Summary:

- US GDP for the second quarter (the first reading) is by far the most important release for today

- University of Michigan will report its final index for June illustrating consumers’ sentiment

- The number of active oil rigs count will be updated this afternoon

Friday is all about the preliminary reading concerning US GDP for the second quarter. In addition to this traders could take a look at the final print of the UoM index as well as the weekly update regarding the number of active oil rigs in the United States - the release rarely tends to be a market mover, but it makes up a part of the overall outlook for the supply side there.

1:30 pm BST - US GDP for Q2: According to the median estimate the US economy expanded at the decent 4.2% pace during the three months through June in annual terms which would be a solid number after the somewhat disappointing first quarter. Notice that the US President Donald Trump weighed in this time as well and broke with a long-standing convention to not comment on any macroeconomic release. He was cited by the WSJ as saying that "if it has a 4 in front (growth) of it, we’re happy. If it has like a 3, but it’s a 3.8, 3.9, 3.7, we’re OK." Recall his tweet concerning the May’s NFP report when he tweeted prior to the release that he had expected a big number - there actually was a big one.

3:00 pm BST - UoM index: There will be the final release of the index illustrating US consumers’ sentiment, hence do not expect fireworks. The consensus suggests that we may expect the unrevised figure at 97.1 points. As usual, along with the index we will be offered long-term inflation expectations too.

6:00 pm BST - Oil rigs count: Baker Hughes is expected to update offer us another report concerning the number of active oil rigs in the US. Admittedly, this kind of data seldom is a market mover for oil prices, it makes up an important part for the overall supply side outlook in the United States. The latest release showed 858 rigs.

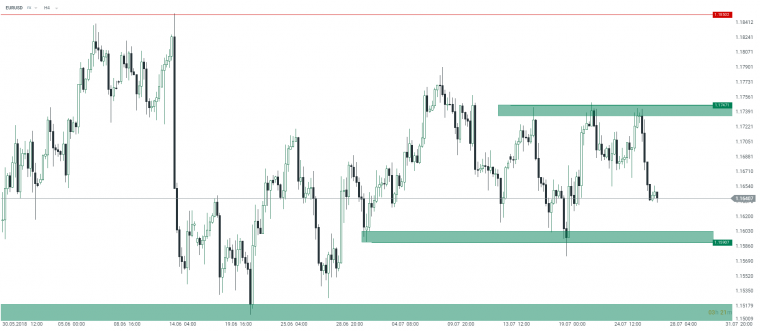

The EURUSD has fallen back in the aftermath of the EBC press conference (there was nothing to be excited about though). The pair approaches its lower boundary in range trading it has been moving within of late. Source: xStation5

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts