Summary:

-

Industrial production picks up

-

US indices close to record highs

-

Early dip in equities treated as buying opportunity

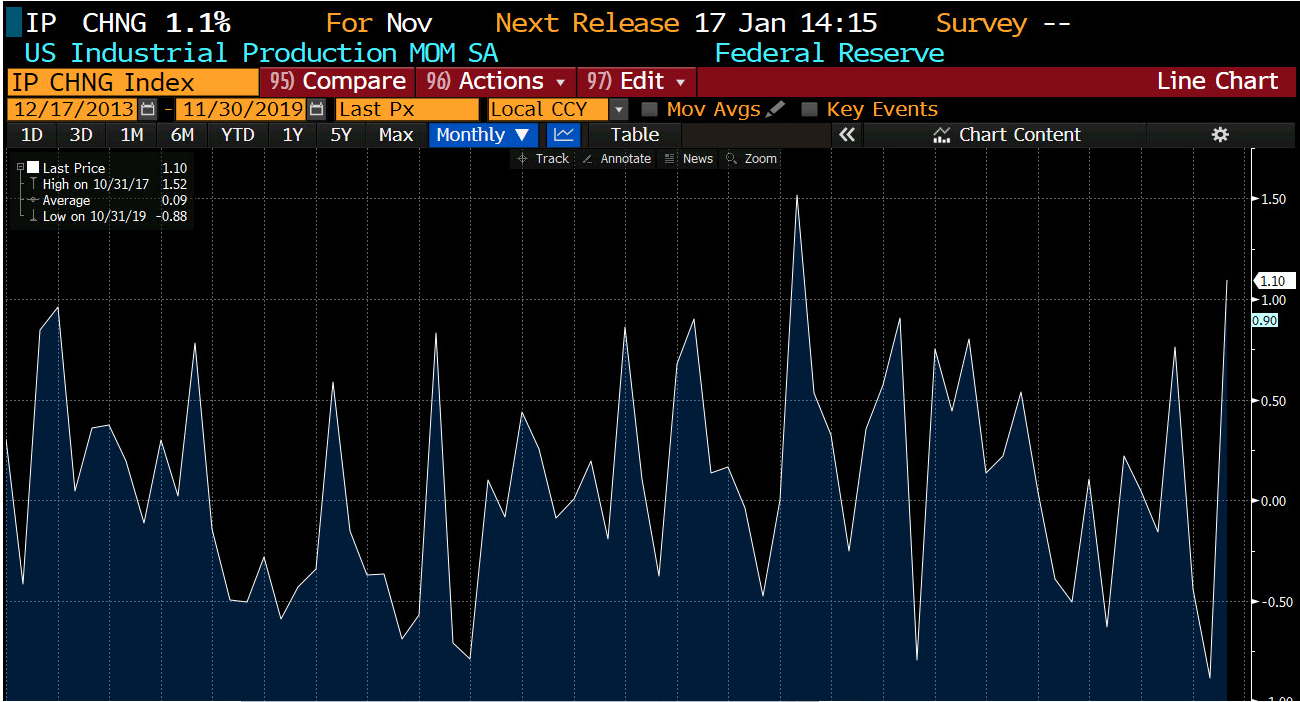

Following on from some better than forecast housing data earlier on (Permits: 1.48M vs 1.41M exp; Starts 1.37M vs 1.34M exp) there’s been further strong data from the US with industrial production picking up encouragingly. For November a rise of 1.1% M/M was above the 0.8% expected and marked a stark improvement on the -0.9% seen last month (revised lower from -0.8% originally). The sharp bounceback can be explained to some extent by the returning GM strikers, with the motor vehicle assembly rate rising the 11.41M units per year from October’s 9.51M units per year.

There’s been a large jump in US industrial production in November, although this can be explained away to some extent by the returning GM workers. Source: Bloomberg

In terms of the US stock markets there’s little that has changed as bulls remain firmly in control of the tape and the leading benchmarks are all close to their highest ever levels. There was a little bit of weakness in the futures this morning as a fall in the pound overnight weighed on sentiment in European bourses as traders start to price in some risk of a no-deal Brexit at the end of next year. However, while the pound remains near it’s daily lows stocks on the continent have bounced and the US100 is back near its record peak just beneath the 8600 level.

The US100 remains in an uptrend whichever way you look at it with the levelling off on the bottom of the H1 Ichimoku cloud around 8515 providing some potential support. Record highs of 8596 lie just over 10 points away. Source: xStation

The US100 remains in an uptrend whichever way you look at it with the levelling off on the bottom of the H1 Ichimoku cloud around 8515 providing some potential support. Record highs of 8596 lie just over 10 points away. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers