Wednesday's session on the financial markets is expected to be relatively mixed, after yesterday's significant sell-off on Wall Street. On the other hand, futures contracts before the opening of the session in Europe indicate an attempt at a rebound after selling pressure. The DE40 contract is currently up 0.3% and the EU50 is up 0.19%. At the same time, the US100 is up 0.22% and the US500 is up 0.26%. Quarterly results on the Old Continent were presented by UBS, Novartis and Crédit Agricole.

UBS financial results for the fourth quarter of 2025: • Pre-tax profit: USD 1.70 billion (forecast: USD 1.46 billion) • Net profit: USD 1.20 billion (forecast: USD 966.7 million) • Share buyback of USD 3 billion in 2026, further actions planned • Expected further cost savings: USD 2.8 billion in 2026

Crédit Agricole's results for the fourth quarter: • Revenue: EUR 6.97 billion (forecast: EUR 6.78 billion) • Net income: EUR 1.03 billion (forecast: EUR 1.10 billion) • CIB revenue: EUR 2.15 billion (forecast: EUR 2.14 billion) • Net income from French retail banking: EUR 150 million (-18% y/y) • Operating expenses: EUR 4.10 billion (forecast: EUR 3.90 billion)

Novartis financial results for the fourth quarter: • Revenue: $13.34 billion (forecast: $13.68 billion) • Basic earnings per share: $2.03 (forecast: $2.01) • Dividend for the financial year: CHF 3.70 • Forecast net sales growth in 2026: low single digits

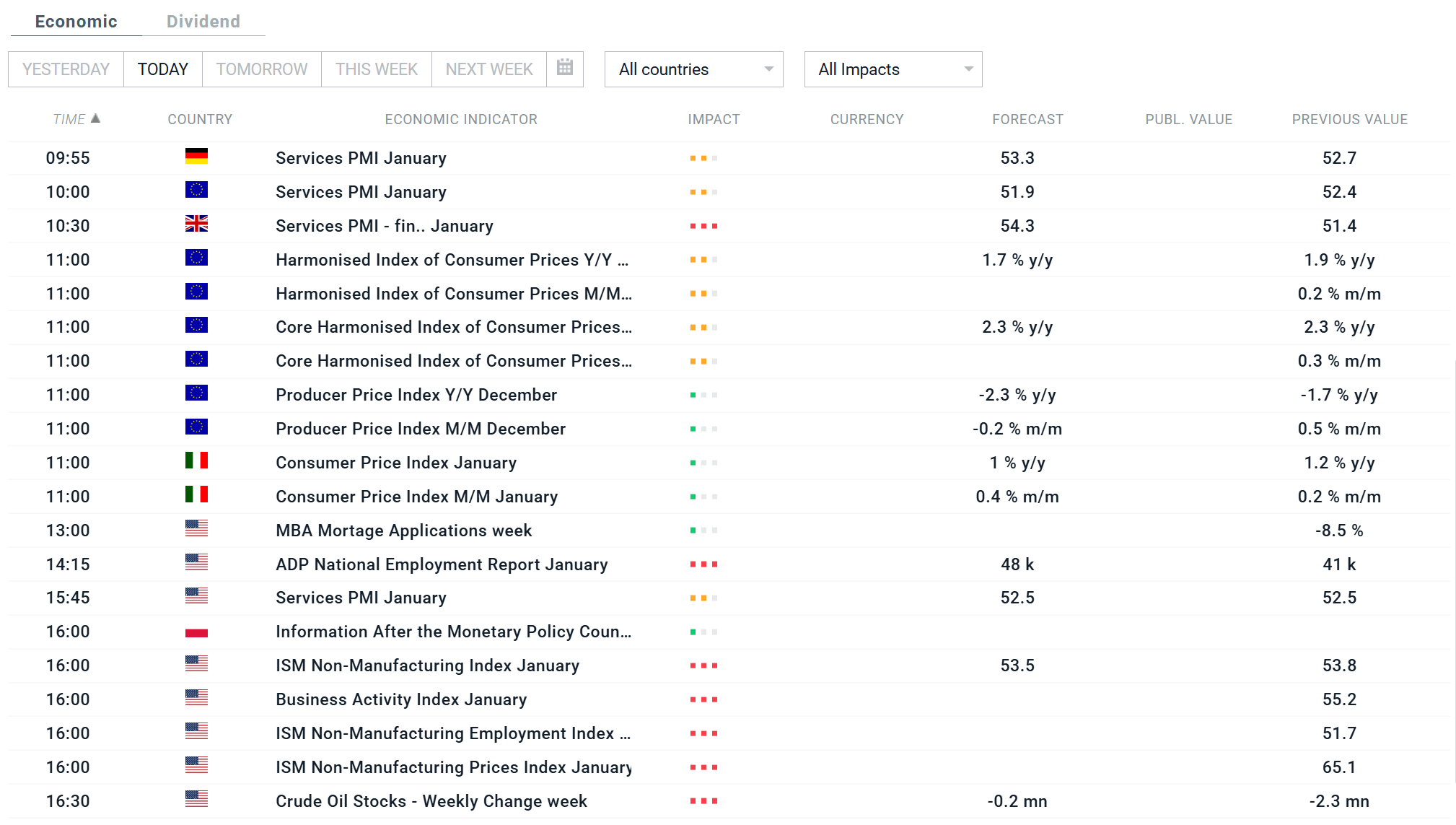

In the near future, it is worth paying attention to the following data: the final PMI index for the services sector (January) from many countries, the preliminary HICP index for the eurozone (January), the preliminary CPI index for Italy (January), the US ADP index (January), the ISM index for the services sector (January), the minutes of the Riksbank meeting (January), the government refinancing announcement (January), ADP in the US (January), ISM Services (January), NBP policy announcement, financial results for Alphabet, Arm, Qualcomm, ELF, Snap, Uber, Eli Lilly, AbbVie, CME and Bunge.

Detailed economic calendar below:

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

US dollar strengthens, pressuring EUR/USD, silver and Bitcoin 📉

Oil surges almost 2% amid US - Iran tensions 📈

📉US100 loses 2%