Summary:

-

US30 moves back into the green after early declines

-

Index boosted by BA earnings

-

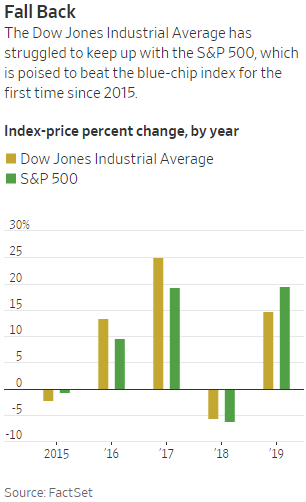

US30 in danger of lagging US500 for 1st time in 4 years

The latest set of earnings results from the US have boosted the Dow Jones Industrial Average (US30 on xStation), with two of the benchmarks largest-weighted stocks reporting ahead of the opening bell. The index had earlier slid to its lowest level in almost 2 weeks below 26,600 but has since recovered after Boeing and Caterpillar reported their figures for the third quarter.

Today’s session could be pivotal for the Dow going forward, with lows around 26585 seen as potentially key support. Should this hold then a move back up to the 27000 region could occur and with price in between the 8 and 21 EMAs there is a feeling that whichever way we go from here could be the start of the next trend. Source: xStation

These two stocks account for comfortably more than 10% of the broader index due to the price-weighted nature with Boeing alone having a weighting of more than 8%. The poor performance of these shares so far in 2019 go some way to explaining the Dow’s underperformance compared to the S&P500 (US500 on xStation) with Boeing being a particular laggard. The aerospace firm’s stock has experienced a double-digit drop over the past 6 months as issues surrounding it 737 Max jet has shaved approximately 370 points of the broader index.

The DJIA has outperformed the S&P500 in each of the past 4 years, but so far in 2019 is lagging behind. Source: FactSet

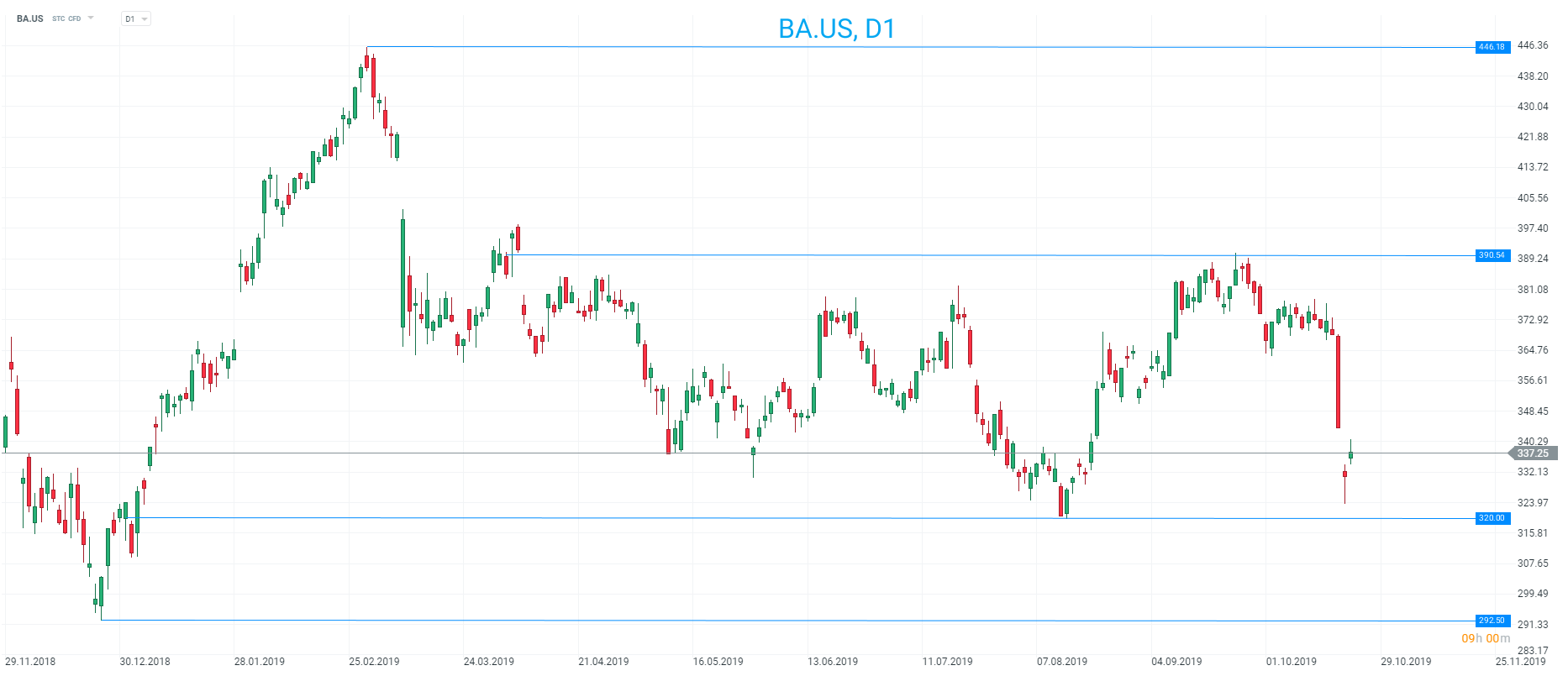

Boeing stock to gain

-

EPS: $1.45 vs $2.09 expected (Refintiv)

-

Revenue: $19.98B vs $19.67B expected (Refinitiv)

This represents a 5-0% slide in profits and 20% drop in turnover. However, a miss in earnings here has seemingly been outdone by some positive remarks on the 737 Max, with the aerospace giant assuming a return to service in the fourth quarter of 2019. Given the recent backdrop and the dour newsflow around Boeing for much of the year, this is seen as a clear positive and the stock is trading higher in the premarket.

Boeing investors have had a trying year but the stock is called to begin higher this afternoon on hopes of a return to service for the trouble 737 MAX jets this quarter. This has seemingly outweighed a disappointing set of results with both profits and revenue falling in Q3. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers