- European indices in the green before a data-packed week

- DE40 with slight gains after good results

- Hypoport with revenue +22% YoY, return to profitability in H1 2024

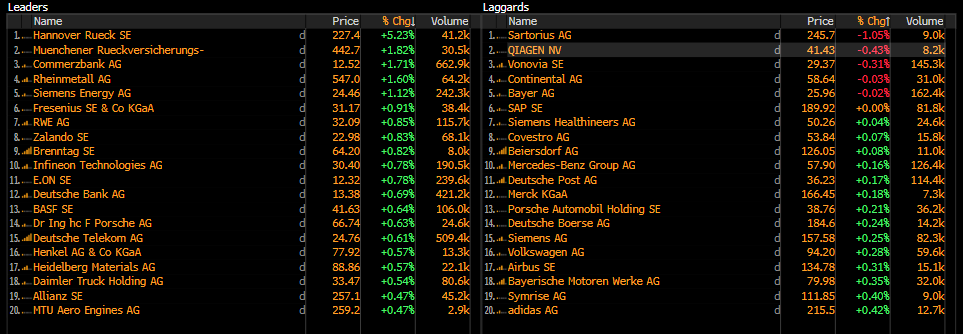

- Hannover Re: EBIT +34% YoY in Q2, above analysts' expectations

General market situation:

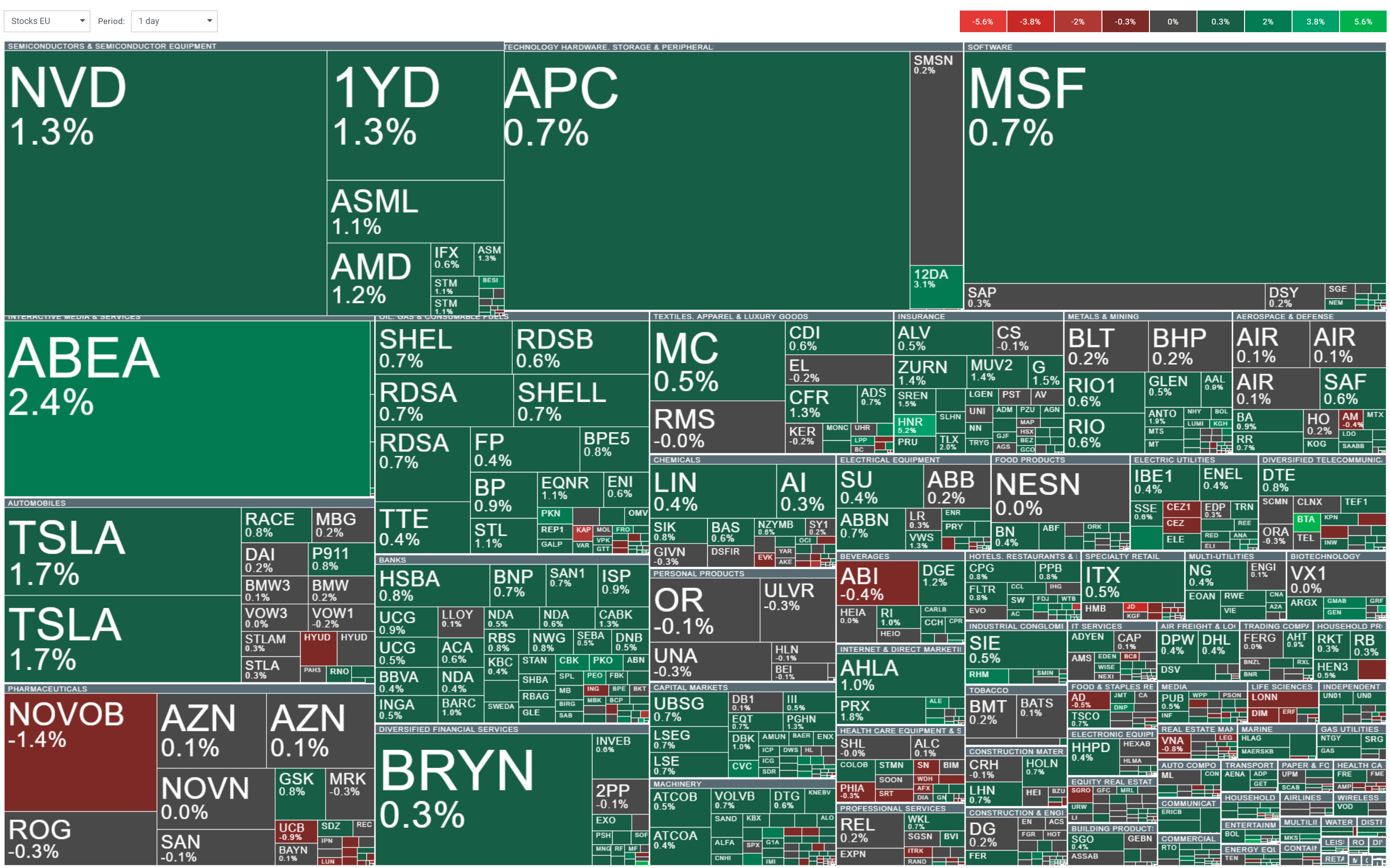

Indices continue Friday's gains, approaching important resistance levels. The French CAC40 remains close to Friday's price. The German DAX is up 0.1%, approaching an important Fibonacci retracement level, and the Spanish IBEX35 is up 0.2%. The strongest performers are the Italian ITA40 index, up 0.6%, and the Polish WIG20, which is making up for Friday's decline with a rise of over 2%. Hypoport is up over 8% after good results, and DAX component Hannover Rueck is up over 5%, also due to better-than-expected results.

Volatility currently observed in the broad European market. Source: xStation

Companies included in the DAX index. Source: Bloomberg Finance L.P.

The DAX (DE40) contract continues to rise after a successful Friday session. After breaking through the closing level of the downward gap, the 23.6% Fibonacci retracement at 17988.5 remains as resistance. Breaking it will allow testing first the 50 and then the 100 SMA. At the same time, the support remains at the lowest point of the bearish weekly candle, which is 17811. Breaking it may involve testing the 200 SMA and later the 38.2% Fibonacci retracement. RSI rebounds after touching the oversold level on Monday, MACD slowly starts to show direction. Source: xStation

Company news:

- Rheinmetall (RHM.DE) received a new order to supply tanks and armored vehicles to the Czech Republic as part of a ring exchange process supporting Ukraine. The contract, worth lower hundreds of millions of euros, includes the delivery of 14 Leopard 2A4 tanks and one Buffalo rescue vehicle. Deliveries will start at the end of 2024 and finish in early 2026. In exchange, the Czech Republic will transfer military equipment to Ukraine.

- Hypoport (HYQ.DE) published on Saturday financial results for the first half of 2024. The company reported significant revenue growth and a return to profitability, mainly due to strong growth in the real estate and mortgage platforms segment. Ronald Slabke, CEO of Hypoport SE, emphasized that the initial positive effects of the mortgage market recovery are beginning to be reflected in the company's revenues, and the scalable platform business model and optimized cost structure contributed to the Group's profit growth of almost 10 million euros.

RESULTS FOR THE FIRST HALF OF 2024:

- Revenue: 218.1 million euros, +22% YoY

- EBIT: 7.9 million euros vs. loss a year earlier

- Earnings per share: 0.81 euros vs. loss of 0.32 euros YoY

RESULTS FOR THE SECOND QUARTER OF 2024:

- Revenue: 110.6 million euros

- EBIT: 3.6 million euros

- Hannover Re (HNR.DE) published on Friday financial results for the second quarter of 2024. The company reported net investment income of 511 million euros, significantly exceeding analysts' expectations. Operating profit (EBIT) amounted to 847 million euros, also above market consensus. The company confirmed its forecast for 2024, assuming net profit of at least 2.1 billion euros and reinsurance revenue growth above 5%.

RESULTS FOR THE SECOND QUARTER OF 2024:

- Net investment income: 511 million euros, +8.7% YoY; consensus: 482.2 million euros

- EBIT: 847 million euros, +34% YoY; consensus: 754.6 million euros

- Combined ratio (P&C): 87.6% vs 90.8% YoY; consensus: 90.7%

- Return on equity: 22.4%; consensus: 21%

BREAKING: US NFIB small business optimism weakens🗽US500 loses 0.8%

Morning wrap (14.10.2025)

US OPEN: "Green" Start to the Week on Wall Street

Indexes reduce gains after Bessent’s comments 🎙️