-

Earnings season slows down

-

US presidential elections to steal the show

-

Fed rate decision and NFP release also on watch this week

Reports from Big Tech companies were key points in last week's earnings calendar. Solid results but mixed outlook for the future periods caused major tech companies to pull back on Friday, dragging the whole US market lower. Earnings stream this week will be more light but still investors will be served reports from some noteworthy companies.

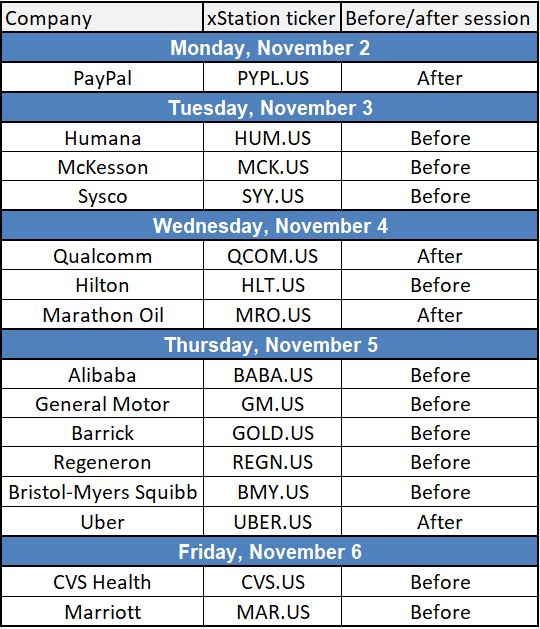

Tech companies will be in the spotlight on Thursday with Alibaba Group and Uber reporting after the Wall Street session closes. Apart from that, releases from Hilton and Marriott on Wednesday and Friday will give a glimpse of how large hotel chains performed during the Covid-impacted summer holiday period. Gold miner Barrick is expected to report solid earnings on Thursday, thanks to a significant gold price jump this year.

However, one should keep in mind that earnings will be of second importance this week. Firstly, there are no reports from big name companies set to release. Secondly, there is not a single day that will see an avalanche of key reports (like Super Thursday last week). Last but not least, its election week! US presidential elections are unquestionably a key event of the week and no earnings report will be even close as important. While elections are held tomorrow, the event is likely to impact markets for days if not weeks. Apart from that, traders should also remember about 2 key macro events scheduled for this week - FED rate decision (Thursday, 7:00 pm GMT) and NFP release for October (Friday, 1:30 pm GMT).

Noteworthy US earnings this week. Source: Bloomberg, XTB

Noteworthy US earnings this week. Source: Bloomberg, XTB

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡