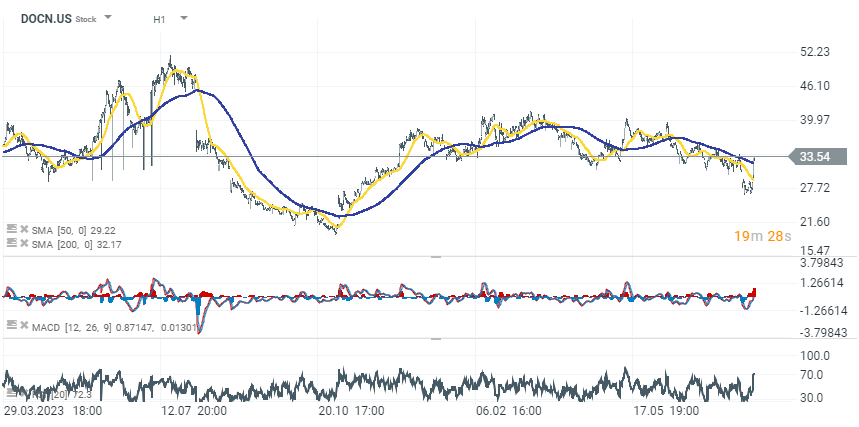

DigitalOcean (DOCN.US) gains over 15% after reporting strong Q2 2024 financial results, exceeding analysts' expectations. The company posted a 13.3% year-on-year revenue growth to $192.5 million, slightly above the estimated $188.6 million. Non-GAAP earnings per share (EPS) came in at $0.48, beating the forecasted $0.39. The company’s revenue guidance for Q3 2024 is $196.5 million, aligning with market expectations.

Financial Metrics

- Revenue: $192.5 million (up 13.3% year-on-year)

- Non-GAAP EPS: $0.48 (beat estimates of $0.39)

- Gross Margin: 61% (same as last year)

- Free Cash Flow: $71.34 million (up 108% from the previous quarter)

- Net Income: $19.4 million (up from $665,000 last year)

- Revenue Guidance for Q3 2024: $196.5 million

- Full-Year Revenue Guidance: Increased to $772.5 million from $767.5 million

Business Metrics:

- Annual Recurring Revenue (ARR): $781 million (up 14.6% year-on-year)

- Net Revenue Retention Rate: 97% (consistent with the previous quarter)

- Billings: $193.8 million (up 14.1% year-on-year)

- Total Customers: 638,000

- Average Revenue Per Customer (ARPU): $99.45 (up 9% year-on-year)

- Key Product Growth: AI/ML-related ARR up over 200% year-on-year

DigitalOcean's management, led by CEO Paddy Srinivasan, highlighted another strong quarter, with revenue growth re-accelerating. DigitalOcean's growth was bolstered by innovations like AI/ML offerings, particularly the integration of Nvidia GPUs for AI workloads, catering to small businesses. Looking ahead, DigitalOcean expects revenue growth to continue, with a slight upward revision in its full-year revenue guidance to $772.5 million.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡