Activision Blizzard (ATVI.US), US video game company, is trading around 11% lower on the day after the UK regulator blocked planned takeover of the company by Microsoft. Activision decided to release its Q1 2023 earnings report today during the session, instead of tomorrow after market close as scheduled, in a likely response to the news earlier today. However, even as results turned out to be better-than-expected, they failed to lift sentiment towards the stock and the company's shares continue to trade at a deep loss today.

Activision Blizzard reported a 25% YoY jump in Q1 net bookings, a measure often seen as a form of adjusted revenue for video game companies, to $1.86 billion (exp. $1.79 billion). Earnings per share reached $0.60, also above $0.51 expected by the market. Net revenue was almost 35% YoY higher at $2.38 billion. Company noted that it has managed to achieve year-over-year growth in its key intellectual properties, with the Call of Duty franchise being the main driver of growth. Company said it had 368 monthly active users in Q1 2023, slightly lower than 372 million reported in Q1 2022.

Activision Blizzard said that it will work aggressively with Microsoft to appeal decision of the UK Competition and Markets Authority (CMA). According to Activision Blizzard, CMA's reasoning that the merger will result in higher prices and fewer choices for customers as well as decreased innovation is irrational and inconsistent with the evidence. Company continues to believe that a tie-up with Microsoft will be pro-competitive. Nevertheless, this has failed to lift investors' sentiment towards the stock as it continues to trade over 10% lower on the day, reflecting lower likelihood of completing merger deal that would see Activision Blizzard being took over at $95 per share.

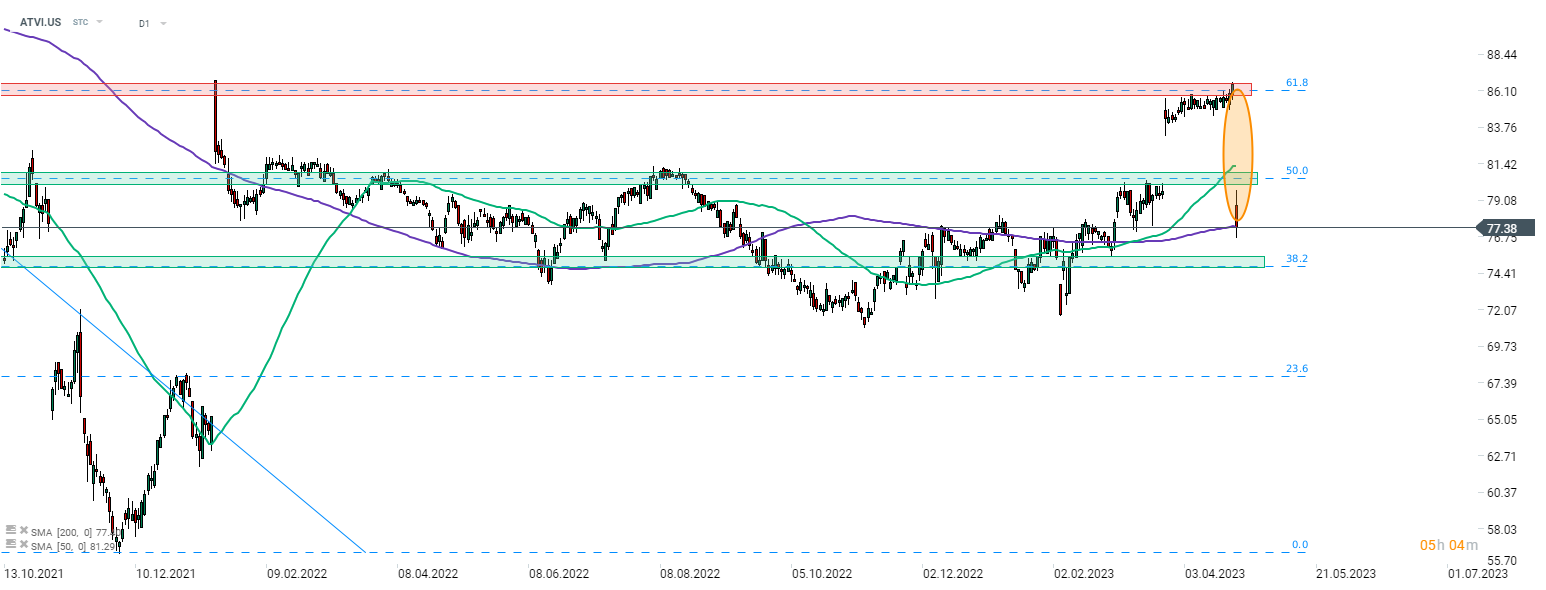

Activision Blizzard (ATVI.US) plunged today after UK CMA blocked takeover by Microsoft. Release of solid Q1 earnings during the session failed to lift the sentiment and bears are trying to push the stock below a 200-session moving average (purple line). Should they succeed, declines may deepen towards the next support to watch - a zone marked with 38.2% retracement of the downward move launched in early-2021. Source: xStation5

Activision Blizzard (ATVI.US) plunged today after UK CMA blocked takeover by Microsoft. Release of solid Q1 earnings during the session failed to lift the sentiment and bears are trying to push the stock below a 200-session moving average (purple line). Should they succeed, declines may deepen towards the next support to watch - a zone marked with 38.2% retracement of the downward move launched in early-2021. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈