Eidos Therapeutics (EIDX.US), the US biotech company, is surging today. Stock is trading around 40% above Friday's closing price after BridgeBio Pharma, the US company focused on genetics diseases, announced that it will acquire Eidos. BridgeBio will buy around 36.3% of Eidos (all outstanding shares it does not own yet). Eidos shareholders will get to choose whether they want to receive BridgeBio shares as a payment or prefer cash. They may choose to receive 1.85 BridgeBio shares per each Eidos share they own or to receive $73.26 per share. Deal is expected to close in the first quarter of 2021. The deal values Eidos at $2.8 billion.

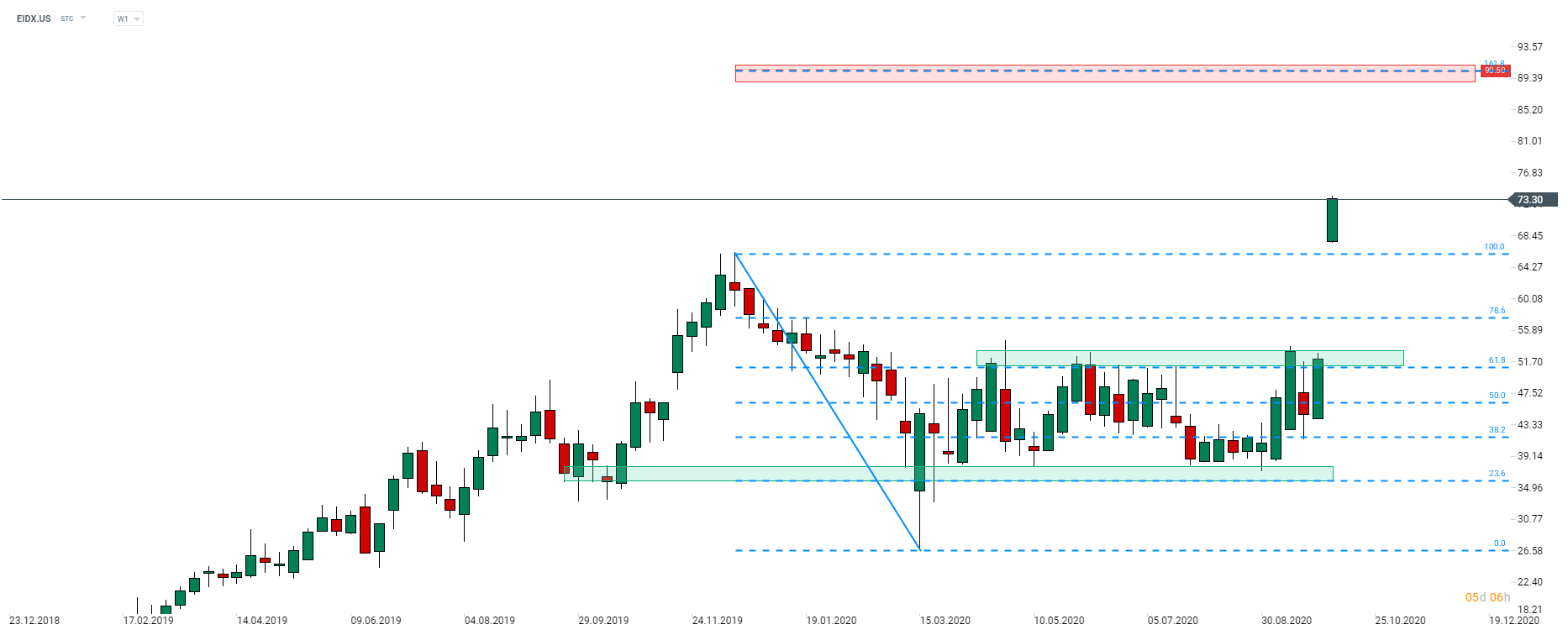

Following today's huge gap at the open, share price of Eidos Therapeutics (EIDX.US) not only jumped above a resistance at 61.8% retracement of early-year drop but also painted a fresh all-time high. Stock is trading around 10% above an all-time high reached in mid-December 2019 and the closest resistance can be found at 161.8% exterior retracement ($90.50 area). Source: xStation5

Following today's huge gap at the open, share price of Eidos Therapeutics (EIDX.US) not only jumped above a resistance at 61.8% retracement of early-year drop but also painted a fresh all-time high. Stock is trading around 10% above an all-time high reached in mid-December 2019 and the closest resistance can be found at 161.8% exterior retracement ($90.50 area). Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡