European stocks are starting Monday's trading with moderate gains, although it is worth bearing in mind that trading immediately after the start of the session can be very volatile, so it may take more time for a specific trend to emerge. At the moment, however, the German DAX is up 0.11% on the cash market, the European Euro Stoxx 50 is up 0.12%, and the Polish WIG20 is up 0.14%.

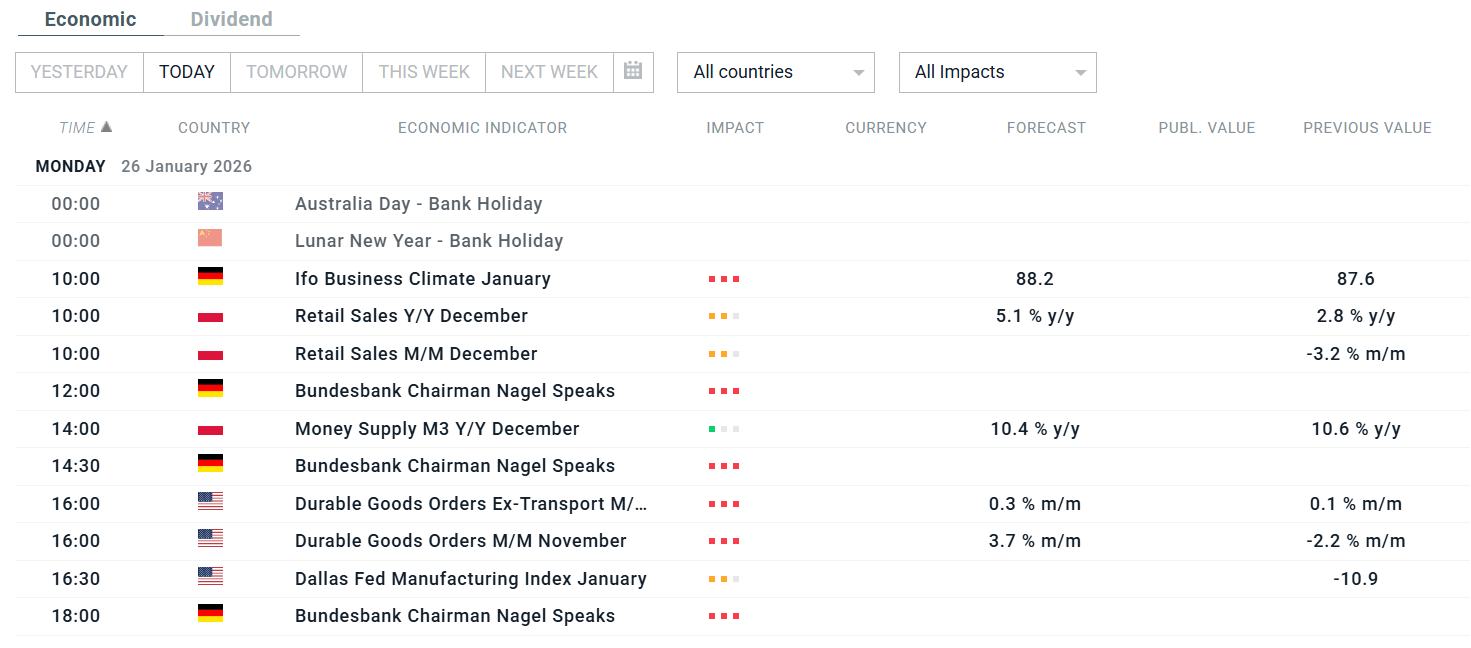

Today's session itself will not be rich in macro data releases that could radically change investor sentiment. We will have to wait until at least tomorrow for those. However, today will see the publication of IFO sentiment data from Germany and a report from Poland on retail sales. A little later, as Wall Street approaches its opening, we will learn the values of changes in durable goods orders.

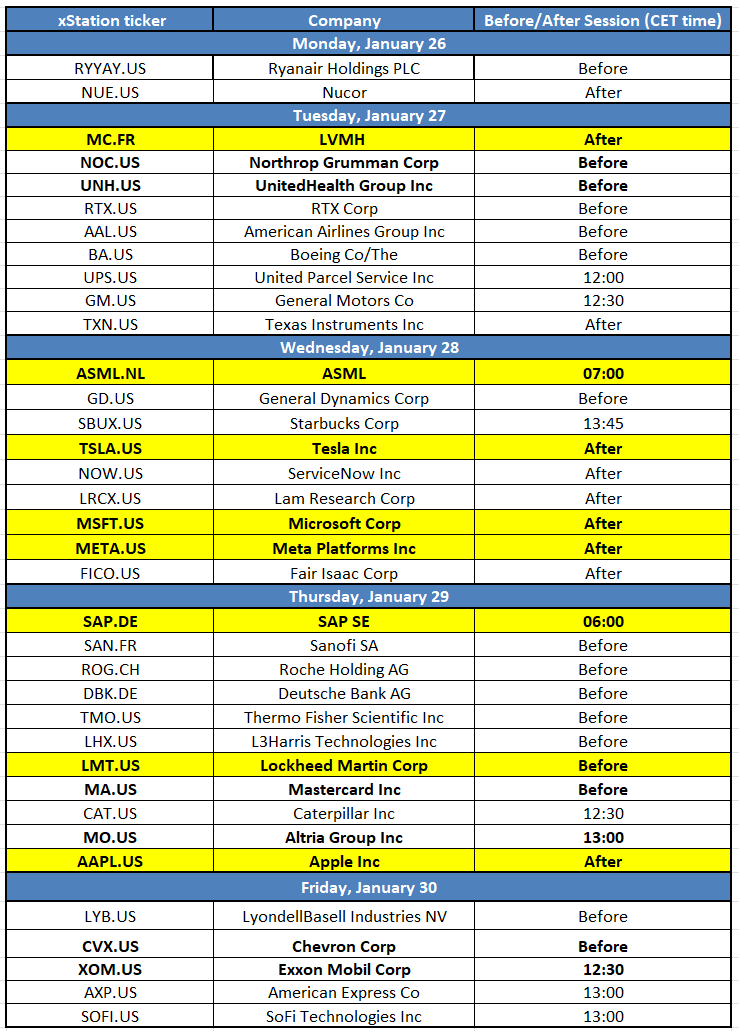

Today's session will most likely be driven by weekly rebalancing, any financial data from major companies, and possible geopolitical events.

Detailed schedule below:

Today's session calendar. Source: XTB

Results calendar for this week. Source: XTB

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)