-

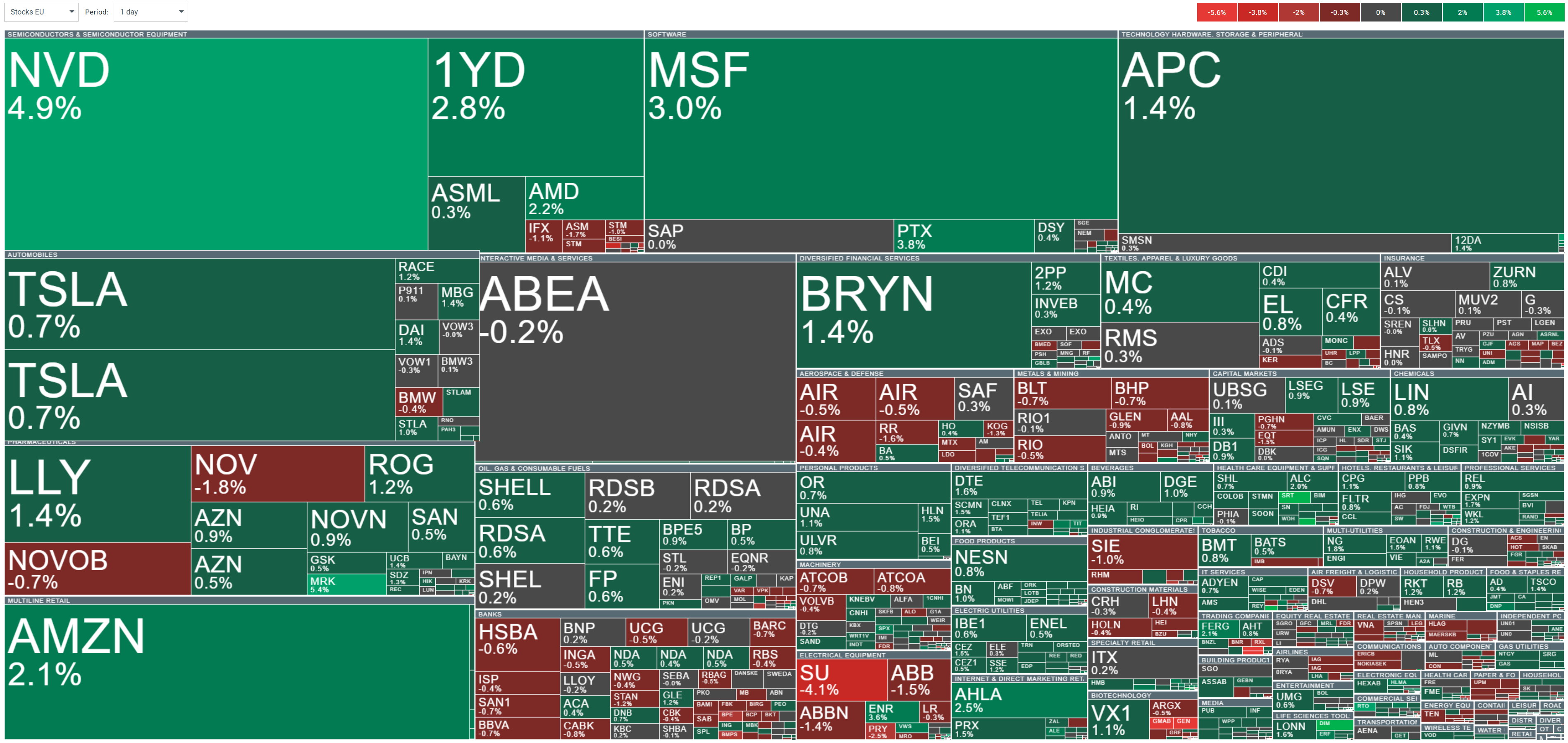

European equities show mixed performance, with W20 leading gains (+0.88%) while EU50 representing broad market is down (-0.44%)

-

Mercedes-Benz (MBG.DE) Shares Rise on Strong Q4 Indication

-

Siemens Energy (ENR.DE) Posts Strong Q1 Results

-

Sartorius (SRT.DE) Surges on Strong 2024 Results

General market situation: European markets are showing a mixed trend, with most indices in negative territory. The W20 leads gains (+0.88%), while NED25 (+0.09%) and UK100 (+0.04%) show modest positive movement. The AUT20 remains flat (0.00%). However, several major indices are declining, with EU50 down (-0.44%), FRA40 (-0.40%), ITA40 (-0.39%), and DE40 (-0.23%). The Swiss SUI20 (-0.04%) and Spanish SPA35 (-0.02%) show marginal declines. The overall sentiment appears cautious, with volatility measures suggesting continued market uncertainty.

Dax Returns by Sector. Source: Bloomberg Financial LP

Volatility is currently observed in the broader European market. Source: xStation

The German DE40 Index is trading slightly below its all-time high (ATH). Bulls will aim to reclaim the record levels, while bears may target a retest of the 78.6% Fibonacci retracement level. In the case of a more significant correction, the 61.8% Fibonacci retracement level, which coincides with the 30-day SMA, could come into play. The RSI is diverging lower within the oversold zone, which may indicate the potential for either a correction or continued upward momentum. Meanwhile, the MACD is tightening and suggests the possibility of a bearish crossover. Source: xStation

Corporate News

-

Mercedes-Benz (MBG.DE) Shares Rise on Strong Q4 Indication - The German luxury automaker's shares climbed as much as 2.4% following a pre-close call that suggested better-than-expected fourth-quarter performance. The company indicated Q4 car margin would exceed the previous 6-7% guidance. Despite positive signals, management remained cautious on China outlook. Analysts noted constructive commentary following similar updates from Renault and Volkswagen, though Mercedes was more reserved regarding 2025 prospects. The company plans to reveal more details about its cost-cutting strategy at the upcoming CMD in February.

-

Siemens Energy (ENR.DE) Posts Strong Q1 Results, Stock Rebounds - Shares jumped as much as3.89% after pre-releasing fiscal Q1 results that beat expectations. Revenue reached €8.94 billion with orders of €13.67 billion, surpassing estimates. Strong performance in Gas Services and Grid Technologies drove results, with free cash flow pre-tax reaching €1.52 billion. The positive results helped recover losses from a recent 20% drop related to DeepSeek concerns. The company indicated it will update free cash flow guidance with H1 results, with analysts projecting potential for >€2 billion.

-

Sartorius (SRT.DE) Surges on Strong 2024 Results, Positive Outlook - The lab equipment manufacturer's shares soared up to 10% after reporting full-year adjusted EBITDA of €945.3 million, exceeding expectations. Q4 showed particularly strong consumables demand, especially in advanced therapies. The company forecasts moderate revenue growth for 2025, citing continuous demand recovery in the life science market. The results triggered gains across the sector, with Merck KGaA rising 6.5% and other peers showing positive momentum. Sartorius plans to provide detailed quantitative guidance after Q1 2025.

Other news coming from individual DAX index companies. Source: Bloomberg Financial LP

MicroStrategy in trouble? Shares down 67% from the highs ✂

Stock of the Week – NVIDIA (21.11.2025)

DE40: European tech and defence stocks sell-off

Morning wrap (21.11.2025)