- PMI data for European countries for April

-

HICP inflation for the EU area

-

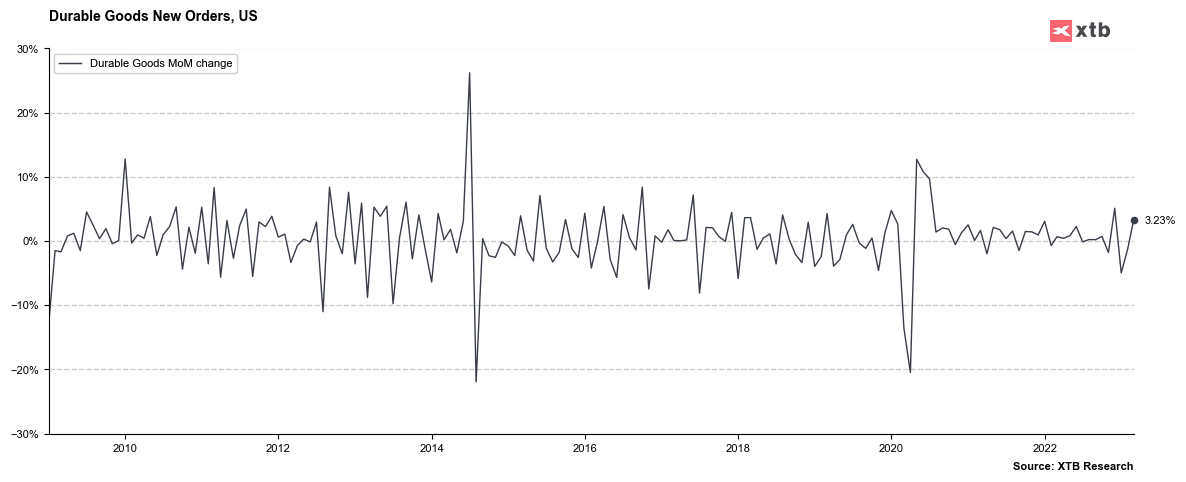

Durable Goods Orders from the US

Today's economic calendar remains relatively light compared to significant events later this week. Starting from 8:00 BST, PMI indicators for the major economies in the European Union will start to be published. Later in the day, data on Durable Goods Orders from the US will be released, indicating the current condition of the US manufacturing sector.

A surprise today was the decision of the Reserve Bank of Australia (RBA). At 5:30 BST, the board decided to raise the OCR rate to 3.85%. However, the majority of analyst forecasts assumed that the rate would remain at 3.60%. Taking into account the unexpected decision and hawkish comments, the Australian dollar is one of the top gaining currencies among developed countries today. In the context of this decision, investors should pay close attention to the speech of board member Philip Lowe at 12:20 pm BST.

Today's calendar:

-

8:15 BST: PMI index for the industry in Spain

-

8:30 BST: PMI index for the industry in Switzerland

-

8:55 BST: PMI index for the industry in Germany

-

9:00 BST: PMI index for the EU area

-

9:00 BST: PMI index for the UK

-

3:00 BST: Durable Goods Orders and Factory Orders in the US

-

9:40 BST: weekly report on crude oil inventories - API

Bankers' speeches

-

12:20 BST: Philip Lowe from RBA

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉