Summary:

- Chinese stocks move down as a local broker downgrades People’s Insurance Company of China shares

- Trade data disappoints, but do not look only at February’s numbers

- Japanese GDP data surprised to the upside

Reality check

The Chinese stock market has plunged 4% (the most since October) weighing on other Asian indices as well following a bearish recommendation send by a local brokerage house. Namely, Citic Securities advised its clients to sell the shares of the People’s Insurance Company of China saying that they are significantly overvalued and could decline more than 50% over the next year. Note that the stocks had surged by the maximum allowed by the exchange in previous five straight days. Taking into account that the downgrade was really substantial one may suspect that it must have been authorized by the regulators. Thus, there is a possibility that those regulators and the government itself have become concerned about the pace of the recent increases in the local stock market thereby they approved such the downgrade. From investors’ point of view this could act as a reality check suggesting that the steep bull market we have seen over the recent weeks may be exaggerated. Technically a reversal came in the vicinity of the strong resistance at around 11800 points and the price has already touched its previous important level placed at 11200 points.

The Hang Seng (CHNComp) is falling over 2% while the Shanghai Composite is slumping as much as 4%. Source: xStation5

The Hang Seng (CHNComp) is falling over 2% while the Shanghai Composite is slumping as much as 4%. Source: xStation5

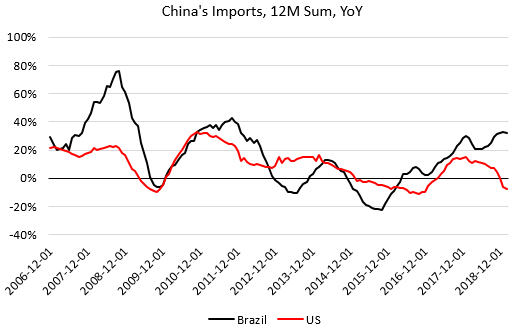

Trade data not so weak as it seems

Over Asian hours trading we were offered the China’s trade data for February. The trade surplus narrowed notably to $4.12 billion from $39.16 billion, well below the expected value of $26.2 billion. Note that the data showed exports slumping as much as 20.7% and imports shrinking 5.2% in annual terms, both far below expectations. China’s imports from the US continued slowing over the month as evidenced by the chart below. What could be interesting, over the recent months China has ramped up imports from Brazil from where it imports mostly agricultural products including soybean. However, keep in mind that the data for February, as it was the case in January as well, was distorted by the Chinese Lunar New Year, therefore we prefered to look at the combined data for these two months. Looking at the China’s trade this way we got that exports fell 5.2% and imports dropped 2.7% in annual terms. These are values that could be directly tied to the trade war with the US as well as the economic slowdown in the Eurozone.

The trada data disappointed, however, the combined numbers for the first two months of 2019 were not so gloomy. Source: Macrobond, XTB Research

The trada data disappointed, however, the combined numbers for the first two months of 2019 were not so gloomy. Source: Macrobond, XTB Research

Solid GDP numbers from Japan

Last but not least, the Japan’s economy expanded 0.5% QoQ in the final quarter of 2018, above the preliminary 0.3% QoQ increase. In annualized terms the growth rate totalled 1.9%, up from 1.4% in the third quarter. While GDP momentum turned out to be quite solid one cannot say the same about the inflation story as GDP deflator stayed at -0.3% YoY. The detailed data showed that consumer spending rose 0.4% QoQ, down from 0.6% QoQ in the three months through September, while business spending rose 2.7% QoQ, up from 2.4% QoQ previously. In a nutshell, the data does not change the BoJ’s reaction function as the central bank is expected to stick its ultra-loose monetary policy in the foreseeable future.

The USDJPY has slid 0.5% over Asian hours trading and it has approached the important technical level. Once the pair breaks this area, room for larger declines could be open. Source: xStation5

The USDJPY has slid 0.5% over Asian hours trading and it has approached the important technical level. Once the pair breaks this area, room for larger declines could be open. Source: xStation5

In the other news:

-

German factory orders for January fell 2.6% MoM, the December’s data was revised to 0.9% MoM from -1.6% MoM