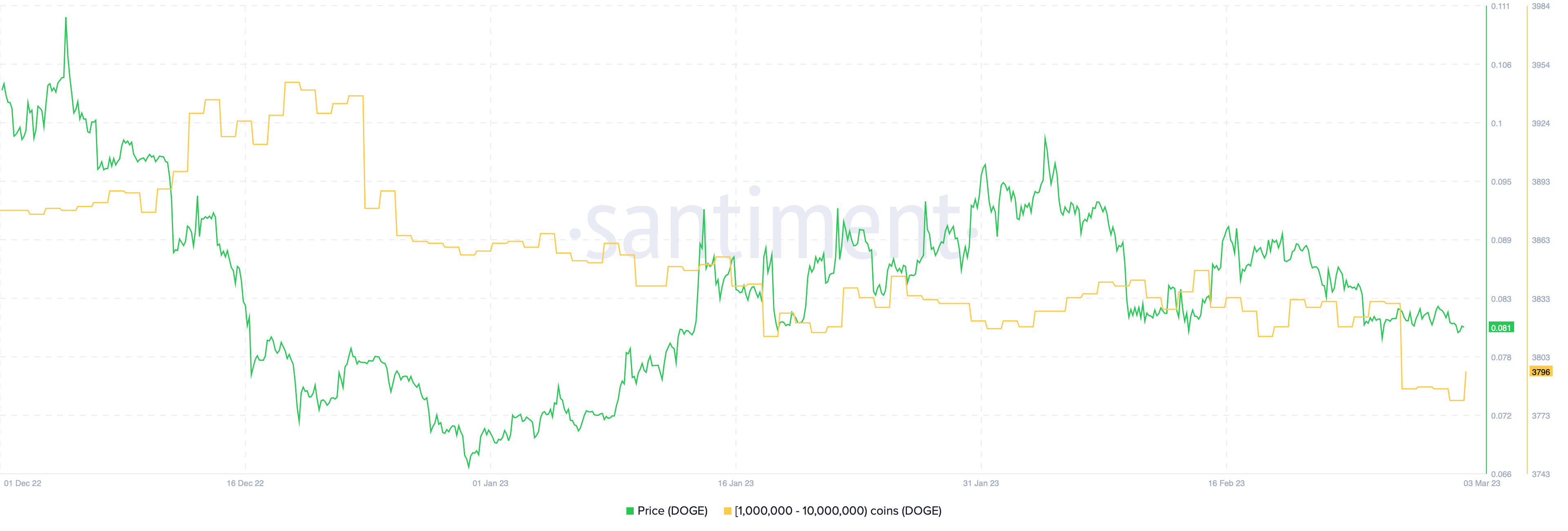

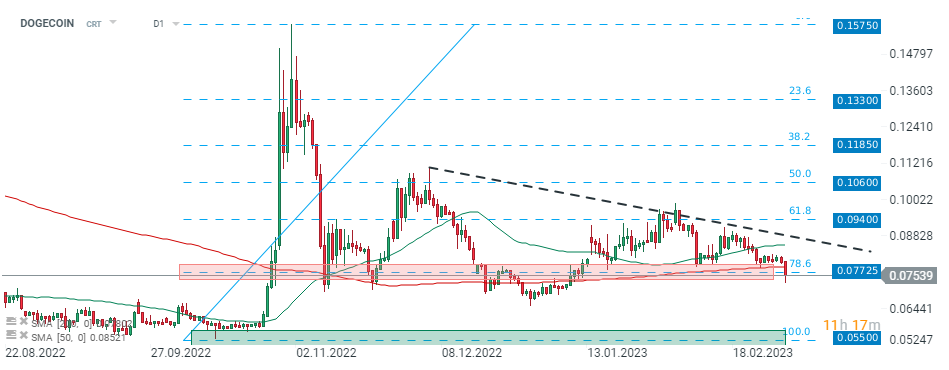

Mounting worries about the fallout of crypto-focused US bank Silvergate Capital sent shockwaves through crypto markets. Bitcoin lost over 6.0% and briefly dropped below $22,000 as long liquidations hit highest level since August. Smaller projects followed in BTC footsteps and also recorded sharp declines. Dogecoin price plunged 9.0% and dropped below major support at $0.07725 which is marked with previous price reactions, 200 SMA (red line) and 78.6% Fibonacci retracement of the last upward wave. Currently buyers attempt to erase some losses, nevertheless as long as price sits below the aforementioned level, sell-off may deepen towards October 2022 lows at $0.0550. Additionally the Supply Distribution chart shows that the number of large investors, which own from 1 million to 10 million DOGE decreased significantly, which supports the bearish scenario.

Number of Doge large investors so called 'whales' has fallen sharply in recent days. Source: Santiment

DOGECOIN, D1 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?