The dollar index fell to 104.15 mark, lowest level since end of June and as prospects of a less aggressive tightening from the Fed put pressure on greenback. Money markets digested the latest NFP report and are pricing an 80% chance of 50 bp in December after delivering four successive 75 bp rate increases. USD weakened not only against major currencies like EUR and GBP pound but also against the Chinese yuan as bets of a swifter reopening of China's economy lent optimism to yuan bulls.

Dollar extends fall and today the most pronounced selling pressure can be spotted against South African Rand and Chinese yuan. Source: xStation5

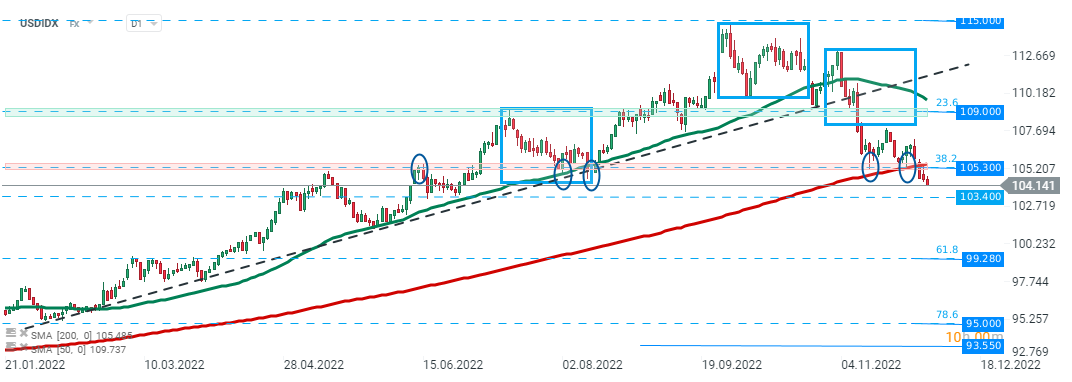

USDIDX erased more than half of this year’s gains and if current sentiment prevails, support at 103.40 may be at risk. Source: xStation5

USDCNH pair is testing major support zone around 6.95, which is marked with lower limit of the local 1:1 structure and 38.2% Fibonacci retracement of the upward wave launched in March 2022. Should break lower occur, next support to watch lies at 6.83 and coincides with 50.0% retracement, however earlier sellers will need to overcome 200 SMA (red line). On the other hand, if buyers manage opt regain control, then another upward impulse may be launched towards resistance at 7.10. Source: Station5

EURUSD hovers near key resistance at 1.06 which coincides with 38.2% Fibonacci retracement of the upward wave launched in January 2021. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report