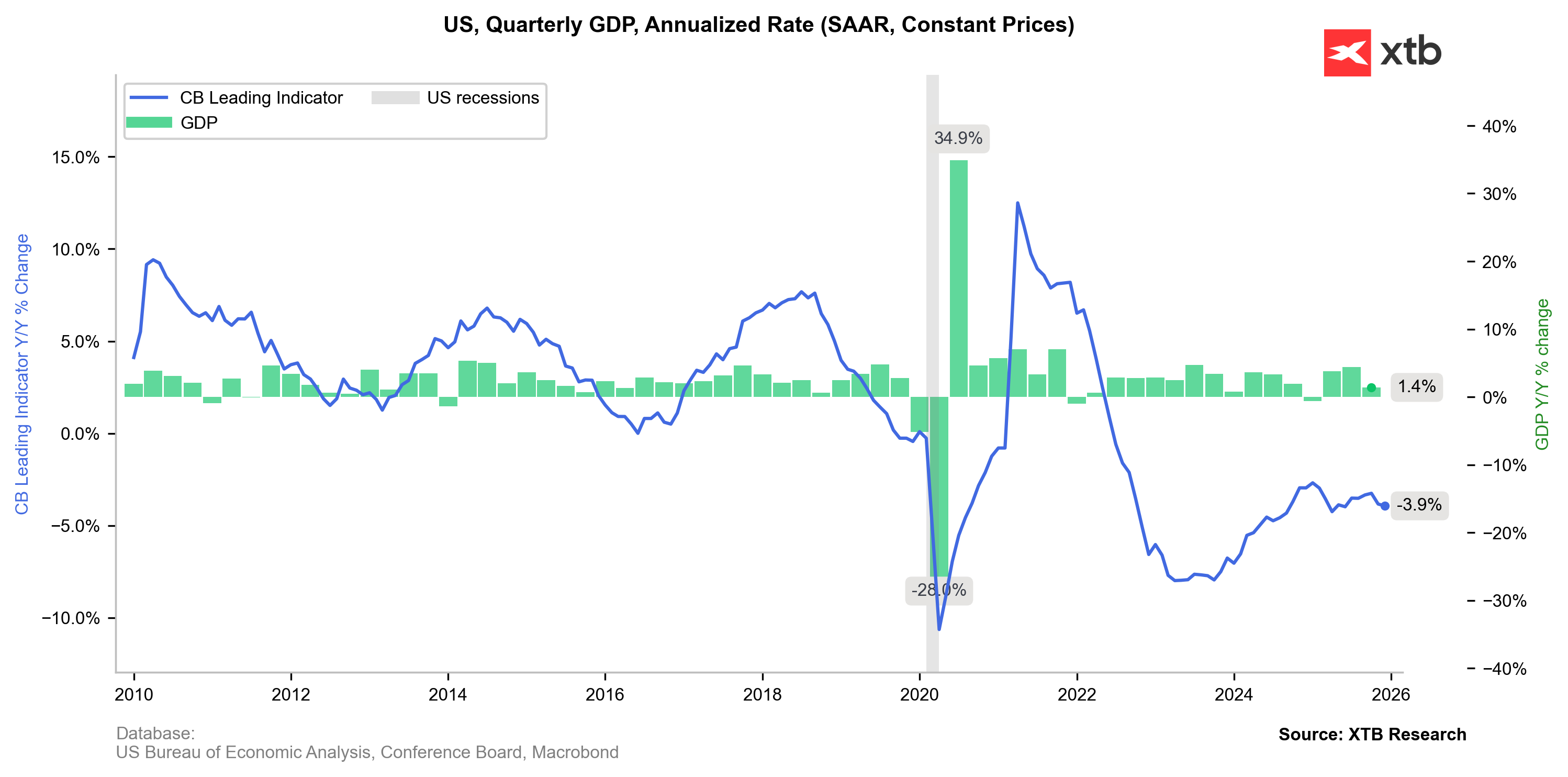

US economic growth slowed drastically in the fourth quarter of 2025, tumbling from a highly optimistic, consumer-driven 4.4% to just 1.4%. At first glance, a result twice as low as the consensus, paired with the first inflationary surprise in months, seems to scream "stagflation!". However, the details of the BEA report look more like a solid foundation for an inflation rebound and an exceptionally poor report card for White House policy.

Source: XTB Research

Record Shutdown, Record Decline

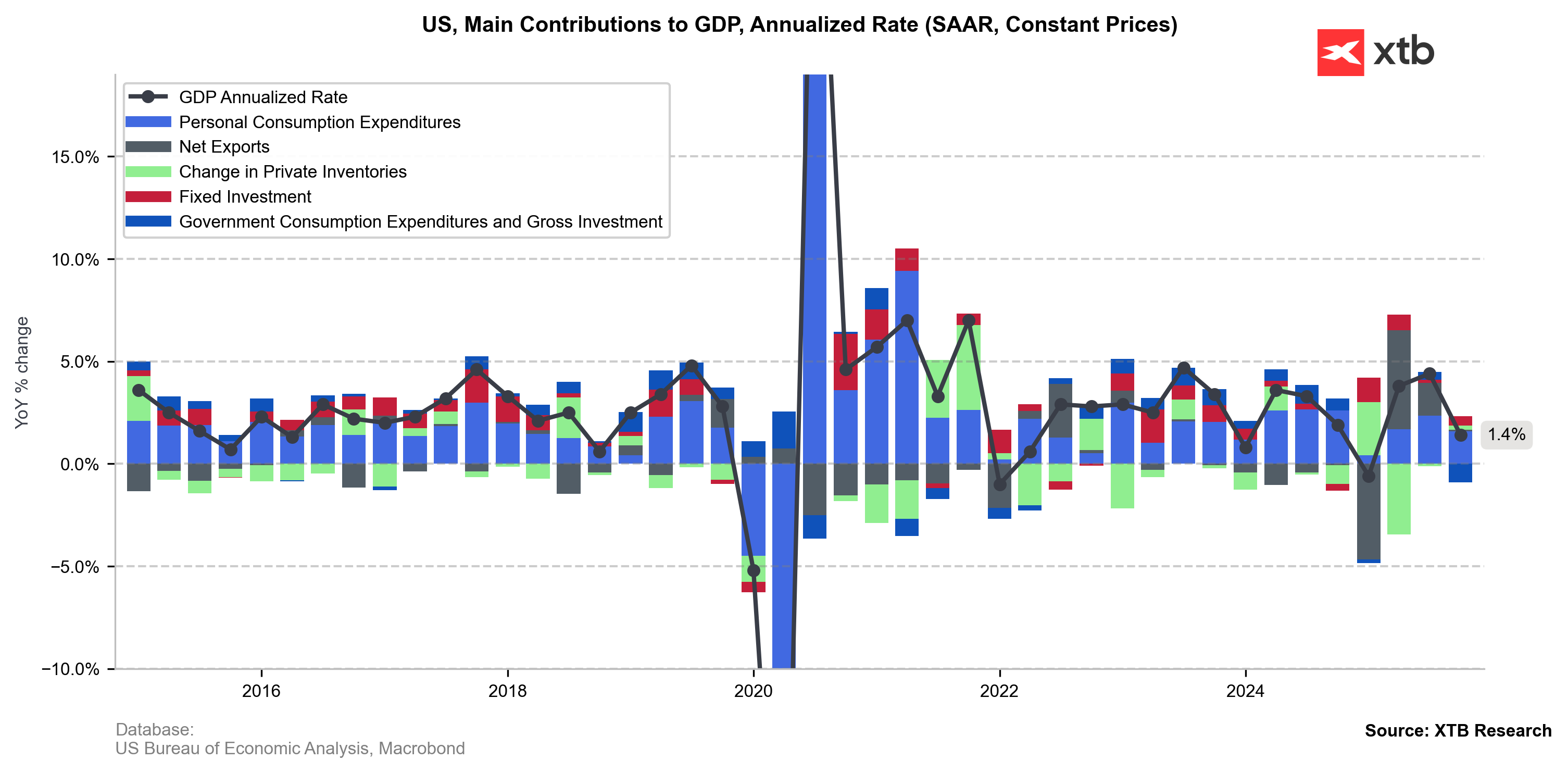

The sharp drop in GDP growth was primarily dictated by the longest government shutdown in history last fall, which suspended federal agency operations and all associated spending—including salaries, social programs, and security. Federal-level spending fell by 1.15%, the worst performance since the 1970s.

Additionally, net exports—the primary engine of GDP data in recent quarters—essentially stalled, calling into question the effectiveness of Donald Trump’s protectionist policies. In fact, exports fell by 0.1% in Q4, driven by a drop in goods; the trade balance was saved only by a slowdown in imports (from 0.6% to 0.2%) rather than an outright decline.

Nevertheless, the report reflects political tribulations rather than structural weakness. The consumer remains the primary driver of the US economy, with spending rising by nearly 1.6% despite inflation lingering above target and a tight labor market. Furthermore, investment growth accelerated, with the most significant capital flow directed toward data processing infrastructure. This suggests ongoing AI adoption, which both the current and nominated Fed chairs expect will increase long-term productivity and limit inflation.

The drop in the US GDP growth was driven by shutdown-driven swings in public sector, not the stagnation in the private economy. Source: XTB Research

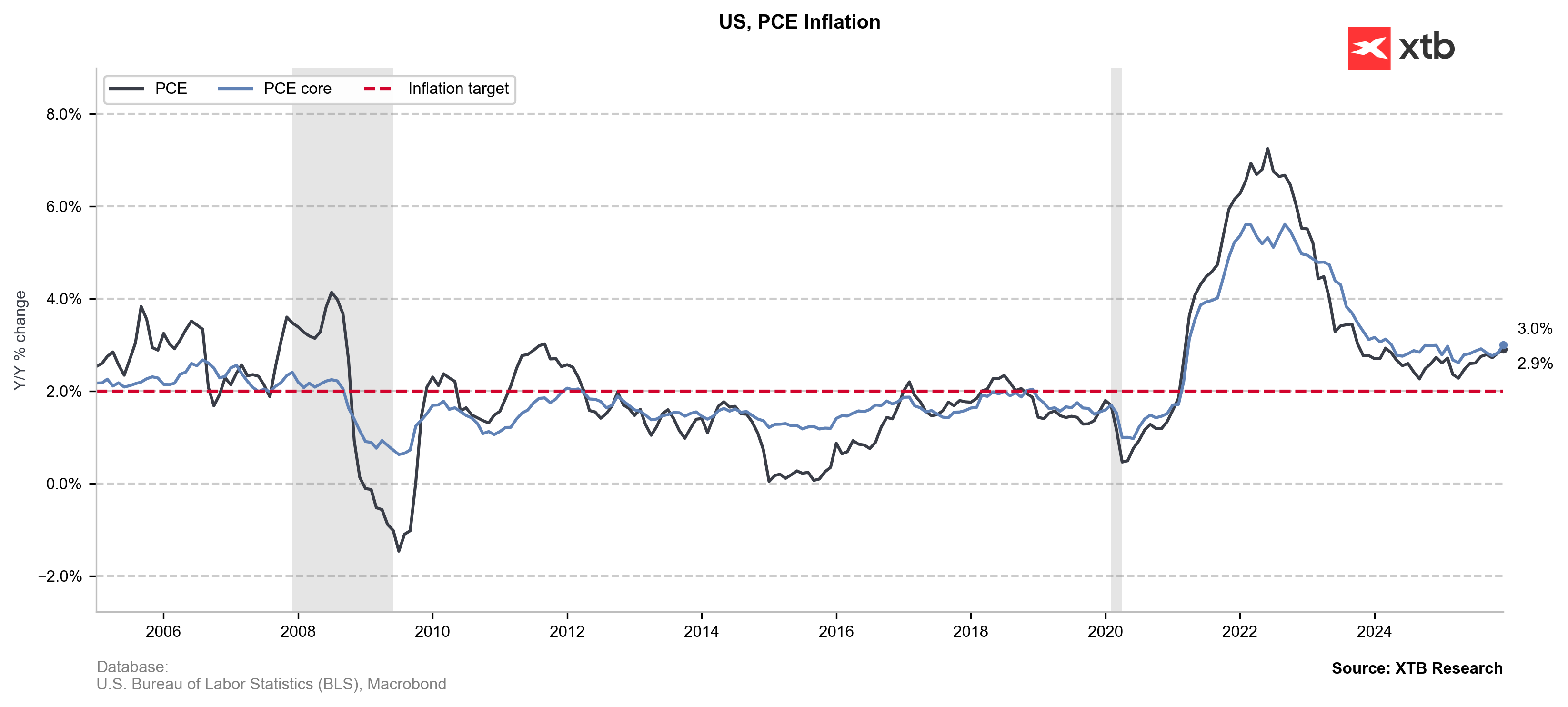

Wall Street Re-discovers Inflation

The negative tone of today’s data was reinforced by the reading of the Fed’s preferred inflation metric. Core PCE, which tracks a broader basket of goods and services than the CPI and includes expenditures made on behalf of consumers (such as health insurance subsidies), rose beyond expectations from 2.8% to 3%.

The increase in PCE inflation has been gradual. Source: XTB Research

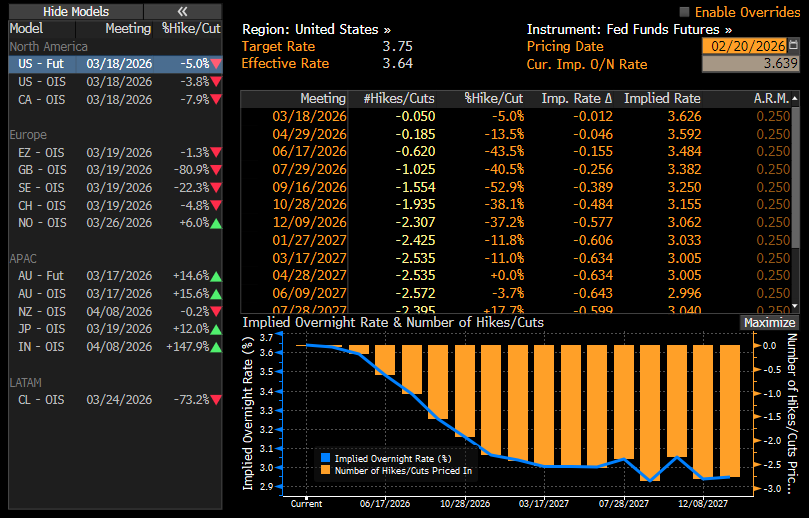

The rise in PCE inflation to 3% should not be surprising given the steady upward trend visible in the data. Wall Street, however, has largely ignored readings that were in line with or lower than expectations for some time, even as they signaled building price pressure. The market has slightly dialed back its pricing for US rate cuts, still betting on July as the next window. Nonetheless, we can expect a sharpening of hawkish rhetoric from the Fed, especially following FOMC Minutes indicating that cutting rates with PCE at 3% would suggest a lack of determination in the fight against inflation.

The implied rate cut probabilities remain vastly the same, with first cut expected in July. Source: Bloomberg Finance LP

The Danger of "Sticky" Spending

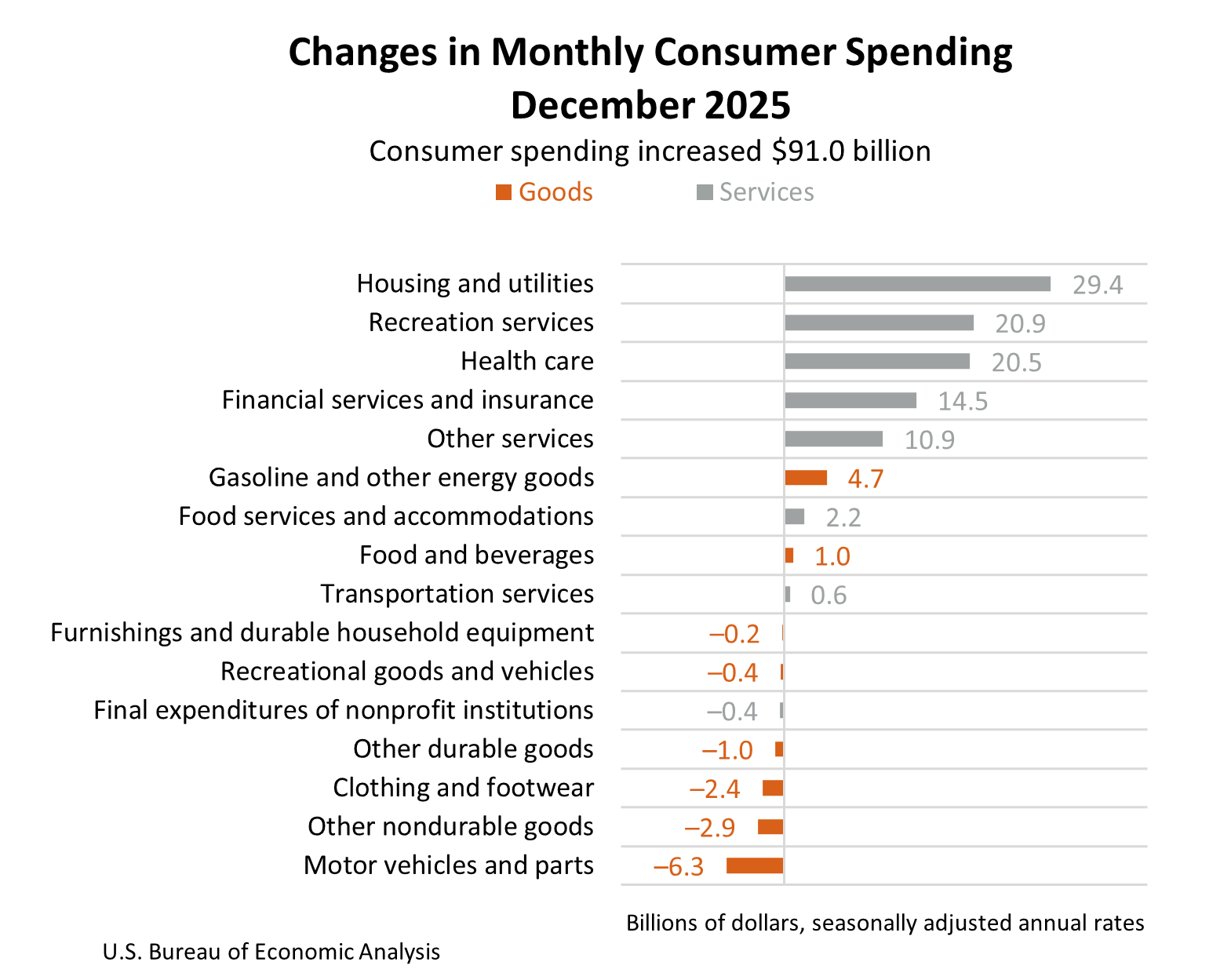

The "sticky" nature of US inflation is also evident in the structure of the PCE report. The largest increases were recorded in "non-discretionary" sectors—healthcare, housing, utilities, and insurance—which are harder to control via higher interest rates. Conversely, the visible drop in spending on goods suggests that consumers are being "squeezed" by the rising cost of living, leading them to forgo discretionary purchases.

Source: BEA

Conclusion: Is the Economy Succeeding "Despite Trump"?

The totality of the data suggests that the US private sector and consumers remain resilient despite political turmoil and the blame-shifting surrounding the shutdown. Furthermore, the stalling of net exports exposes a fact buried under the White House’s protectionist agenda: global supply chains and production capacities cannot be moved to the US overnight. After the volatility caused by mass inventory stockpiling ahead of tariffs, trade structures should gradually stabilize. However, the regular growth in import value simply means that Americans are still buying the same goods—they are just paying a higher price for them.

Aleksander Jablonski

Quant Analyst

Three markets to watch next week (20.02.2026)

Trump will hold a press briefing on the Supreme Court's tariff decision in 12 minutes 💡

BREAKING: TRUMP’S GLOBAL TARIFFS STRUCK DOWN BY US SUPREME COURT 🚨🏛️

BREAKING: US GDP growth rate collapse🚨📉