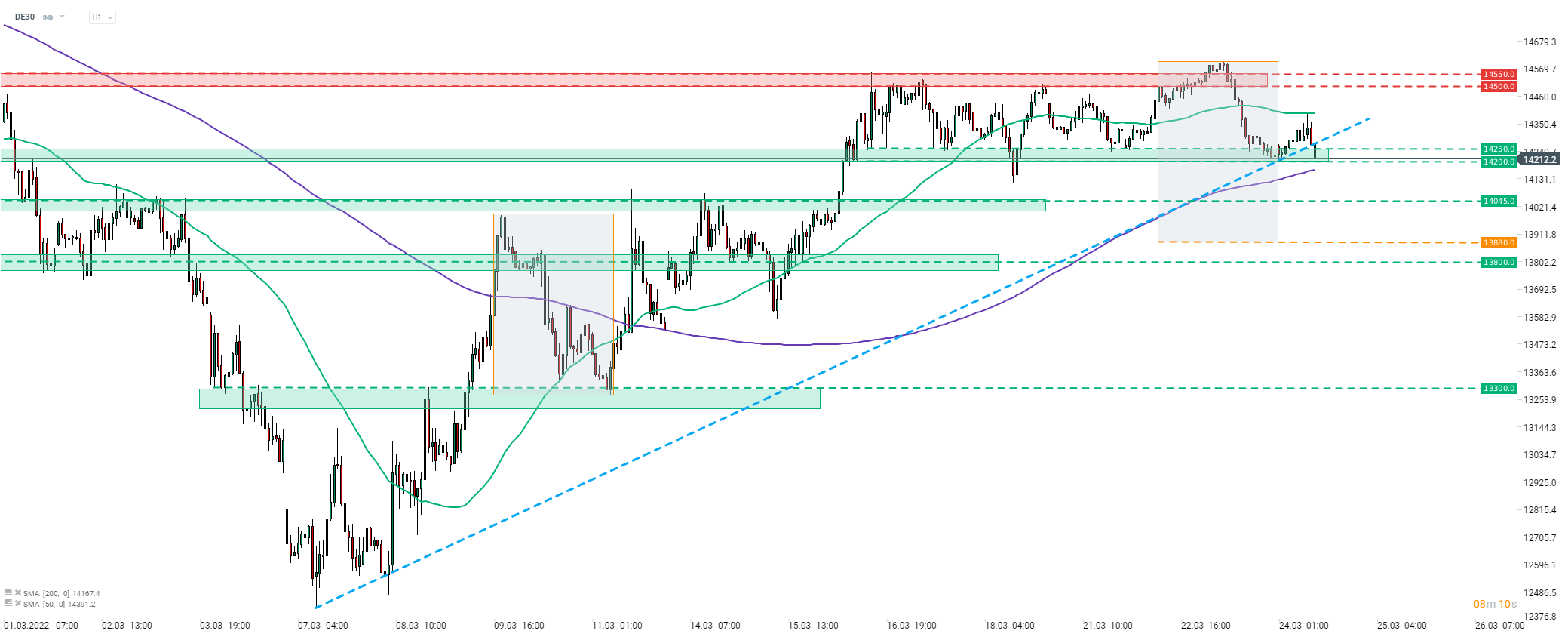

DE30 tests lower limit of trading range

-

HeidelbergCement to propose €2.40 dividend per share

European stock markets launched today's cash session slightly higher but have given back all of the gains since. Russian MOEX is the top performer today with a 4% gain as the Moscow exchange reopened after an almost month-long halt. However, the gain is mostly a reflection of the weakening ruble. RTS index ,or USD-denominated MOEX, trades 9% lower at press time. NATO summit in Brussels is underway but so far there were no comments from officials on the result. Nevertheless, it is certainly an event to watch amid current geopolitical turmoil.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appA look at the DE30 chart at H1 interval shows that the German index remains stuck in a 350-point wide trading range. Index made an attempt of breaking above this upper limit of the range in the 14,500-14,550 pts area yesterday but failed to sustain the move. A pullback pushed DE30 back towards the lower limit of the range in the 14,200-14,250 pts area. Should we see a break below, the 200-hour moving average at around 14,170 pts (purple line) may offer some support. However, if this technical support fails to halt sell-off, a deeper decline may be on the cards. A key support is marked with the lower limit of a local market geometry at around 13,880 pts but bears would have to break below the psychological 14,000 pts area before testing it.

Company News

Daimler Truck (DTG.DE) reported a 11% year-over-year jump in 2021 revenue, to €39.8 billion. Adjusted Ebit improved from €657 million in 2020 to €2.55 billion in 2021. Company said that it expects 2022 revenue to reach €45.5-47.5 billion, up 14-19% from 2021 levels.

Management of HeidelbergCement (HEI.DE) will propose paying out €2.40 dividend per share from 2021 profits.

According to Manager Magazin, Joe Kaeser - chairman of supervisory board at Siemens Energy (ENR.DE) - is considering whether to separate Siemens Gamesa and Siemens Energy. Siemens Gamesa is a subsidiary of Siemens Energy. Kaeser reportedly has even considered a full write-down of Gamesa assets amid struggles within the subsidiary.

Siemens Energy (ENR.DE) is trading slightly higher following reports on potential separation of Gamesa assets. Stock is testing a crucial resistance zone marked with 23.6% retracement of a downward move started in early-2021, downward trendline and the upper limit of the Overbalance structure. Breaking through this mix of resistance levels could improve sentiment towards the stock and lead to a test of the 38.2% retracement that coincides with a previous local high in the current downtrend structure. Source: xStation5

Siemens Energy (ENR.DE) is trading slightly higher following reports on potential separation of Gamesa assets. Stock is testing a crucial resistance zone marked with 23.6% retracement of a downward move started in early-2021, downward trendline and the upper limit of the Overbalance structure. Breaking through this mix of resistance levels could improve sentiment towards the stock and lead to a test of the 38.2% retracement that coincides with a previous local high in the current downtrend structure. Source: xStation5