Deckers Outdoor Corp (DECK.US) initially surged by even 13% (now +11.30%) after the company reported strong fiscal Q2 earnings, with net sales rising 20% year-over-year to $1.31 billion, surpassing analysts' consensus of $1.2 billion. The growth was driven by robust demand for Hoka and UGG brands, with Hoka sales up nearly 35% and UGG up 13%. This positive momentum led Deckers to raise its full-year guidance, now forecasting $4.8 billion in net sales with an adjusted EPS of $5.15 to $5.25.

Financial summary:

- Net Sales: $1.31 billion (+20% YoY), above estimate of $1.2 billion.

- Hoka Sales: $570.9 million (+35% YoY), above estimate of $517.7 million.

- UGG Sales: $689.9 million (+13% YoY), above estimate of $634.4 million.

- Teva Sales: $22 million (+2.3% YoY).

- Sanuk Sales: $2.8 million (-48% YoY).

- Gross Margin: 55.9%, up from 53.4% YoY, estimate was 52.1%.

- Wholesale Sales: $913.7 million (+20% YoY), above estimate of $823.2 million.

- Adjusted EPS: $1.59, well above consensus estimate of $1.2.

- Full-Year Net Sales Guidance: Raised to $4.8 billion.

- Full-Year Adjusted EPS Guidance: $5.15-$5.25.

Management highlighted Deckers’ expanding innovation pipeline and international growth potential, particularly for Hoka and UGG. Despite projecting a seasonal slowdown in the latter half of the fiscal year, the company anticipates ongoing strength from new product launches and increased market presence abroad. Notably, the raised gross margin forecast of 55% to 55.5% reflects disciplined distribution and strong full-price sales momentum across brands, positioning Deckers for continued growth in a competitive footwear market.

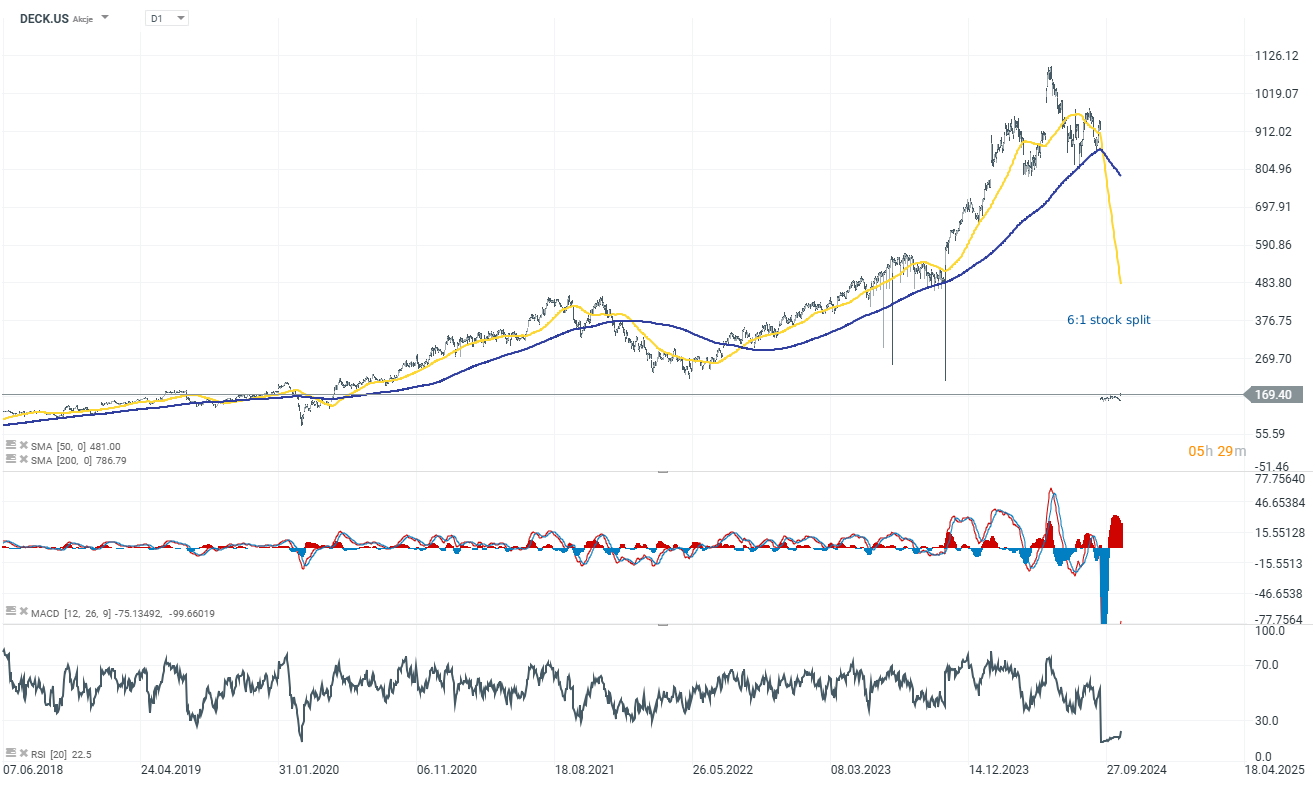

Price Chart (D1 interval)

The company's market capitalization is up by 11.50% today, making it the second-highest gainer in the S&P 500 index, following Tapestry (+14.40%). The stock price has risen to $170, close to its historical all-time high reached before the 6:1 stock split.

Source: xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street