Western European stock exchanges started today's session with gains, following the positive sentiment from Wall Street. Investors are reacting to weaker data from the U.S. labor market, which has increased expectations for imminent interest rate cuts by the Federal Reserve. However, in the following hours, the mood changed — indices recorded declines. This is particularly noticeable in Germany, where after an initial rebound, the DE40 index turned downward, signaling increased caution among investors. It currently remains around the opening level.

The French government of Prime Minister François Bayrou lost a vote of confidence yesterday, leading to its downfall and deepening the political crisis in France. In response, President Emmanuel Macron appointed Sébastien Lecornu, a former defense minister and loyal ally, as the new prime minister, tasked with attempting to maintain pro-business reforms amid political deadlock.

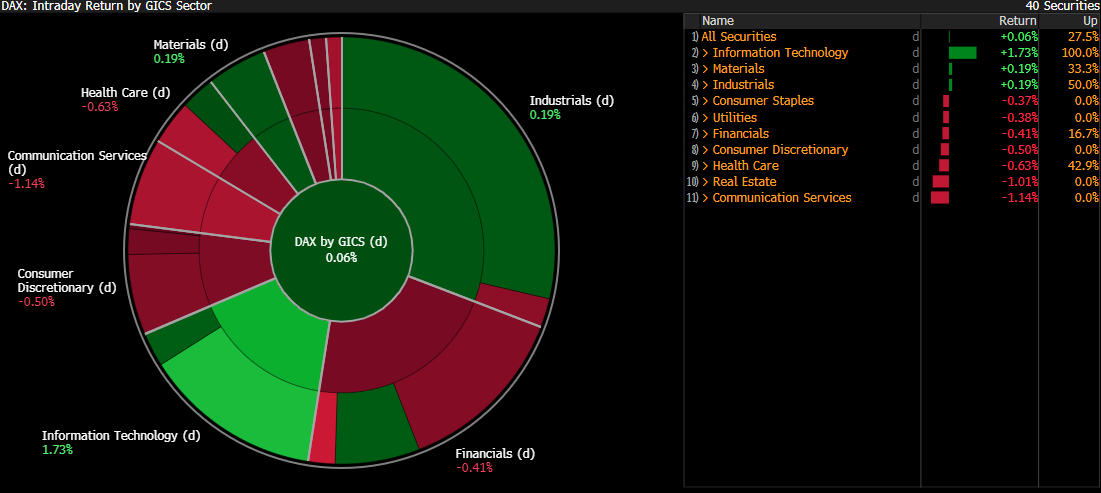

Source: Bloomberg Finance LP

The index is mainly supported by IT companies, undoubtedly buoyed by positive sentiment towards the sector from across the ocean. Consumer goods are losing the most, amid concerns about consumer conditions in the face of deteriorating data.

DE40 (D1)

The price on the German index is at a very important point from a technical perspective. The price is holding below the upward trend line. In the event of breaking the resistance zone around 23,580 points, it is difficult to determine how low the declines may stop. If buyers want to regain initiative, their task is becoming increasingly difficult due to the fact that the trend line will soon intersect with the resistance zone and the EMA50 average.

Company News:

- Rheinmetall (RHM.DE) - being one of the leaders in the European defense sector, is recovering losses after yesterday's correction in the upward trend. The CEO said in an interview yesterday that the company intends to become a one-stop provider of all solutions.Barclays analysts stated that the sector, underinvested for over two decades after the end of the Cold War, is now facing a potential supercycle of defense spending that could last until the 2030s. The company is up about 1%.

- Inditex (ITX.ES) – shares are up 6–7% after the company announced accelerated sales at the turn of August and September.

- Novo Nordisk (NOVOB.DK) – the stock is up about 2% following the announcement of restructuring and a plan to reduce employment by over 11%.

- SAP (SAP.DE) – up about 2%, supported by demand for cloud solutions and AI technologies.

- ASML (ASML.NL) – the company is up about 1%, benefiting from positive Oracle forecasts regarding orders in the cloud sector and TSMC's sales results.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war