The defense sector is standing out today with broad-based gains across European trading floors. Defense stocks are advancing widely and are leading the way on nearly every exchange. In Norway, shares of Kongsberg Gruppen are climbing, while in Sweden SAAB is up nearly 4%. In Germany, RENK Group and Hensoldt are posting strong gains, with Rheinmetall retesting highs from earlier this year. In the UK, BAE Systems and Rolls-Royce are on the rise. Meanwhile, in Italy, Fincantieri is up more than 5%, and Leonardo is advancing close to 3%.

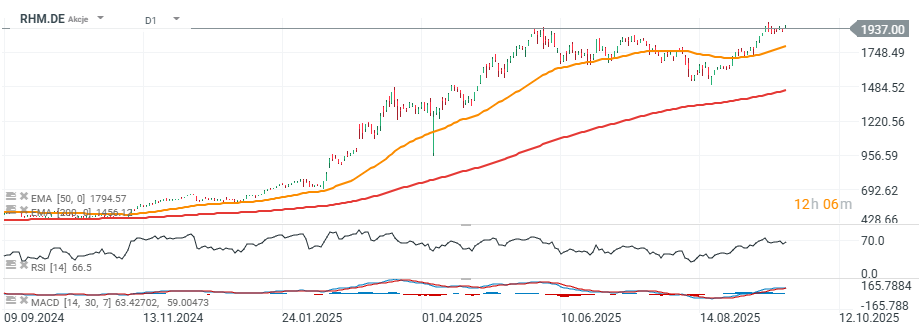

Drone incidents in Europe, combined with comments from former U.S. President Donald Trump — who stated that Ukraine, with unwavering NATO support, could reclaim all territories seized by Russia — along with the prospect of a “hybrid” escalation in Eastern Europe, suggest that defense companies are likely to secure large contracts for many years to come. After an almost 30% correction, shares of Germany’s largest defense contractor Rheinmetall have rebounded and are holding at historic highs near €2,000 per share.

Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈