German equity market sentiment is weak today, with the DE40 contract down nearly 0.3%, pressured by declines in automotive stocks and a pullback in BASF shares. After a series of drops, Rheinmetall (RHM.DE) is attempting to stabilize, though the stock has fallen almost 25% from its historical highs near EUR 2,000 per share.

- The prospect of peace in Ukraine continues to remove upward momentum from Europe’s defense sector. Shares of Rheinmetall, Hensoldt, Kongsberg Gruppen, Leonardo, Fincantieri, and BAE Systems have all recorded notable declines, though they are attempting to stabilize today.

- Bank of America upgraded flatexDEGIRO with a price target of EUR 37.4 per share, supporting a slight gain in the stock. JP Morgan noted that tobacco, brewing and beauty sectors are showing favorable growth prospects.

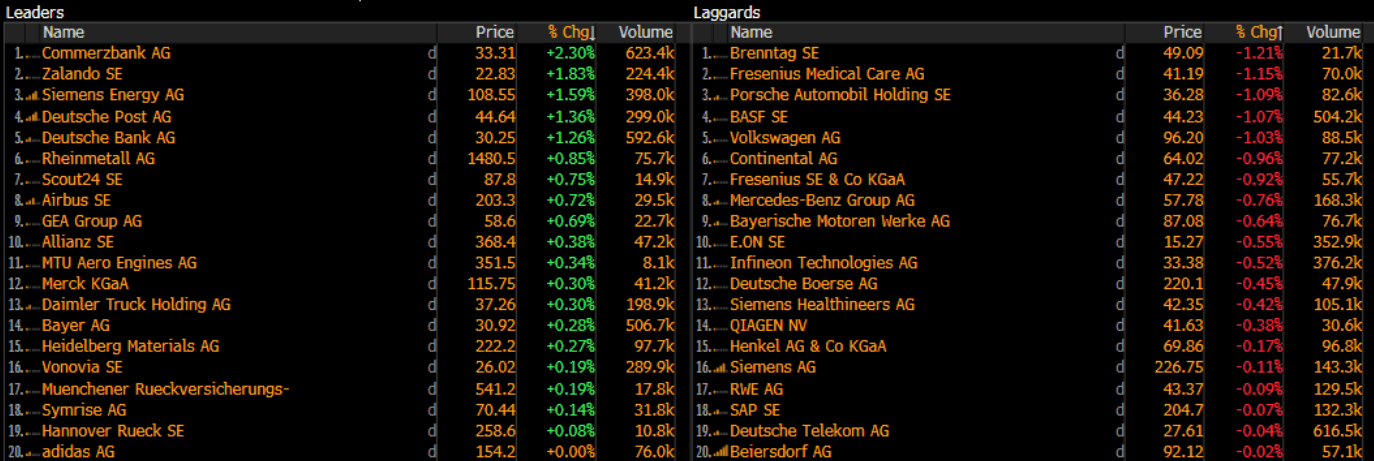

Gainers today include Zalando, Commerzbank, Siemens Energy and Deutsche Bank. Underperformers include Brenntag, Fresenius, Porsche, BASF and Volkswagen.

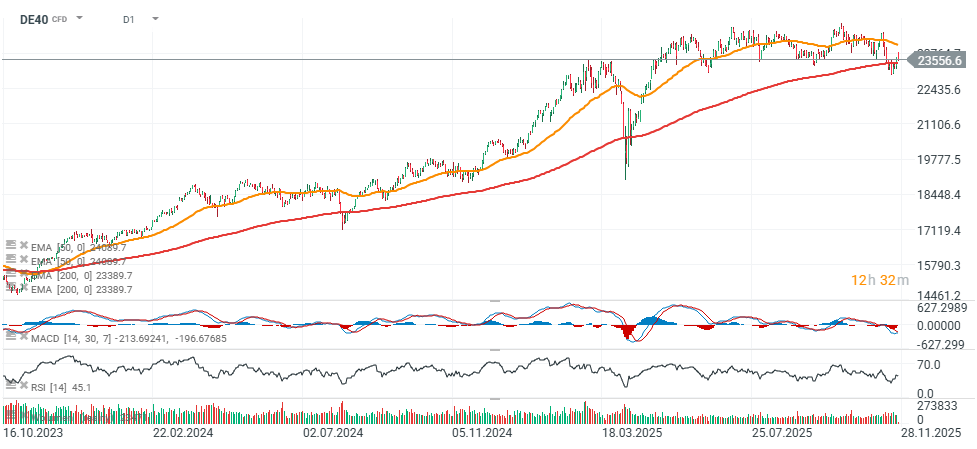

DE40 Chart (D1)

Looking at DAX futures, the index recently bounced off the 200-day EMA (red line), which it has tested for the third time since the summer of 2024. However, sentiment weakened again today, and the benchmark is heading toward a test of the 23,400 level. At the same time, selling volume is not very high, and the MACD suggests a potential defense of support (golden cross).

Source: xStation5

Rheinmetall strengthens military training capabilities with Varjo

Rheinmetall continues to expand beyond traditional hardware manufacturing by partnering with Finnish startup Varjo, which specializes in Mixed Reality technologies. This move reflects a broader trend: European defense budgets increasingly include not only equipment purchases but also investments in advanced training systems. For investors, this signals Rheinmetall’s intent to strengthen its position in the rapidly growing military-simulation segment. Expanding into high-margin training systems could become an important strategic “business pillar,” making the market highly attentive to this cooperation.

Rheinmetall is joining forces with Varjo to integrate Mixed Reality headsets into its vehicle training systems, enabling more flexible and scalable military training.

Shift away from traditional simulators:

Mixed Reality technologies are replacing large, costly simulators, enabling training anywhere and at lower cost—supporting higher margins and faster implementation. Europe is increasing spending on tanks, armored vehicles, and military trucks, boosting demand for advanced operator training.

Large market potential:

-

Varjo estimates the military Mixed Reality market will reach €600 million by 2030.

-

The global defense training and simulation market could reach $15–20 billion this decade.

Varjo was founded by former engineers from Nokia, Microsoft and Nvidia; its customers include Lockheed Martin, Boeing and Aston Martin.

Growing cooperation in defense:

Following Russia’s invasion of Ukraine, defense firms increasingly collaborate instead of relying solely on slow, expensive internal development cycles.

Strategic relevance for Rheinmetall:

-

Mixed Reality strengthens Rheinmetall’s ambitions in digital defense systems.

-

CEO Armin Papperger has stated his intention to expand in naval technologies and digital startups — Varjo fits well into this strategy.

Potential investment opportunity:

Varjo is open to strategic investors (“anything is possible”), creating room for a closer partnership.

Varjo recently raised $40 million from investors including Atomico, EQT Ventures, Volvo Car Tech Fund, and Lifeline Ventures, giving it capital for further scaling.

Rheinmetall Stock (D1)

Rheinmetall shares have fallen below the 200-day EMA for the first time in three years, suggesting that markets view the prospect of peace in Ukraine as increasingly realistic. Despite solid guidance and results, the company’s valuation may face pressure in a “peace scenario,” as momentum rotates out of defense stocks into other sectors.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war