Today's session in Europe is unfolding in exceptionally good spirits. Investors on practically all major exchanges are seeing green boards, and indices are recording clear gains.The largest increases are seen on the DAX and AEX, with rises above 0.6%. The FTSE 100 and ATX20 are performing weaker, with declines around 0.15%.

Buyers are not deterred by either geopolitical tensions or the prolonged "government shutdown" in the United States. On the contrary, some investors interpret the fiscal troubles in the USA as a factor increasing pressure on the Federal Reserve to accelerate interest rate cuts. This further fuels the appetite for risk in Europe and Asia.

Source: Bloomberg Finance Lp

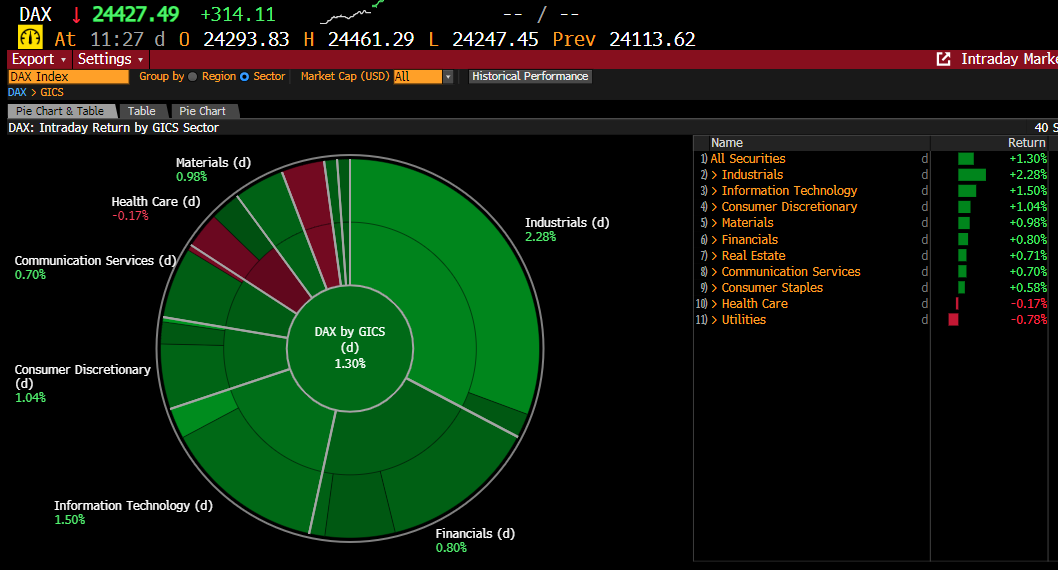

The German Index is experiencing unusual gains today. The industrial and IT sectors are rising the most, while utility companies are slightly down.

Macroeconomic Data

In the background of today's trading, macroeconomic data plays an important role. Due to the shutdown in the USA, the report on new unemployment benefit claims and durable goods orders data will not be published.

- Data publications from Europe are proceeding without disruptions. Eurostat data showed an increase in the unemployment rate in the eurozone from 6.2% to 6.3%.

- At 1:00 PM, the market is also awaiting the Challenger report on planned layoffs and employment in the USA, which may be a factor for additional volatility in the markets.

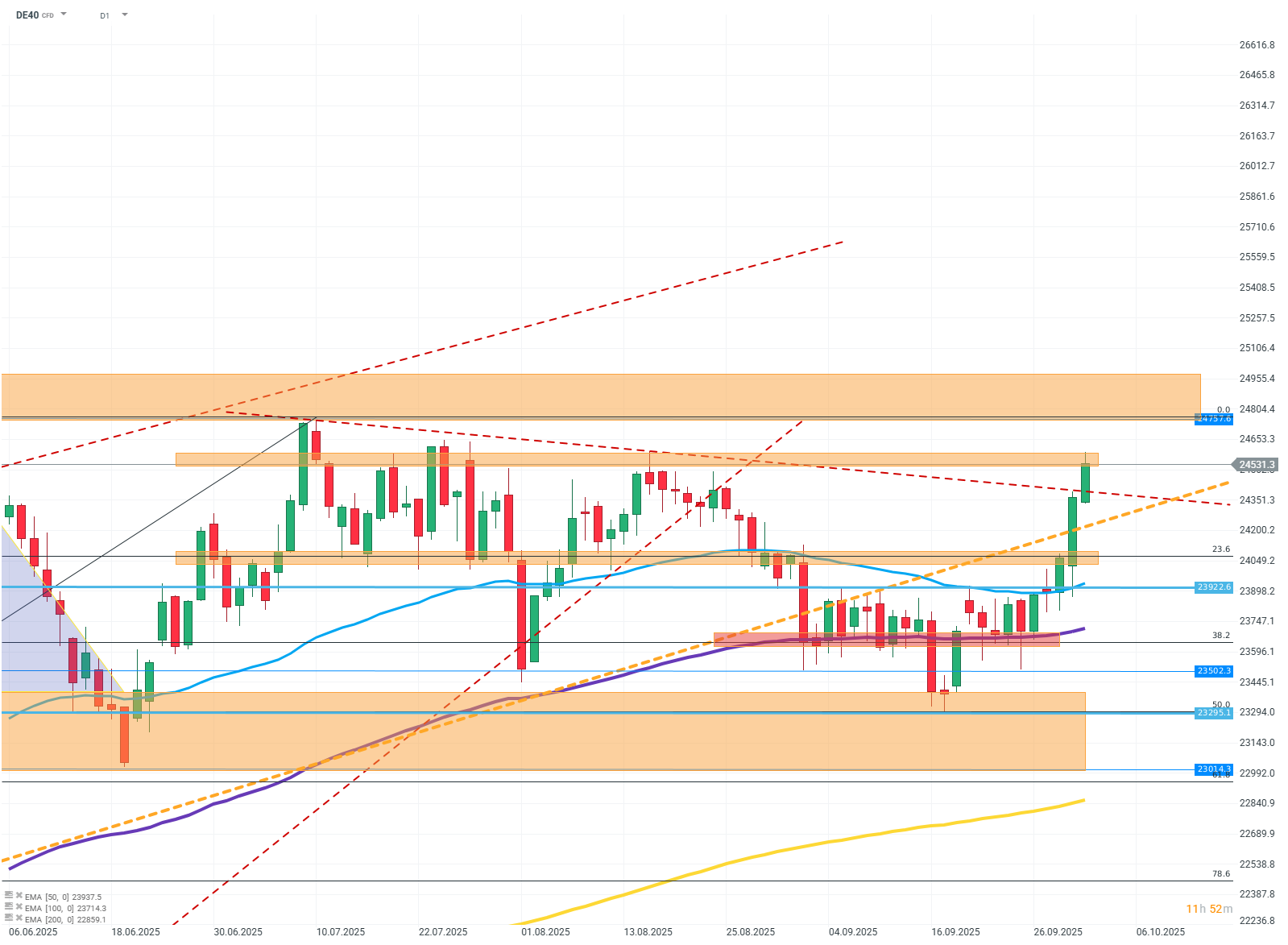

DE40 (D1)

Source: xStation5

The chart shows that buyers have forcefully broken through the resistance zone at FIBO 23.6 and are currently halted at the last support zone separating the price from the ATH. Breaking the resistance around 24530 may result in testing the vicinity of the ATH, while bouncing off the resistance will most likely mean a return to consolidation between 24500 and 23500.

Company News:

Siemens (SIE.DE) — The German giant is up over 2% following the announcement of a "spin-off" of its subsidiary (Siemens Healthineers).

Rational (RAA.DE) — The company is up 3% after receiving a positive recommendation from an investment bank, with a new target price of 1035 euros.

Novo Nordisk (NOVOB.DK) — The Danish pharmaceutical giant is up over 2% after an investment bank raised its recommendation for the company's shares.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?