- DAX falls during Tuesday's session

- Market sentiment remains mixed amid the publication of quarterly results by major companies and expectations of a potential further easing of political tensions.

- DAX falls during Tuesday's session

- Market sentiment remains mixed amid the publication of quarterly results by major companies and expectations of a potential further easing of political tensions.

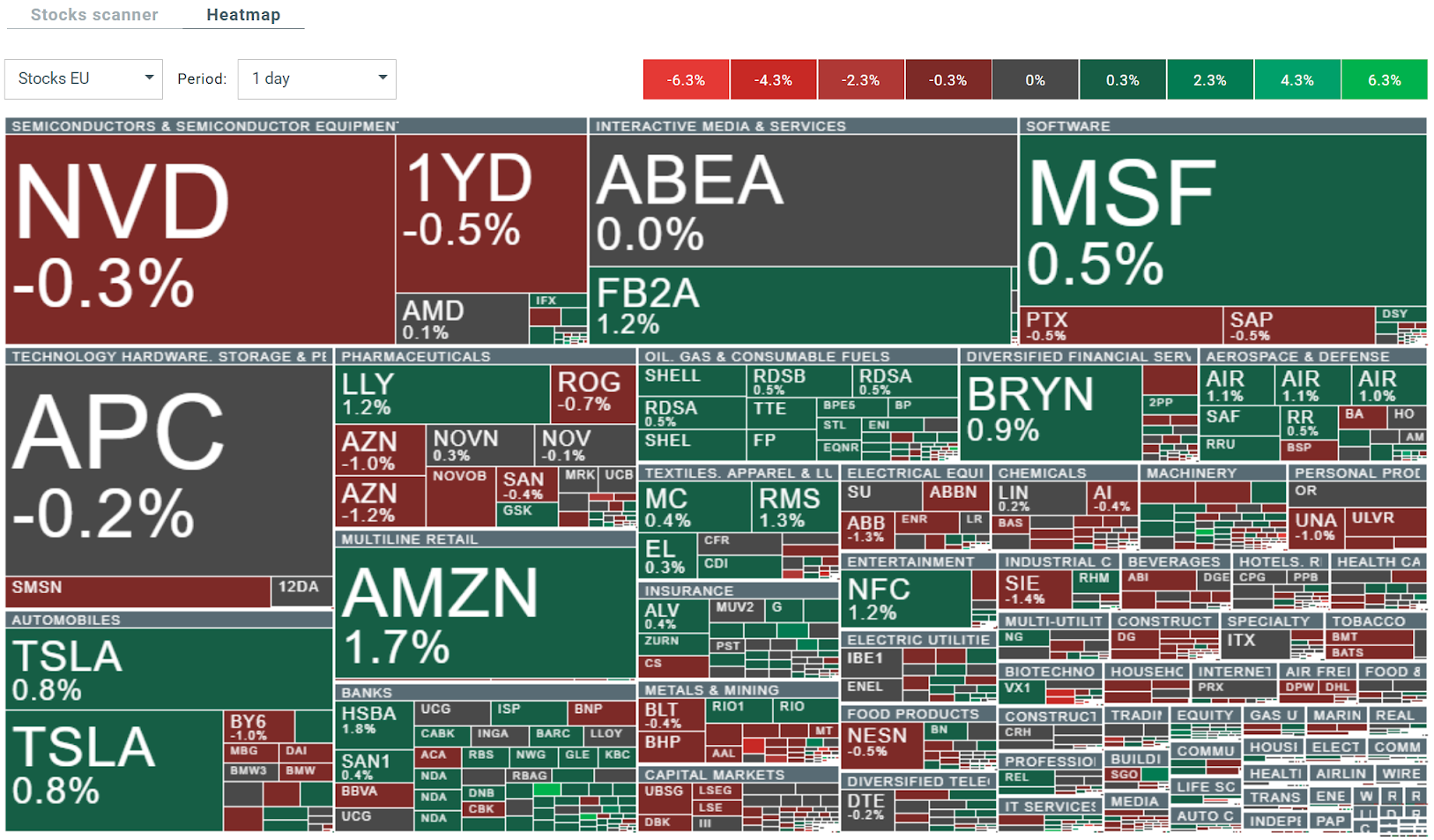

European stock indices remain near record highs, although the STOXX 50 is down slightly after rising 1% the previous day, when the market rebounded after easing concerns about the banking sector and US-China trade tensions. Most of the continent's major indices are down slightly, with Germany's DE40 currently losing 0.34%. Market sentiment remains mixed as the largest companies publish their quarterly results and expectations grow for a potential further easing of political tensions.

Source: xStation

Volatility is currently being observed in the broader European market. Source: xStation

The DAX is falling during Tuesday's session and is once again paving the way to test the key support level set by the 50-day exponential moving average (blue curve on the chart), which shows that despite “warmer” messages on the US-China front, investors are still concerned about geopolitical uncertainty or are resuming closing long positions after a series of long and dynamic rallies. At the moment, however, the index is still maintaining a technical uptrend, looking at the price pattern above the 50- and 100-day EMA. The RSI for the last 14 days has fallen below 70 points to the 52-point zone, which is a relatively neutral value indicating neither oversold nor overbought conditions. Source: xStation

News:

- Unilever (ULVR.UK) has revised its schedule for spinning off Magnum due to the US government shutdown. Such delays may affect the valuation of the company's assets and investor sentiment in the FMCG market.

- Stellantis (STLA.IT) – The company's CEO has publicly confirmed its commitment to the Italian market despite difficulties with car demand, which may prove important for stabilizing the automotive brand's share price.

- Leonardo (LDO.IT) is set to announce a €10 billion joint venture with Airbus (AIR.DE) and Thales (HO.FR), which could translate into a significant increase in the company's potential and long-term valuation in the aerospace and defense sector.

- Atos (ATO.FR) forecasts annual revenues of over EUR 8 billion, compared to market expectations of EUR 8.23 billion, which is a positive signal for shareholders of this IT services company.

What does the sell-side say?

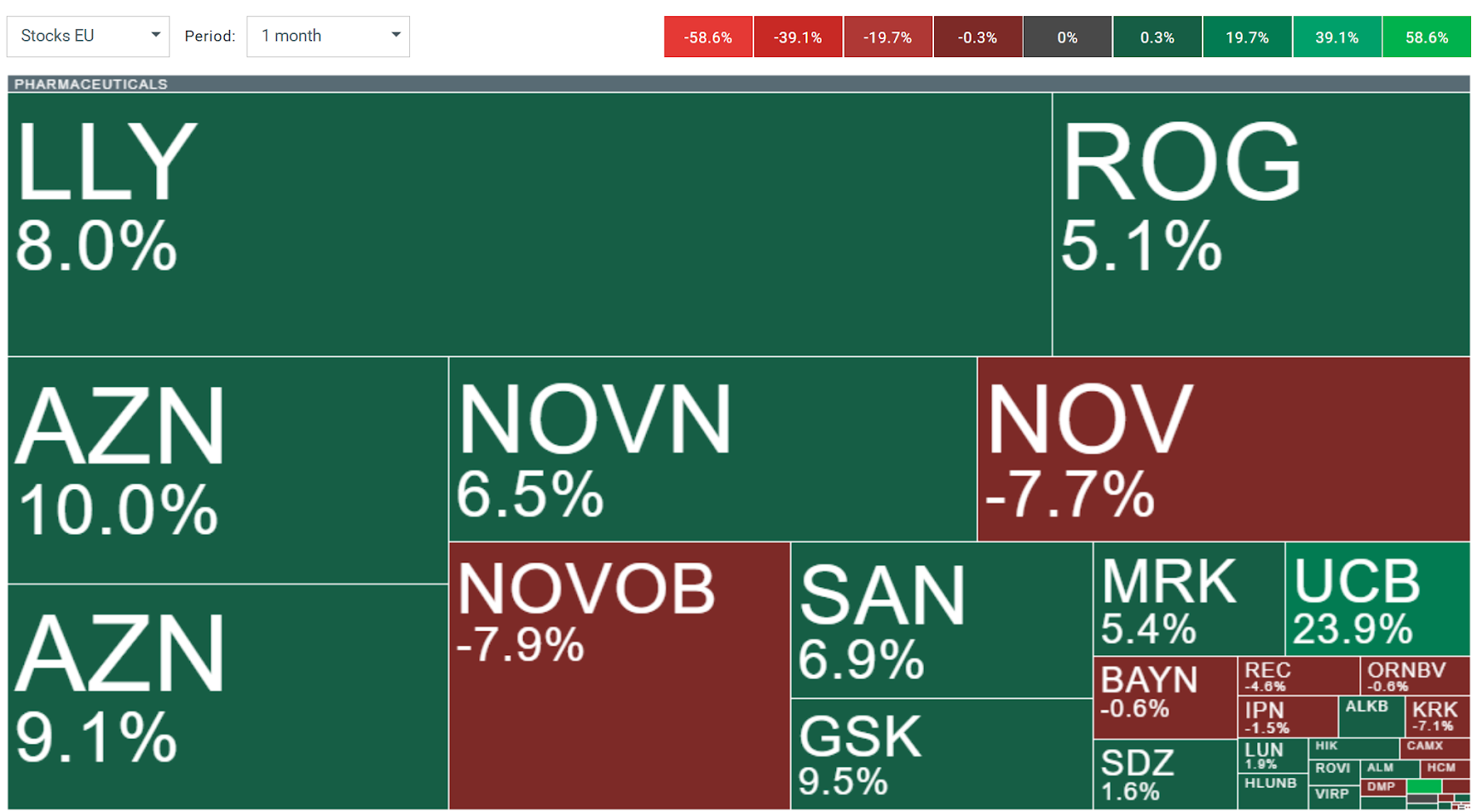

Investors are returning to European healthcare companies, which have rebounded by around 10% from their September lows, driven by Pfizer and AstraZeneca's pricing agreements with the Trump administration, which have eased concerns about regulatory pressure. According to analysts at Barclays and HSBC, cheap valuations and improving earnings momentum create room for further growth, especially with the euro stabilizing and US imports rebounding. Despite ongoing risks in drug pricing policy and margins, the sector is still considered the most undervalued in Europe, with an improvement in results forecast for the fourth quarter. According to analysts at Rathbones and Edmond de Rothschild, companies offering strong sales growth and concrete development plans will be key for investors, as the market begins to focus on fundamentals again. At the same time, the sector remains a defensive beneficiary of capital rotation towards stable industries such as consumer goods and utilities. Although medical stocks are still about 14% below last year's peak, more and more analysts believe that “the worst is behind them” and that their solid cash flows and balance sheets may once again attract institutional capital.

Source: xStation

Daily summary: Nvidia fails to rescue Wall Street; fears of an AI bubble push stock markets down❗

🚨US100 erases all daily gains

BREAKING: NATGAS muted after almost in-line EIA data release 💡

Palo Alto - after Earnings