- European market holds steady at opening

- Mixed Eurozone PMI

- Defense stocks suffer on unfavorable peace talks

- European tech in decline amid waving AI boom

- European market holds steady at opening

- Mixed Eurozone PMI

- Defense stocks suffer on unfavorable peace talks

- European tech in decline amid waving AI boom

Yesterday's session was not successful for buyers, as American indices clearly lost ground, and many commentators and analysts expected the declines to transfer to Europe after the market opened. European indices on the cash market opened with moderate declines, but futures contracts are already in growth territory. The SUI20 contracts are rising the most in the morning hours, by almost 1%. Smaller increases can be observed in the FRA40, ITA40, and UK100 contracts, where they are limited to 0.4-0.6%.

European markets will be pricing further direction today based on yesterday's strong Wall Street movements, a solid dose of macroeconomic data from the old continent, and some comments from central bankers.

ECB bankers had their speeches today. The bank's president, Christine Lagarde, strongly criticized the reluctance of European countries to implement key reforms and pointed out that the current level of interest rates allows for growth noticeably greater than what is being observed.

Macroeconomic Data:

- The situation in the United Kingdom continues to deteriorate. Retail sales fell month-to-month by -1.1% against expectations of 0%.

- In France, industrial PMI readings are significantly falling and remain in contraction territory (47.8). The composite PMI also remains in contraction (49.9), supported by a relatively good Services reading (50.8).

- The German reading remains ambivalent. The composite and industrial PMI falls more than expected but remains in growth territory (52.1 and 52.7). The industrial reading performs worse, with a decline to 48.4 against expectations of growth to around 49.8.

- In the Eurozone, services remain the strength of the economy with PMI rising above expectations to 53.1, but industry continues to disappoint, falling to 49.7.

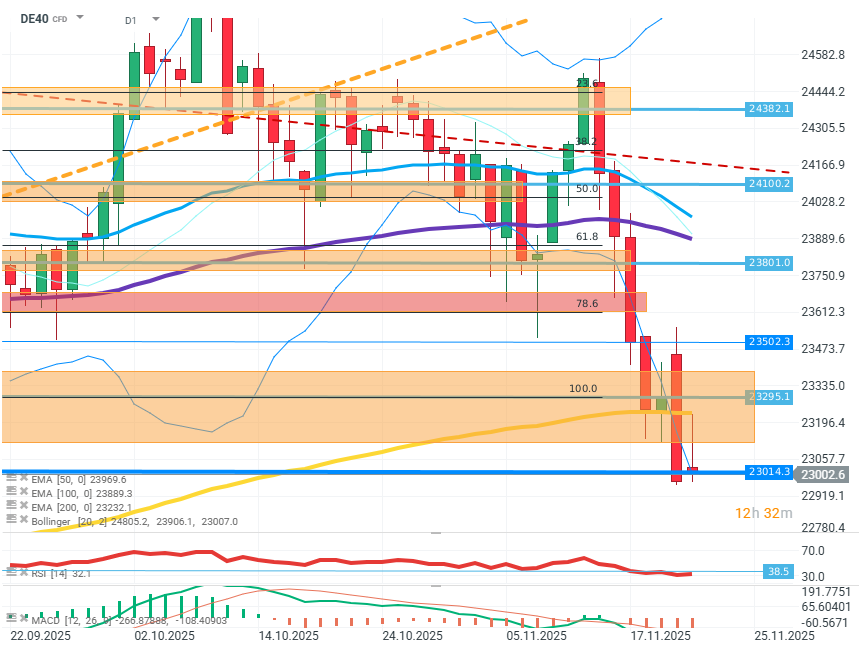

DE40 (D1)

Source: xStation5

The price on the index continues a strong downward movement, passing through the resistance zone around the FIBO 100 retracement and the EMA200 average. Buyers managed to halt the declines only at the level of 23000, the last minimum from May. The RSI's transition into the oversold territory (38) and the lower limit of the Bollinger bands favor an attempt at a corrective increase.

Company News:

- The extremely unfavorable peace proposal for Ukraine recently proposed by the USA is negatively impacting the valuations of European defense companies. RENK (R3NK.DE), Hensoldt (HAG.DE) are losing about 3%. Rheinmetall AG (RHM.DE) is losing as much as 7%.

- The retreat from risk and shaken faith in the AI boom is putting pressure on the valuations of European tech companies. Infineon (IFX.DE) is losing 4%, ASML (ASML.NL) is down over 7%, Siemens (SIE.DE) is depreciating by 8%.

- Babcock (BAB.UK) - The producer of nuclear and military equipment published very good results, exceeding expectations and showing, among other things, a 27% profit increase. However, amid weak sentiment, the company is still losing over 2% of its capitalization.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings