Shares of Electricite de France (EDF.FR), the French utility company, trade 7% higher today after surging as much as 10% at one point. Move was triggered by reports saying that French government wants to buy stakes of minority shareholders and delist the company. Reuters reported that French government may spend as much as €10 billion on 16.3% of EDF shares it does not currently own and its convertible debt. 16.3% equity stake was valued at €5.7 billion based on Tuesday's closing prices while convertible bonds were valued at around €3 billion. However, a spokesman for the French Finance Ministry rejected the report and declined to confirm the €10 billion figure mentioned. Sources that Bloomberg spoke with said that the figure was overstated.

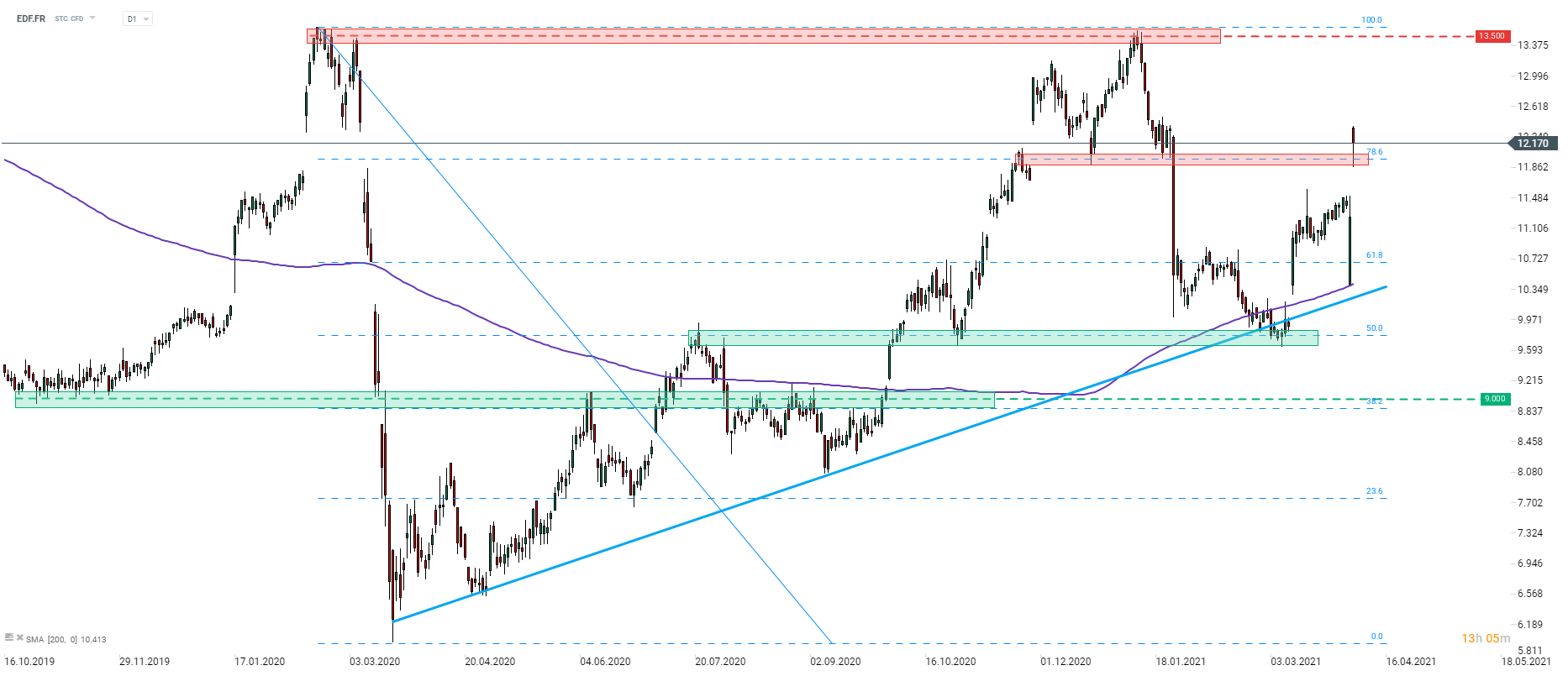

Share price of EDF opened above the 78.6% retracement of the 2020 pandemic drop today. While some gains were erased after the French authorities denied they are willing to spend €10 billion to delist Electricite de France, stock has managed to remain above the 78.6% retracement and it is the near-term support to watch. French authorities did not rule out the possibility of buying out minority shareholders completely, they have only denied €10 billion price tag reported by Retuers.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street