The beginning of the new month seems to favor European stock markets. A clear wave of optimism has returned, supported by positive data coming from the economies of the old continent. The latest PMI readings indicate a significant revival of the industrial sector in the Eurozone, covering key economies such as Germany, France, Italy, and Spain, where industrial activity has exceeded market expectations. The positive investor sentiment has returned in response to these data, fostering bullish moods.

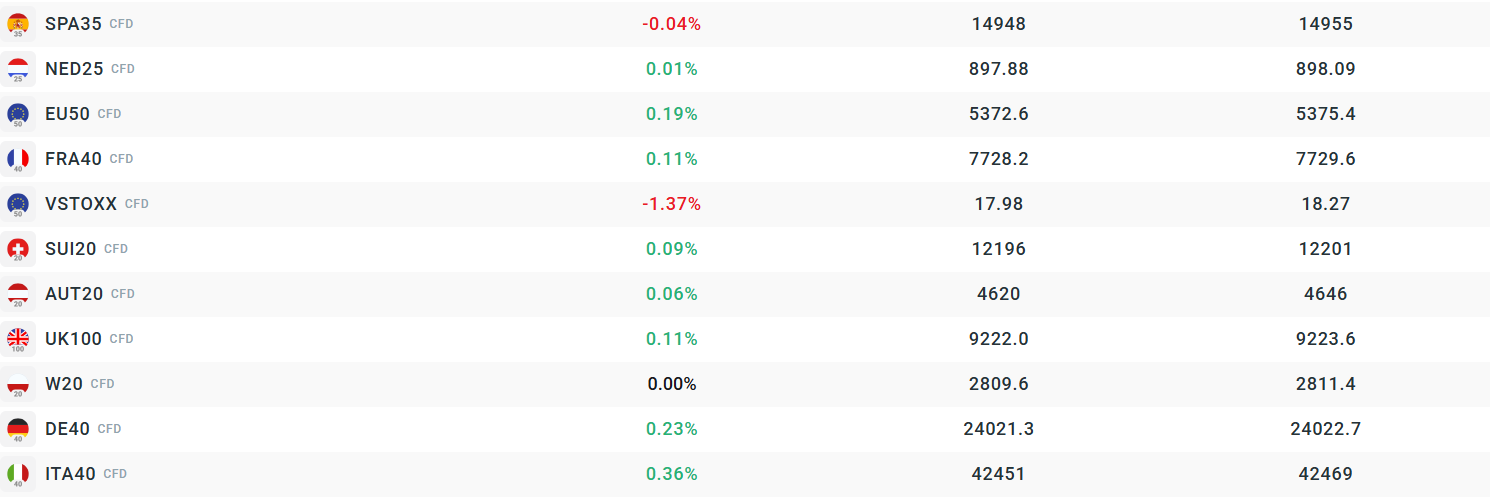

European financial markets are experiencing moderate euphoria today, with indices registering reasonable gains. The German DAX index is up about 0.2%. The Euro Stoxx 50, covering the largest companies in the Eurozone, rises by 0.15%. The French CAC 40 shows an increase of around 0.1%. The worst performer is the Spanish IBEX 35, which loses 0.17%, while the Italian FTSE rises by 0.3%.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

Source: xStation5

Currently observed volatility in the broader European market. Source: xStation

The DE40 index is presently in a phase of technical hesitation, oscillating around the 24,370-point level. On the daily chart, it can be seen that the price balances just above the 50-period (green) and 100-period (orange) exponential moving averages, which serve as the nearest support zones. Meanwhile, the 200-period moving average (purple) remains clearly lower, marking a long-term defense line for the bulls.

Source: xStation5

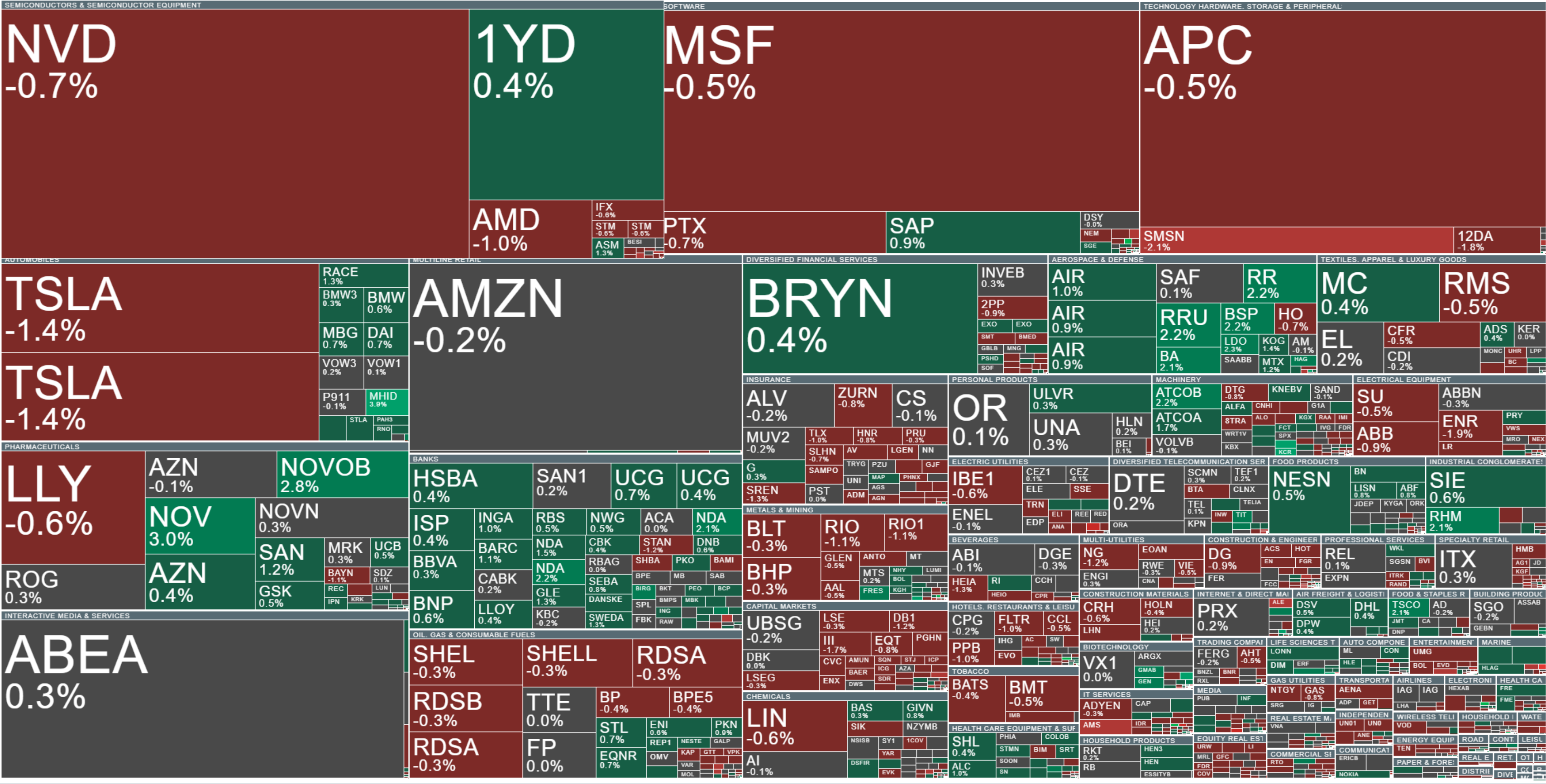

Company news:

Konecranes (KCR.FI) gains 4.7% today after Goldman Sachs upgraded its recommendation to “buy.” Analysts at this institution set a new price target of 95 euros, which was positively received by investors. The increased interest in Konecranes shares reflects growing expectations for the company’s further development and improved financial results.

Orsted (ORSTED.DK) rises 1.5% following the announcement that Equinor, one of its key strategic investors, committed to subscribing to new Orsted share rights worth up to 6 billion Danish kroner (DKK). This decision signals strong capital support from Equinor, which is an important vote of confidence in Orsted’s further growth and prospects. Investors generally view such information positively, as subscription of new shares by a strategic partner not only provides the company with additional financial resources but also confirms its stability and credibility in the market.

Novo Nordisk (NOVOB.DK) shares increased by 2.8% after the company announced that its drug Wegovy, containing semaglutide, demonstrated cardiovascular benefits independent of weight loss. Data from the SELECT study indicate that Wegovy reduces the risk of heart attack, stroke, and cardiovascular death.

TeamViewer (TMV.DE) gains nearly 10% today after Bank of America doubled its recommendation upgrade to “buy.” Analysts at this institution raised the price target to 16.3 euros, implying a potential 80% increase in the stock price compared to the last close. The positive investor sentiment stems from the belief that the company is well-prepared for potential disruptions related to artificial intelligence as well as from improved revenue growth forecasts for 2025-2028.