Stock market indices from the Old Continent are struggling this week. Spike in political uncertainty triggered by snap parliamentary elections being called in France, as well as hawkish FOMC meeting, are putting pressure on sentiment towards European indices this week. German DAX 40 is trading almost 4% lower week-to-date, while French CAC40 is this week's top laggard in Europe, dropping over 5% week-to-date and erasing this year's gains.

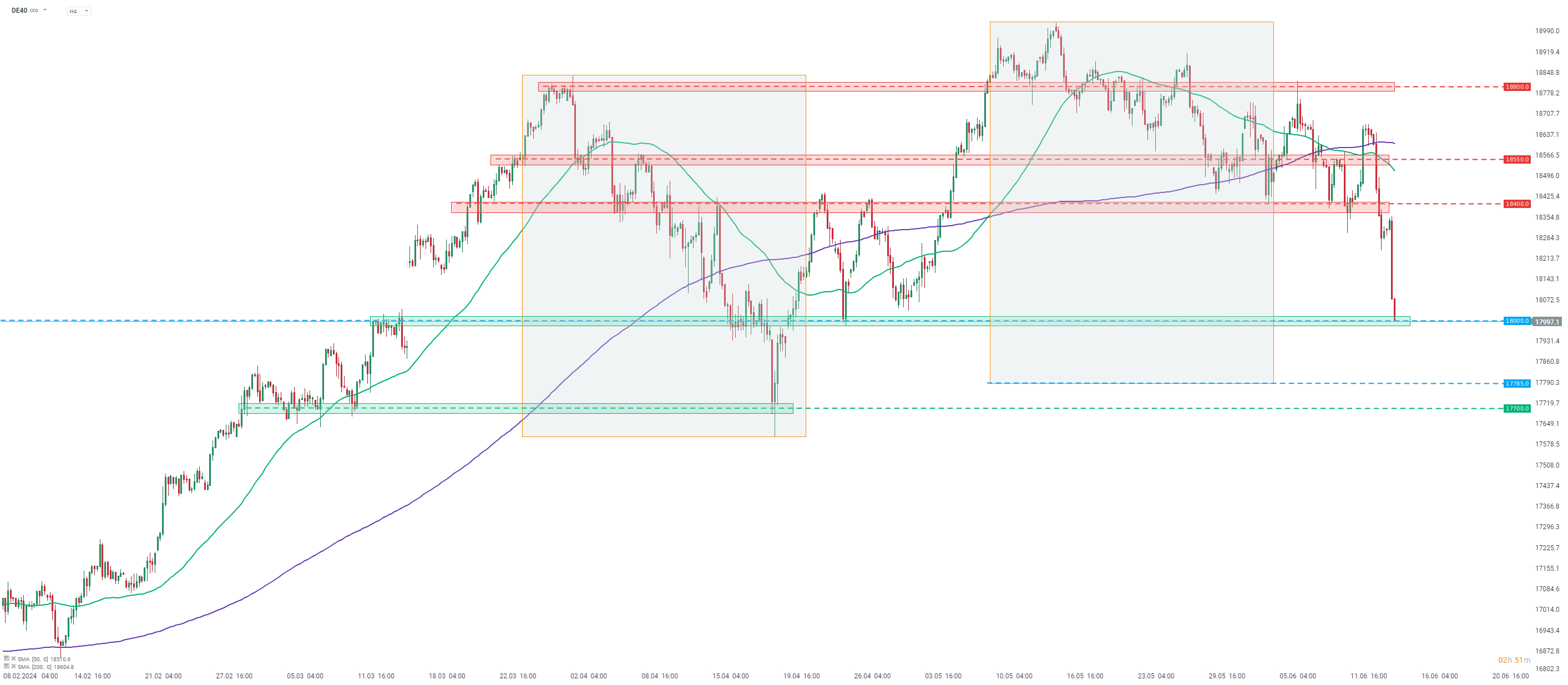

Taking a look at German DAX futures (DE40) at H4 interval, we can see that the index has plunged over 500 points this week - from around 18,570 pts at the close of last week's trading to around 18,000 pts now. The index is testing a psychological support zone in the 18,000 pts area, marked with previous price reactions. However, even a drop below this hurdle would not make the outlook immediately bearish. A drop below the lower limit of local market geometry at 17,785 pts will be needed to confirm trend reversal.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers