-

European stock markets trade higher

-

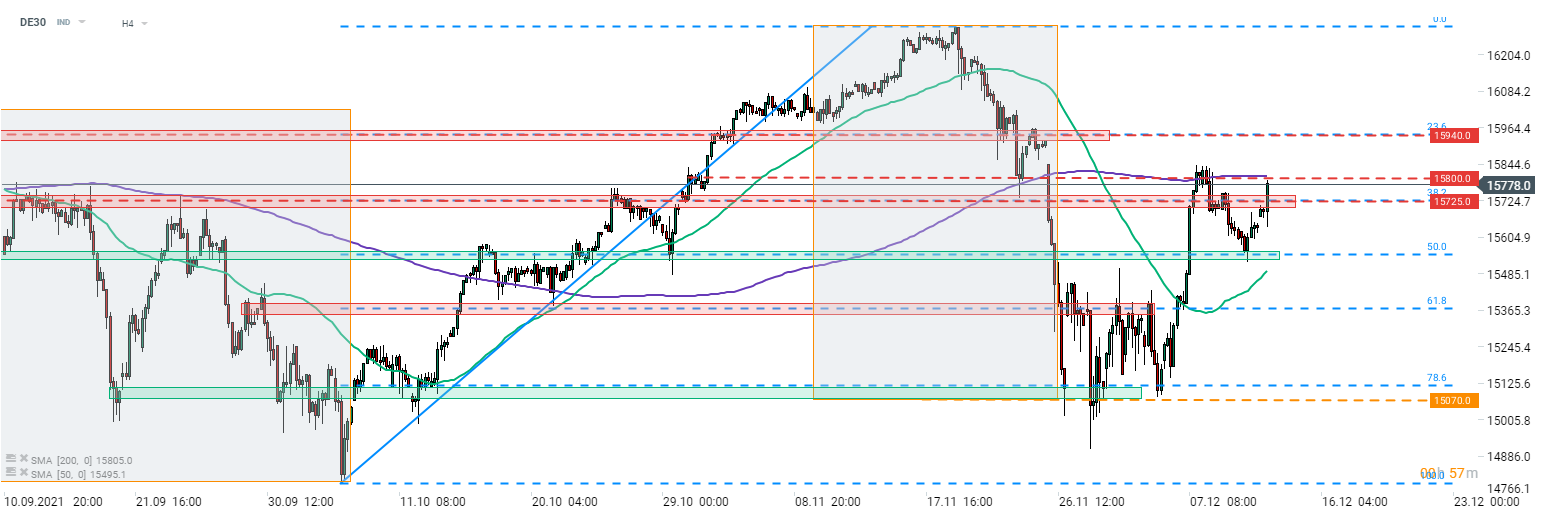

DE30 tested 15,800 pts but failed to break above

-

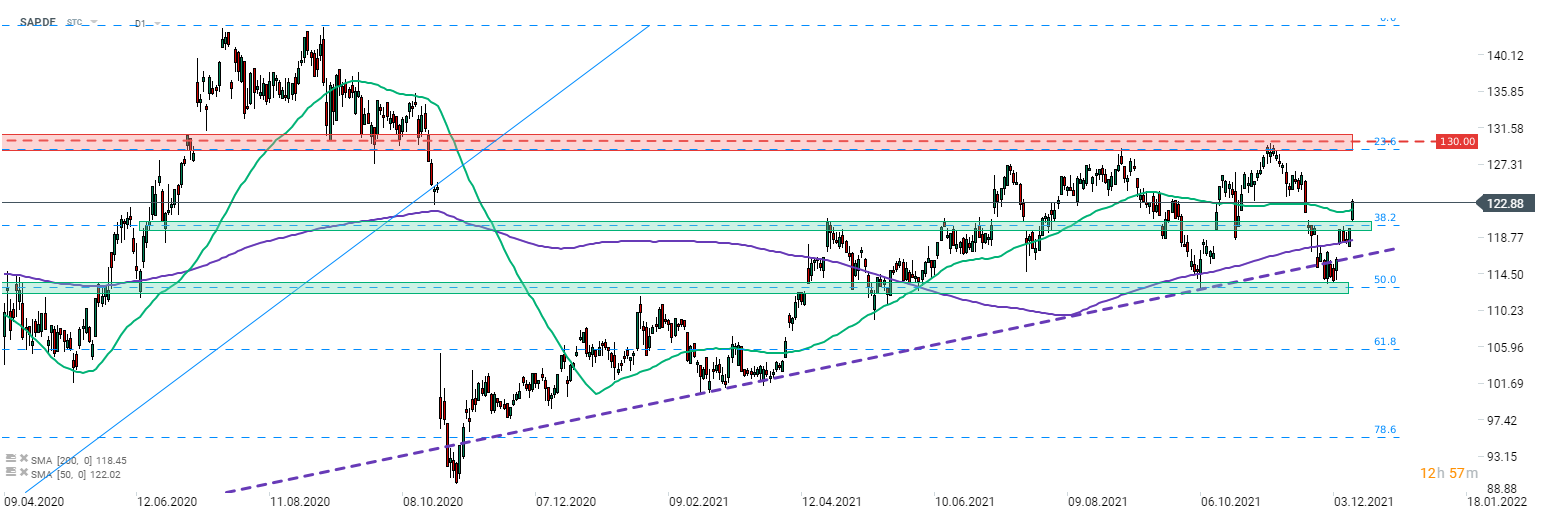

SAP jumps following upgrade at UBS

European stock markets trade higher at the start of a new week. Improvement in risk moods can also be spotted on the commodity markets, where precious metals, industrial metals and oil trade higher. Blue chips indices from Germany and Sweden are today's top performers, gaining around 1% each. On the other hand, Russian indices lag dropping around 1% at press time. The day ahead is light in terms of data releases but the week ahead will be abundant in rate decisions from top central banks.

Source: xStation5

Source: xStation5

German DAX (DE30) trades higher at the beginning of a new week, along with other major indices from the Old Continent. Index bounced off the support zone marked with 50% retracement of October-November upward impulse (15,725 pts area) at the end of the previous week and the recovery is being continued today. Price tested the 15,800 pts area earlier in the day but has failed to break above it. DE30 has been reacting to the retracements of the aforementioned upward impulse therefore bulls should focus on 15,940 pts area (23.6% retracement) in case we see a break above the 200-period moving average (purple line, H4 interval, 15,800 pts area).

Company News

According to the Handelsblatt report, Cariad, software unit of Volkswagen (VOW1.DE), partnered up with Bosch to develop automotive software together. It is said that Volkswagen will invest over hundred million euros as a part of the deal.

According to a Reuters report, Gerry Grimestone, UK Investment Minister, offered to host a meeting between Airbus (AIR.DE) and Qatar Airways in order to try to find a way out of the current row between the two companies. Qatar Airways said that it has been asked by the domestic regulator to ground 20 out of its 53 Airbus A350 jets but Airbus claims that the airline tries to misrepresent the issues and refuses to accept the proposed repair plan.

Harald Wilhelm, CFO of Daimler (DAI.DE), said that the German luxury auto manufacturer targets a double-digit operating margin, which results in an upbeat outlook for dividends. Carmaker has managed to maintain double-digit margins in spite of a recent shortage of raw materials and semiconductors. In other news, it was reported that Daimler reached a $197 million settlement in the Canadian diesel emissions case.

Analysts' actions

-

Brenntag (BNR.DE) upgraded to "buy" at Deutsche Bank. Price target set at €99.00

-

SAP (SAP.DE) upgraded to "buy" at UBS. Price target set at €147.00

SAP (SAP.DE) rallies today, being supported by the upgrade at UBS. Stock managed to break above the price zone marked with 38.2% retracement of the post-pandemic recovery move (€120.00 area) and is now trading at the highest level in 3 weeks. The major resistance zone to watch ahead can be found ranging above the 23.6% retracement in the €130.00 area. Source: xStation5

US OPEN: Netflix in Wall Street’s Spotlight

Chart of the Day: JP225 (20.10.2025)

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks